Hovnanian Enterprises, Inc. (NYSE:HOV) on Thursday reported a net loss of $9.8 million, or $0.07 per common share, for the second quarter of fiscal 2018 ended April 30. The loss compares with a net loss of $6.7 million, or $0.05 per common share, during the same quarter a year ago.

Wall Street was expecting a loss of $0.04 per share. Shares were down 8% at $184 in morning trading Thursday.

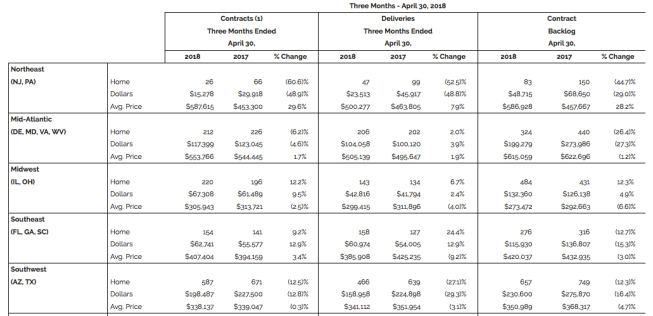

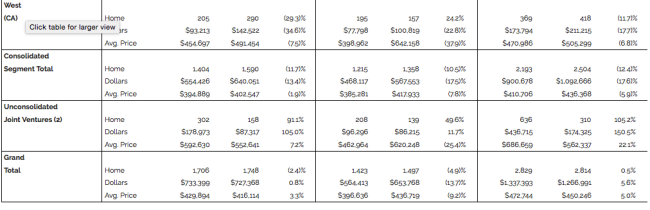

Total revenues decreased 14.2% to $502.5 million in the second quarter of fiscal 2018, compared with $585.9 million in the second quarter of fiscal 2017. Deliveries, including unconsolidated joint ventures, decreased 4.9% to 1,423 homes compared with 1,497 homes during the second quarter of fiscal 2017. Consolidated deliveries were 1,215 homes for the second quarter of fiscal 2018, a 10.5% decrease compared with 1,358 homes during the same quarter a year ago.

The number of contracts, including unconsolidated joint ventures, for the second quarter ended April 30, 2018, decreased 2.4% to 1,706 homes from 1,748 homes for the same quarter last year. The number of consolidated contracts decreased 11.7% to 1,404 homes, during the second quarter of fiscal 2018, compared with 1,590 homes during the second quarter of 2017.

The dollar value of contract backlog, including unconsolidated joint ventures, as of April 30, 2018, was $1.34 billion, an increase of 5.6% compared with $1.27 billion as of April 30, 2017. The dollar value of consolidated contract backlog, as of April 30, 2018, decreased 17.6% to $900.7 million compared with $1.09 billion as of April 30, 2017.

Contracts per community, including unconsolidated joint ventures, increased 8.7% to 11.2 contracts per community for the quarter ended April 30, 2018 compared with 10.3 contracts per community, including unconsolidated joint ventures, in last year’s second quarter. Consolidated contracts per community decreased 2.8% to 10.6 contracts per community for the second quarter of fiscal 2018 compared with 10.9 contracts per community in the second quarter of fiscal 2017.

For May 2018, contracts per community, including unconsolidated joint ventures, increased 5.9% to 3.6 contracts per community compared to 3.4 contracts per community for the same month one year ago.

As of the end of the second quarter of fiscal 2018, community count, including unconsolidated joint ventures, was 153 communities, a 10.0% year-over-year decrease from 170 communities at April 30, 2017. Consolidated community count decreased 9.6% to 132 communities as of April 30, 2018 from 146 communities at the end of the prior year’s second quarter.

Home building gross margin percentage, after cost of sales interest expense and land charges, was 13.8% for the second quarter of fiscal 2018 compared with 12.6% in the prior year’s second quarter. For the six months ended April 30, 2018, homebuilding gross margin percentage, after cost of sales interest expense and land charges, improved to 14.3% compared with 13.0% in the first half of last year.

Total SG&A was $61.7 million, or 12.3% of total revenues, in the second quarter of fiscal 2018 compared with $61.5 million, or 10.5% of total revenues, in the second quarter of fiscal 2017. For the first half of fiscal 2018, total SG&A was $124.1 million, or 13.5% of total revenues, compared with $121.6 million, or 10.7% of total revenues, in the first half of the prior fiscal year.

Total liquidity at the end of the second quarter of fiscal 2018 was $274.0 million.

In the second quarter of fiscal 2018, approximately 2,000 lots were put under option or acquired in 27 communities, including unconsolidated joint ventures. Consolidated lots controlled increased year-over-year to 26,537, as of April 30, 2018, from 26,103 lots at April 30, 2017. The total consolidated land position, as of April 30, 2018, was 26,537 lots, consisting of 13,949 lots under option and 12,588 owned lots.

“We are encouraged that the number of consolidated lots controlled increased year-over-year for the second consecutive quarter. In order to drive future growth in revenues and profitability, we continue to focus on growing our community count through increased investments in land and land development,” stated Ara K. Hovnanian, chairman, president and CEO. “As expected, our operating results for the second quarter of fiscal 2018 improved sequentially. Additionally, our gross margin percentage and contracts per community, including unconsolidated joint ventures, continued to exhibit signs of strength, which was evident in year-over-year improvements for both metrics. Throughout the spring selling season, most of our communities experienced solid traffic and robust demand for new homes. We reported 11.2 contracts per community for the second quarter of fiscal 2018, which is the highest level of contracts per community we have reported for any quarter since the fourth quarter of 2005.”

Commenting on the successful resolution of litigation involving Solus Alternative Asset Management LP, J. Larry Sorsby, executive vice president and CFO, said, “We are pleased that last week the lawsuit filed by Solus with respect to our financing transaction with GSO was dismissed, which concludes this matter on favorable terms for us. All of the benefits to our company provided in our GSO financing commitments remain completely intact.”

Hovnanian concluded, “Provided there are no adverse changes in current market conditions, we expect further improvements in our operations resulting in solid profitability during the fourth quarter of fiscal 2018. Revenue growth from continued investments in new communities will allow us to leverage our total SG&A and interest costs, which we expect will lead to higher levels of profitability in future years. Furthermore, an improving economic backdrop, coupled with positive demographic trends, should result in more normalized levels of activity in the national housing market.”