The New Home Company Inc. (NYSE: NWHM), Aliso Viejo, Calif., on Thursday morning reported a net loss of $0.6 million, or $(0.03) per diluted share for its first quarter ended March 31, compared to net income of $0.8 million, or $0.04 per diluted share in the prior year period.

The year-over-year decrease in net income was primarily attributable to a 120 basis point decline in home sales gross margin, a 120 basis point increase in selling and marketing expenses as a percentage of home sales revenue, and a decrease in fee building revenues and margin. These items were partially offset by a 14% increase in home sales revenue and income tax benefits related to the 2018 first quarter pretax loss and discrete tax items for the 2018 first quarter.

The company reported:

· Total revenues of $123.2 million vs. $125.0 million

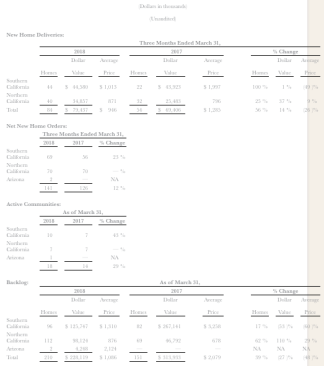

· Home sales revenue of $79.4 million, up 14%; deliveries up 56%

· Net new home orders up 12%

· Backlog units up 39%

· Ending community count up 29% to 18 compared to 14

Wholly Owned Projects

Home sales revenue for the 2018 first quarter increased 14% to $79.4 million, compared to $69.4 million in the prior year period. The increase in home sales revenue was driven by a 56% increase in deliveries, which was partially offset by a 26% lower average selling price of homes delivered to $946,000 due to the strategic initiative to expand our portfolio to include more affordably-priced product and grow community count.

Gross margin from home sales for the 2018 first quarter was 12.3% as compared to 13.5% in the prior year period. The 120 basis point decline in home sales gross margin was primarily due to a product mix shift and higher interest costs. The mix shift was impacted by 2017 first quarter deliveries from a higher-margin Crystal Cove community in Newport Coast, CA and our Santa Clara community in the Bay Area, both of which closed-out during 2017. Adjusted gross margin from home sales for the 2018 first quarter, excluding interest in cost of home sales, was flat with the prior year period at 15.7%*.

Our SG&A expense ratio as a percentage of home sales revenue for the 2018 first quarter was 15.9% versus 14.5% in the prior year period. The 140 basis point increase in the SG&A rate was primarily due to higher selling and marketing costs related to the ramp up of new communities, higher co-broker commissions, and a lower amount of G&A expenses allocated to the fee building business due to lower fee revenues.

Net new home orders for the 2018 first quarter were up 12% to 141 homes, compared to 126 homes in the prior year period. The increase was primarily driven by a 13% increase in average selling communities during the quarter. The company’s monthly sales absorption rate for the 2018 first quarter was flat with the prior year period at 2.8 sales per average selling community. The company’s ending active selling community count was up 29% as of the end of the 2018 first quarter as compared to the year ago period end. The company’s cancellation rate for the 2018 first quarter remained at the lower end of the industry at 6% as compared to 7% in the prior year period.

The dollar value of the company’s wholly owned backlog at the end of the 2018 first quarter was $228.1 million and totaled 210 homes, compared to $313.9 million and 151 homes in the prior year period. The decrease in backlog dollar value resulted from a 48% lower average selling price of homes in backlog at $1.1 million as compared to $2.1 million a year ago. The year-over-year decline in the company’s average selling price of homes in backlog was driven primarily by the mix of homes in backlog in Southern California. The 2017 first quarter backlog included homes from two higher-priced luxury communities located in Newport Coast, CA that closed out in 2017.

Fee Building Projects

Fee building revenue for the 2018 first quarter decreased 21% to $43.8 million, compared to $55.6 million in the prior year period. The decrease was primarily due to a decrease in fee building construction activity. Our fee building gross margin was $1.1 million compared to $1.7 million in the prior year period. The lower fee building gross margin was the result of lower fee revenues and a change in the fee building business arrangements. Management fees from joint ventures were $1.0 million during the 2018 first quarter compared to $1.2 million in the prior year period.

Unconsolidated Joint Ventures (JVs)

The company’s share of joint venture income was $0.3 million for the 2018 first quarter, up slightly from the prior year period, and was driven primarily by deliveries from our Mountain Shadows community in Paradise Valley, AZ.

The following sets forth supplemental information about the company’s joint ventures. Such information is not included in the company’s financial data for GAAP purposes but is provided for informational purposes.

Joint venture net income totaled $0.8 million, compared to a net loss of $0.9 million in the prior year period. Joint venture home sales revenue totaled $31.2 million, compared to $25.1 million in the prior year period, while joint venture land sales revenue totaled $0.8 million for the 2018 first quarter, compared to $1.5 million in the prior year period.

At the end of the 2018 first quarter, our joint ventures had seven actively selling communities compared to nine at the end of the 2017 first quarter. Net new home orders from joint ventures for the 2018 first quarter decreased 8% to 36 homes as compared to 39 homes in the prior year period. The dollar value of homes in backlog from joint ventures at the end of the 2018 first quarter was $67.2 million from 84 homes, compared to $64.0 million from 69 homes in the prior year period.

Income Taxes

The company recorded a $0.9 million income tax benefit for the 2018 first quarter, which included a $0.4 million benefit for discrete items related primarily to energy tax credits that were extended in February 2018, compared to a tax provision of $0.5 million in the prior year period. The company’s effective tax rate was 56.9%, 29.4%* before discrete items, as compared to 38.5%, 38.2%* before discrete items, in the 2017 first quarter. The year-over-year decrease in rate before discrete items was the result of the Tax Cuts and Jobs Act that was enacted in December 2017 that reduced the corporate federal tax rate from a maximum of 35% to a flat 21%, effective for 2018.

Balance Sheet and Liquidity

As of March 31, 2018, the company had real estate inventories totaling $459.4 million, of which $381.8 million represented work-in-process and completed homes (including models), $41.7 million in land and land under development, and $35.9 million in land deposits and pre-acquisition costs. The company owned or controlled 2,924 lots through its wholly owned operations (excluding fee building and joint venture lots), of which 1,768 lots, or 60%, were controlled through option contracts. The company ended the 2018 first quarter with $91.1 million in cash and cash equivalents and had no borrowings outstanding under its $200.0 million revolving credit facility. The company ended the 2018 first quarter with $319.0 million in debt outstanding (net of unamortized discount, premium and debt issuance costs), a debt-to-capital ratio of 55.1% and a net debt-to-capital ratio of 46.7%*.

Guidance

The company’s current estimate for full year guidance for 2018 is as follows:

· Home sales revenue of $600 – $640 million

· Fee building revenue of $120 – $150 million

· Home sales gross margin of 14.5% – 15.0%

· Income from unconsolidated joint ventures of $1.5 million

· Wholly owned active year-end community count of 19

· Joint venture active year-end community count of 6

The company’s current estimate for the 2018 second quarter is as follows:

· Home sales revenue of $100 – $120 million

· Fee building revenue of $30 – $40 million

· Income from unconsolidated joint ventures of $0.2 million

· Wholly owned active quarter-end community count of 20

· Joint venture active quarter-end community count of 7

“During the first quarter, The New Home Company continued to make progress in laying the groundwork to achieve its 2018 goals and position the company for the future,” said The New Home Company’s CEO Larry Webb. “Home closings were up 56% year-over-year, quarter ending backlog increased 39% on a unit basis, and net new orders grew 12%. New order growth was somewhat impacted by delayed community openings in the quarter, which resulted in partial-quarter contributions from a handful of communities. Fortunately, we were able to work through these delays and saw an acceleration in sales activity in April, which resulted in year-over-year order growth of 71% for the month, or an absorption rate of 3.4 per month. Wholly owned lot count at the end of the first quarter increased by 75% over last year as we expanded our product portfolio in Arizona, Northern California and the Inland Empire in Southern California.”

Webb continued, “The housing fundamentals in California and Arizona continue to be solid, with healthy job growth and low levels of existing inventory in both states. We continue to pursue a strategy of product differentiation at a number of price points, which we believe will appeal to a deeper pool of buyers and increase long-term value for shareholders.”