Toll Brothers, Inc. (NYSE:TOL) on Tuesday morning reported net income of $111.8 million, or $0.72 per share diluted, for its second fiscal quarter ended April 30, 2018. The gain compared to net income of $124.6 million, or $0.73 per share diluted, in FY 2017’s second quarter. Wall Street was expecting a gain of $0.76 per share. Shares of TOL were down more than 4% at $41.72 in pre-market trading Tuesday.

Among the results:

- Pre-tax income was $152.7 million, compared to $199.2 million

- Impairments were $13.8 million compared to $4.3 million

- Income from unconsolidated entities was $2.6 million compared to $45.9 million

- Other income was $15.8 million compared to $14.0 million

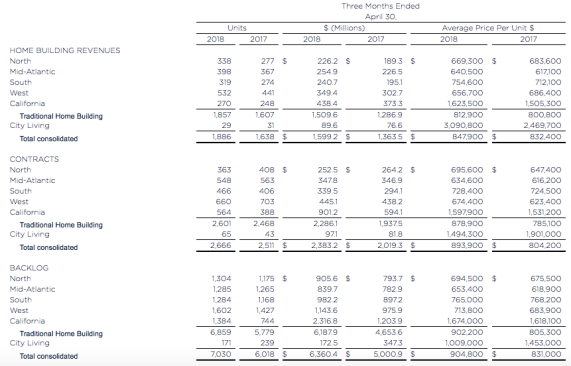

- Revenues were $1.60 billion, the highest second quarter ever – up 17%; home building deliveries were 1,886 units – up 15%

- Net signed contract value was $2.38 billion, the highest quarter ever – up 18%; contract units were 2,666 – up 6%

- Per-community net signed contracts were 9.04 per community – up 16% – the highest second quarter since FY 2005

- Backlog value at second-quarter end rose to $6.36 billion, the highest second quarter ever – up 27%; units totaled 7,030 – up 17%

- Gross margin, as a percentage of revenues, was 18.8%

- Adjusted Gross Margin, which excludes interest and inventory write-downs (“Adjusted Gross Margin”), was 22.5%

- SG&A, as a percentage of revenues, was 10.4%

- Income from operations was 8.4% of revenues

- Increased its dividend in April to $0.11 per share from $0.08 per share

- Repurchased approximately 1.8 million shares of its common stock at an average price of $45.44 per share for a total purchase price of approximately $81.5 million in its second quarter and approximately 6.2 million shares at an average price of $46.86 per share for a total purchase price of approximately $291.5 million to-date in FY 2018

Toll issued the following guidance for the remainder of the year:

- Full FY 2018 deliveries of between 8,000 and 8,500 units with an average price of between $830,000 and $860,000; third-quarter deliveries of between 2,100 and 2,200 units with an average price of between $830,000 and $850,000

- FY Adjusted Gross Margin of between 23.75% and 24.25% of revenues; third-quarter Adjusted Gross Margin of 23.4%

- FY SG&A, as a percentage of FY revenues, of approximately 10.0%; third-quarter SG&A, as a percentage of third-quarter revenues, of approximately 9.6%

- FY Other income and Income from unconsolidated entities of between $130 million and $160 million, with approximately $20 million in the third quarter

- FY tax rate of between 23% and 25%; third-quarter tax rate of approximately 27.5%

Douglas C. Yearley, Jr., Toll Brothers’ chief executive officer, stated: “Our double-digit dollar growth in revenues, contracts and backlog reflects the health of the luxury new home market. We had another solid spring selling season. … Revenues rose 17% this quarter with increases in every region. California revenues rose 17% and was our largest region, producing 27% of total revenues. The North was up 19%, the Mid-Atlantic was up 13%, the South was up 23%, the West was up 15% and City Living was up 17%. California and the Western region, combined, produced nearly 50% of total revenues, reflecting the strategic diversification of the Company’s operations over the past decade. With our $6.36 billion backlog, our highest second-quarter backlog ever, we believe FY 2018 will be a year of significant revenue growth.

Martin P. Connor, Toll Brothers’ chief financial officer, added: “Our rental apartment business continues to grow. We now control a pipeline of approximately 16,000 units in projects completed, in construction, under development or in approvals. We are expanding this operation beyond our metro Boston to Washington, D.C. base and now have teams in San Francisco, Los Angeles, Atlanta, Dallas and Phoenix.”

Robert I. Toll, executive chairman, stated: “Jobs are plentiful, unemployment is low, wages are rising and existing home price appreciation is providing the equity for customers to buy new homes. Home ownership and household formation rates are increasing, while supply remains constrained. With our solid land positions and the capital to expand, we are gaining market share and look forward to continued growth.