Mortgage rates knocked out a few first-time buyers, but the move…

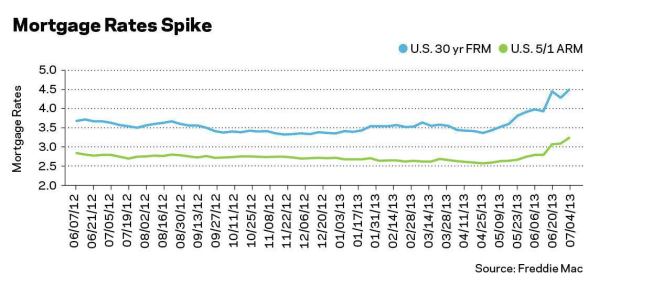

There was a heated debate over the past few months as to whether higher mortgage rates would have a negative or a positive effect on home sales. One group expected a surge in sales, as people try to beat further price increases. The other camp argued that there would be no surge, and the only effect would be a loss of buyers due to higher monthly payments and fewer affordable homes.

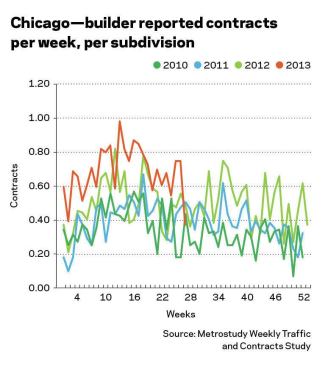

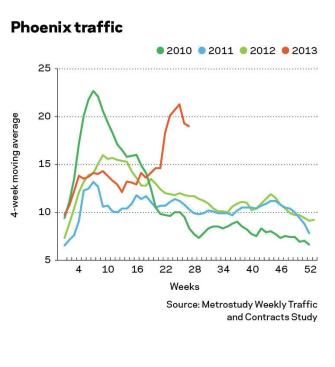

Metrostudy has been tracking the effects of higher mortgage rates on home sales and traffic in new-home builder models. Our survey results show increased volatility in traffic and sales, but the trends are indeed mixed.

Our analysis reveals that the reaction in the marketplace is divided according to what type of buyer is involved. In the case of projects for move-up buyers, we have seen some people advancing their home buying decision. If they would have bought in 2014, some of them are accelerating the process and buying this year to beat further increases in mortgage rates (and in home prices, for that matter). The move-up group has more financial flexibility to time their purchase than the first-time home buyer group.

Meanwhile, the entry-level segment has not had the luxury to time a purchase, and as a result many of these people have simply left the home buying market and may continue to rent.