TriPointe Group, Irvine, on Wednesday reported net income of $42.9 million, or $0.28 per diluted share, for the first quarter of 2018 ended March 31, compared to net income available to common stockholders of $8.2 million, or $0.05 per diluted share, for the first quarter of 2017. Wall Street was looking for a gain of $0.24.

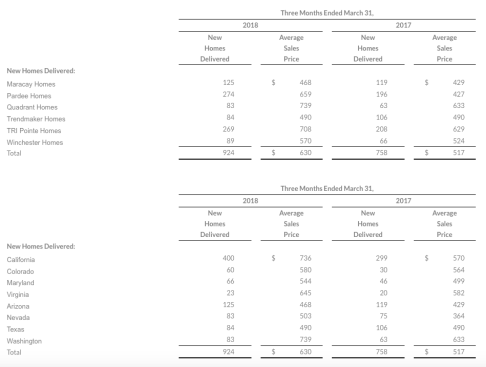

Home sales revenue increased $190.6 million, or 49%, to $582.6 million for the first quarter of 2018, as compared to $392.0 million for the first quarter of 2017. The increase was primarily attributable to a 22% increase in new home deliveries to 924, and a 22% increase in the average sales price of homes delivered to $630,000, compared to $517,000 in the first quarter of 2017.

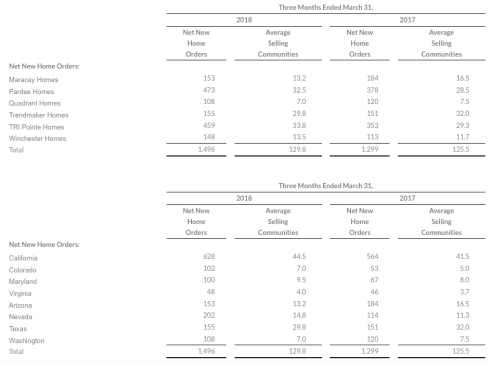

New home orders increased 15% to 1,496 homes for the first quarter of 2018, as compared to 1,299 homes for the same period in 2017. Average selling communities increased 3% to 129.8 for the first quarter of 2018 compared to 125.5 for the first quarter of 2017. The company’s overall absorption rate per average selling community increased 11% for the first quarter of 2018 to 11.5 orders (3.8 monthly) compared to 10.4 orders (3.5 monthly) during the first quarter of 2017.

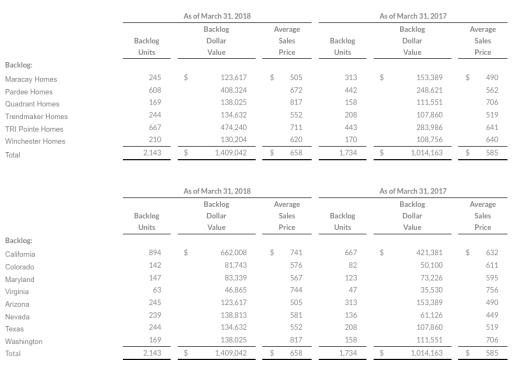

The company ended the quarter with 2,143 homes in backlog, up 24%, representing approximately $1.4 billion, up 39%. The average sales price of homes in backlog as of March 31, 2018 increased $73,000, or 12%, to $658,000, compared to $585,000 as of March 31, 2017.

Home building gross margin percentage for the first quarter of 2018 increased to 22.7%, compared to 18.8% for the first quarter of 2017. Excluding interest and impairments and lot option abandonments in cost of home sales, adjusted home building gross margin percentage was 25.2%* for the first quarter of 2018, compared to 21.3%* for the first quarter of 2017. The increase in home building gross margin percentage was largely due to the mix of homes delivered, primarily in California.

Selling, general and administrative expense for the first quarter of 2018 decreased to 12.9% of home sales revenue as compared to 15.7% for the first quarter of 2017 primarily due to increased leverage as a result of a 49% increase in home sales revenue.

“2018 is off to a great start,” said TRI Pointe Group CEO Doug Bauer. “We saw strong demand throughout the quarter, as evidenced by our absorption rate of 3.8 homes per community per month. This demand was broad based, both from a geographic and segmentation standpoint, which enabled us to raise prices in several of our communities and helped offset cost pressures that the home building industry has been facing.”

“Our performance this quarter is a testament to the quality of our local leadership teams and the emphasis TRI Pointe Group has put on design and innovation,” said TRI Pointe Group COO Tom Mitchell. “Housing fundamentals remain strong in the markets in which we build, and we’ve been able to capitalize on this strength by making sure we have the right product in the right location. We have empowered our local teams to run their operations in an entrepreneurial manner, and they in turn have embraced TRI Pointe’s unique approach to home building. This dynamic has been our formula for success for several years now, and we believe it will continue into the future.”

For the second quarter of 2018, the company expects to open 16 new communities, and close out of 19, resulting in 128 active selling communities as of June 30, 2018. In addition, the company anticipates delivering 50% to 55% of its 2,143 units in backlog as of March 31, 2018 at an average sales price in a range of $620,000 to $630,000. The Company anticipates its home building gross margin percentage will be in a range of 21.0% to 21.5% for the second quarter. Finally, the Company expects its SG&A expense as a percentage of home sales revenue to be in the range of 11.5% to 12.0% for the second quarter.

For the full year 2018, the Company is reiterating its original guidance of growing average selling communities by 5% compared to 2017 and delivering between 5,100 and 5,400 homes at an average sales price of approximately $610,000. The company is updating its home building gross margin percentage for the full year 2018 to be in the range of 21.0% to 21.5%, raising the low end of its previously stated range of 20.5% to 21.5%. The company is reiterating its original guidance of SG&A expense as a percentage of home sales revenue to be in the range of 9.9% to 10.3% and its effective tax rate to be in the range of 25% to 26%.