D.R. Horton, Inc. (NYSE:DHI) on Thursday reported net income for its second fiscal quarter ended March 31 of $351.0 million, or $0.91 per diluted share, up 53% from $229.2 million, or $0.60 per diluted share, in the same quarter of fiscal 2017. Wall Street was looking for a gain of $0.86.

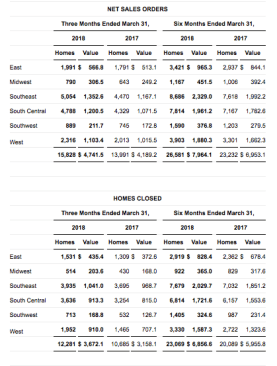

Home building revenue for the quarter increased 16% to $3.7 billion from $3.2 billion in the same quarter of fiscal 2017. Homes closed in the quarter increased 15% to 12,281 homes compared to 10,685 homes closed in the same quarter of fiscal 2017. The current quarter results included $30.1 million of pre-tax inventory and land option charges to cost of sales, of which $24.5 million related to the settlement of an outstanding dispute associated with a land transaction.

For the six months ended March 31, 2018, net income attributable to D.R. Horton increased 24% to $540.3 million, or $1.41 per diluted share, compared to $436.1 million, or $1.15 per diluted share, in the same period of fiscal 2017. Homebuilding revenue for the first six months of fiscal 2018 increased 15% to $6.9 billion from $6.0 billion in the same period of fiscal 2017. Homes closed in the first six months of 2018 increased 15% to 23,069 homes compared to 20,089 homes closed in the same period of fiscal 2017.

The company’s effective tax rates for the three and six month periods ended March 31, 2018 reflect a tax benefit from the rate reduction from the December Tax Cuts and Jobs Act of 2017 (Tax Act), an excess tax benefit related to stock-based compensation and the February Bipartisan Budget Act of 2018, which retroactively reinstated the federal tax credit for energy-efficient homes. The six-month period ended March 31, 2018 included a one-time non-cash income tax charge of $108.7 million to re-measure the company’s net deferred tax assets as a result of the Tax Act.

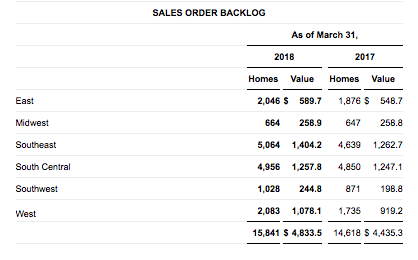

Net sales orders for the quarter increased 13% to 15,828 homes and 13% in value to $4.7 billion compared to 13,991 homes and $4.2 billion in the same quarter of the prior year. The company’s cancellation rate was 19% compared to 20% in the prior year quarter. Net sales orders for the first six months of fiscal 2018 increased 14% to 26,581 homes and 15% in value to $8.0 billion compared to 23,232 homes and $7.0 billion in the same period of fiscal 2017.

The company’s homes in inventory at March 31, 2018 increased 8% to 29,400 homes compared to 27,100 homes at March 31, 2017. The company’s home building land and lot portfolio at March 31, 2018 increased 13% to 257,700 lots, of which 48% were owned and 52% were controlled through option contracts, compared to 227,300 lots at March 31, 2017, of which 52% were owned and 48% were controlled through option contracts.

The company ended the second quarter with $528.9 million of home building unrestricted cash and a home building debt to total capital ratio of 24.2%.

Donald R. Horton, chairman, said, “Our balance sheet strength, liquidity and continued earnings growth are increasing our strategic and financial flexibility, and we plan to maintain our disciplined, opportunistic position to enhance the long-term value of our company. We continue to expect to grow our revenues and pre-tax profits at a double-digit annual pace, while generating increasing annual operating cash flows and returns. With 29,400 homes in inventory at the end of March and 258,000 lots owned and controlled, we are well-positioned for the remainder of fiscal 2018 and future years.”

During the second quarter of fiscal 2018, the company paid cash dividends of $47.1 million and repurchased 500,000 shares of common stock for $22.5 million. The company’s remaining stock repurchase authorization at March 31, 2018 was $152.1 million. The company has also declared a quarterly cash dividend of $0.125 per common share that is payable on May 25, 2018 to stockholders of record on May 11, 2018.

Forestar Group Inc. (NYSE:FOR)(“Forestar”), a majority-owned subsidiary of D.R. Horton, currently operates in 18 markets and 10 states. Forestar’s operating results for the three-month period ended March 31, 2018 and from October 5, 2017 (acquisition date) through March 31, 2018 are fully consolidated in the company’s financial statements with the 25% interest not owned by the company reported as noncontrolling interests.

During the quarter, Forestar sold a portion of its assets for $232.0 million and recognized a gain on the sale of $0.7 million. This strategic asset sale included projects owned both directly and indirectly through ventures and consisted of approximately 750 developed and under development lots, over 4,000 undeveloped lots, 730 unentitled acres, an interest in one multi-family operating property and a multi-family development site. The net proceeds after purchase price adjustments and other costs associated with selling these projects was $217.5 million.

Based on current market conditions and the company’s results for the first six months of fiscal 2018, D.R. Horton offered the following full-year guidance:

· Consolidated pre-tax profit margin of12.1% to 12.3%compared to prior guidance of 11.8% to 12.0%

· Consolidated revenues between $15.9 billion and $16.3 billion

· Homes closed between 51,500 and 52,500 homes

· Home sales gross margin in the range of 20.5% to 21.0%, with potential quarterly fluctuations that may be outside of this range

· Income tax rate of approximately 25%, excluding the first quarter non-cash charge to reduce net deferred tax assets as a result of the Tax Act

· Cash flow from operations of at least $800 million excluding Forestar, an increase of $100 million from prior guidance due primarily to a higher expected pre-tax profit margin

· Home building SG&A expense of around 8.7% of home building revenues

· Financial services operating margin of approximately 30%

· Outstanding share count increase of less than 1%