The delta now, between what typical Americans pay to buy a new single-family home and a used one in today’s wacky housing market, is $54,500. New homes’ median price is $312,400, and existing homes median price is $257,900.

That’s a 21.1% difference in the price tag, new versus resale. To be fair in analyzing this, however, the historical difference between new and existing prices runs at about 15%, which would equate to about $38,685.

Your challenge, and housing’s challenge, and would-be home buyers’ challenge, is that extra 5% difference, which translates as an added $16,000 to the price of a new home. It’s too big a gap given the halting pace of wage growth, and because it’s hard to bridge that gap, too many people may continue to bid on too few homes. So, prices will continue to spiral, outpacing household incomes, stretching value toward overvaluation. We know all too well how this story plays out.

Look at the headwinds you face as new home builders today–a regulatory stack of costs on your land and construction code compliance, volatility, tight supply spikes and threatened tariff impacts on materials costs, uncertainty and cost-per-hour pressures on skilled construction labor, and costlier–if more widely available–capital finance to boot.

How will you go at this $16,000 chasm, even as expense-pressure intensifies on that $16,000 difference between new vs. resale in historical terms? Will you talk about it, and explain why the gap’s there? Or will you change what you’re doing, and bridge the gap?

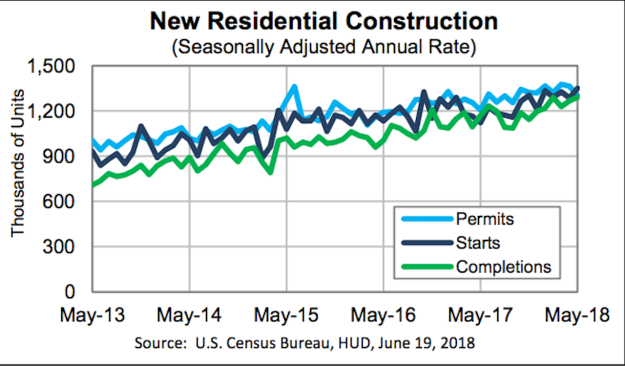

Despite healthy residential construction starts, permits, and completions data in yesterday’s data release from the U.S. Census Bureau and the U.S. Department of Housing and Urban Development, one view of housing activity is that new construction is running at recession levels.

The industry is building 30 percent fewer homes than a decade ago and roughly the same number as were built during the mid-1990s, when the population was 20 percent smaller.

The reasons for not narrowing the divide between new home prices and resales in today’s business, policy, capital investment, and consumer trends and spending environment are clear, real, and potent. No one can deny that regulatory overreach, a lack of predictable and low-priced skilled workers, and materials supply and pricing gyrations cause expense and operations models to change–added costs get absorbed and passed along somehow. This series of impediments, many of them externalities over which home building businesses have little influence and no control, negatively impacts home builders’ confidence despite strong business fundamentals at work today.

They’re all very good reasons for not supplying the market–you and me kind of people who are looking to participate in society by working for and achieving social and economic mobility, contribute to their communities, and live the American Dream–what it needs.

Some will stand by those very good reasons and justify why that gap in price between new and existing is the way it is. And they’ll be right to do so.

Some, however, won’t–and don’t already–tolerate that narrative. They see themselves in business dynamically connected with consumers–not only what they aspire to, but what they have the means to attain–and adjust their operations models, product lines, and engagement value propositions to a market in flux. Like the one we’re in now.

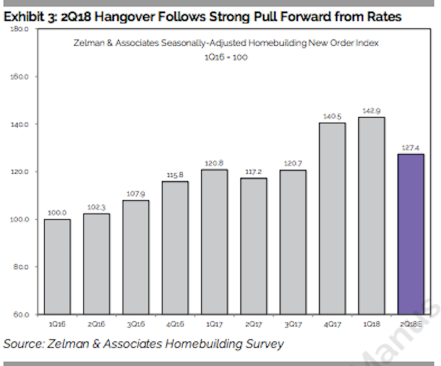

In the latest deployment of The Z Report [For a free trial of The Z Report, click here] from the team at Zelman & Associates, analysts look at incipient impacts of emerging pressures on consumers–mortgage rates, in particular–by way of focusing builders’ attention where they really need to focus. On consumers.

“In the near term, builders should be cognizant of the fact that it may take some time for buyers to adjust to the “new normal” of higher mortgage rates, even at historically-low levels. Therefore, it is possible that incentives or less-aggressive price increases may be necessary to spur a re-acceleration in order activity, even if that comes at the near-term expense of lower margins given persistent material and cost inflation.”

This speaks to an essential truth about builders. They have to get better and better as builders, and they have to get more and more resilient as businesses.

So, some will look at the $16,000 separation–or, rather what it stands for as the divide in value proposition between new and existing–as a challenge, and an opportunity.

Most of the business community will talk about tariffs, regs, labor costs, and capital expense, and explain why that gap continues to yawn between new homes and resales.

But a few–the ones working creatively on density, on automation and factory assembly, on design of smaller, more livable homes, on total-cost-of-ownership, on applying data to reduce cost of sales, on start-to-completion disciplines in “right-the-first-time” velocity, in other words, on what they control–will take action, and are already doing so, to close the gap. In fact, they’re working on models and deliverables that will price new homes below what typical existing homes go for.

Business reality works like this: most of the others’ pain is a big opportunity for a few.

When consumers come first, new rules of business, operation, construction, finance, and community planning apply.