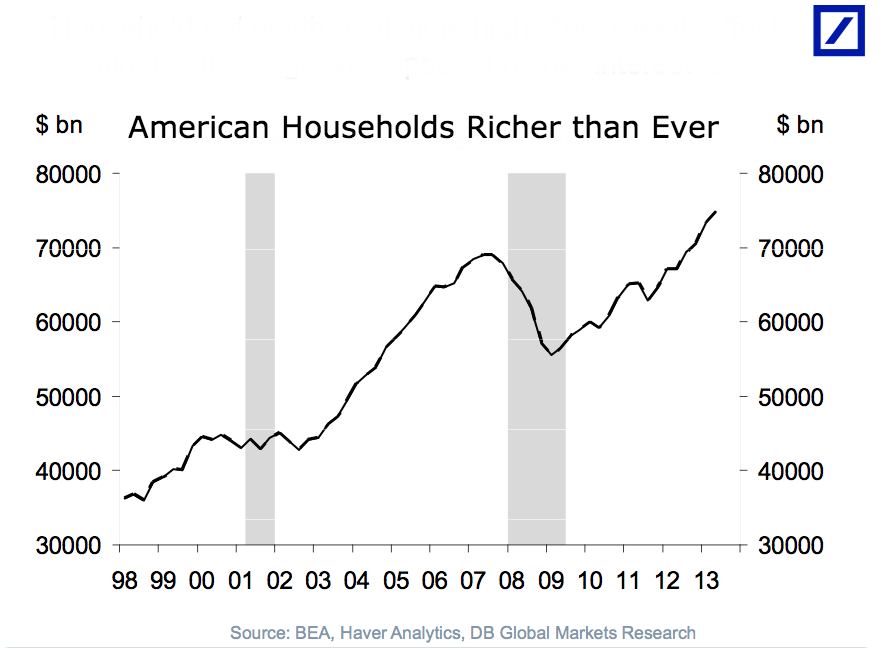

The stock market is at a record high. And, in most markets, housing prices are recovering rapidly. Taken together, these two positive developments have wiped out the $13 trillion loss in net worth American households suffered during the recession. In fact, as the chart shows, household net worth is at an all-time high, at more than $70 trillion.

How does that help housing (and you)?

Well, first of all the wealth effect drives, to a certain extent, consumer spending. It’s generally accepted that every $1 increase in household wealth leads to an additional 6 to 10 cents of consumer spending. And consumer spending accounts for 65% or so of economic activity, which means it’s the linchpin of economic growth.

Stick with me now. According to Torsten Slok, Deutsche Bank’s chief international economist, economic growth (and the wealth effect) will trump the negative effect of higher interest rates that could be triggered by any so-called tapering by the Fed. So there’s another reason to focus on the upside for housing in 2014.