M.D.C. Holdings, Inc. (NYSE: MDC), Denver, on Thursday morning reported the following results for its first quarter ended March 31:

2018 First Quarter Highlights and Comparisons to 2017 First Quarter

- Net income up 74% to $38.8 million, or $0.68 per diluted share, from $22.2 million or $0.40 per diluted share**

- Effective tax rate of 23.3% vs. 38.8%

- Pretax income up 39% to $50.5 million from $36.4 million

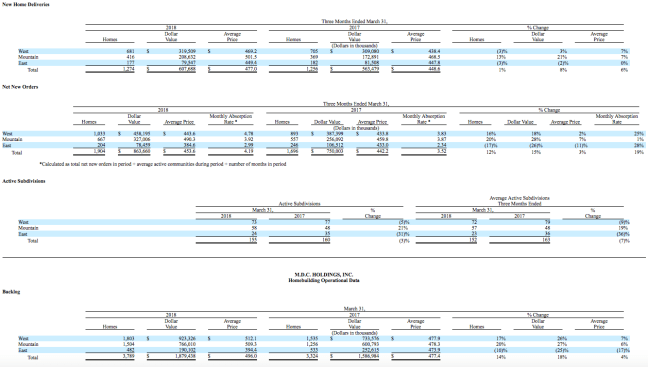

- Home sale revenues up 8% to $607.7 million from $563.5 million

- Average selling price of homes delivered up 6% to $477,000

- Gross margin from home sales percentage up 230 basis points to 18.2% from 15.9%

- Impairments of $0.6 million vs. $4.9 million

- Selling, general and administrative expenses as a percentage of home sale revenues (“SG&A rate”) improved 10 basis points year-over-year to 11.7%

- Dollar value of net new orders up 15% to $863.7 million from $750.0 million

- Monthly sales absorption pace of 4.19, up 19%

- Ending backlog dollar value up 18% to $1.88 billion from $1.59 billion

- Lot purchase approvals more than doubled to 4,072 lots in 47 communities

- * Excluding the impact of significant one-time or infrequent items

- ** Per share amount has been adjusted for the 8% stock dividend declared and paid in the 2017 fourth quarter

- 2018 Outlook – Selected Information

- Backlog dollar value at March 31, 2018 up 18% year-over-year to $1.88 billion

- Gross margin from home sales in backlog at 3/31/2018 modestly exceeds 2018 first quarter closing gross margin of 18.2%

- Backlog conversion ratio (home deliveries divided by beginning backlog) for Q2 2018 estimated to be in the 39% to 40% range

- Active subdivision count at 3/31/2018 of 155, down 3% year-over-year but up 3% from 12/31/2017

- Targeting a 10% year-over-year increase in active subdivision count by year end (from 151 at 12/31/2017 to at least 166 at 12/31/2018)

- Lots controlled of 21,453 at 3/31/2018, up 44% year-over-year

- Quarterly dividend of $0.30 ($1.20 annualized) declared in April 2018, up 30% year-over-year (after adjusting for 8% stock dividend in December 2017)

- Revised estimate for full year 2018 effective tax rate of 24% to 26%, excluding impact of any further discrete items

Larry A. Mizel, MDC’s chairman and CEO, stated, “We are pleased with our 2018 first quarter results, highlighted by a 74% year-over-year increase in net income. Our quarter benefited from solid top-line growth, a significant expansion of our gross margin percentage and a much lower effective tax rate. At the same time, our 2018 spring selling season kicked off with our strongest first quarter net order absorption rate since 2006. We believe that this robust sales activity was driven by strong consumer demand and limited housing supply, combined with our increased offering of more affordable homes, which more than offset any negative impact from rising mortgage rates.”

Mr. Mizel continued, “We approved over 4,000 lots for purchase in the 2018 first quarter, with almost 50% of those lots designated for the SeasonsTM collection, which is the centerpiece of our efforts to drive affordability. Even at this lower price point, we continue to offer the benefits of a build-to-order model, where our customers can personalize their homes to match their own unique preferences. We believe that this approach provides us with a competitive advantage as we look to continue to drive our growth through this important home buyer segment.”

Mr. Mizel concluded, “With our ending backlog value up nearly 20% from a year ago, we enter our second quarter with the opportunity for more significant year-over-year growth in revenues for the balance of the year, which could drive enhanced operating leverage to complement our already significantly expanded gross margin from home sales. With that in mind, we are optimistic about our prospects for the continued growth of the company’s core* pretax operating margin and return on equity in 2018.”