Taylor Morrison Home Corporation (NYSE: TMHC), Scottsdale on Tuesday reported net income of $47 million, or $0.41 per share, for the first quarter ended March 31, up from $35.6 million, or $0.30 per share, in the prior year quarter. Analysts were expecting a gain of $0.37.

Among the results:

- Sales per outlet were 2.8

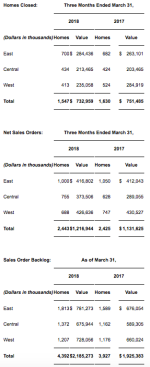

- Net sales orders were 2,443

- Home closings were 1,547

- Total revenue was $752 million

- Home closings gross margin, inclusive of capitalized interest, was 18.8 percent

“We closed the quarter with a sales pace of 2.8—our best pace since the first half of 2013—representing a 40 percent two-year growth rate,” said Sheryl Palmer, chairman and CEO of Taylor Morrison. “We recognized these strong paces across our portfolio touching each market, consumer segment and price point. The momentum continued into April which had a sales pace of 2.9.”

For the first quarter, net sales orders were 2,443 with an average community count of 288. The company ended the quarter with 4,392 units in backlog, a year-over-year increase of 12%, with a sales value of more than $2.1 billion.

“Our performance in the quarter drove $0.41 of EPS, a home closings gross margin of 18.8% and an EBT margin of 7.9%, both improving 80 basis points from this quarter last year,” said Palmer. “I’m pleased to see this accretion in margin rate which is due in part to mix and attributable to the strengthening of our operational efficiencies and cost savings practices.”

“For the quarter, closings totaled 1,547, three less than our stated guidance,” added Palmer. “Although we over delivered on our expectations in Q4 despite the hurricanes, we underestimated the length of time it would take our impacted markets to recover the lost time on our construction starts. With local access to the trades tightening and the shift in focus to rebuilding efforts, our ability to close and deliver homes to our 100 percent standard of completion was affected. We are not changing our guidance for the year, as this is purely a first-half timing issue.”

“Our earnings before income taxes were $59 million, or 7.9% of revenue, and income taxes totaled about $12 million for the quarter, representing an effective rate of 19.8%,” said Dave Cone, executive vice president and CFO. “This is significantly lower than the first quarter of 2017 due in large part to tax reform. In addition, our Q1 tax rate came in more favorable due to legislation passed this February which extended energy tax credits retroactively through the end of 2017. The energy credits resulted in a one-time benefit of $3.8 million in the first quarter.”

Home building inventories were $3.1 billion at the end of the quarter, including 5,053 homes in inventory, compared to 4,396 homes in inventory at the end of the prior year quarter. Homes in inventory at the end of the quarter consisted of 3,132 sold units, 384 model homes and 1,537 inventory units, of which 201 were finished.

The Company finished the quarter with $288 million in cash and a net home building debt to capitalization ratio of 33.1 percent. As of March 31, 2018, Taylor Morrison owned or controlled approximately 37,000 lots, representing 4.7 years of supply, and is focused on securing land for 2020 and beyond.