Little could Californians have known–as they voted to enact the Proposition 13 in 1978–that, in doing so, they’d help cause and exacerbate today’s housing crisis in the state 40 years in.

At the same time, voters may have inadvertently meddled with a core, timeless principle behind one of Ben Franklin’s most quotable quotes: “In this world nothing can be said to be certain, except death and taxes.”

The long and the short of it is that watershed-moment Prop 13–and a series of correlative tax law adjustments passed over the years that conditionally allow people to take the advantage of a low real estate assessment with them if they move–give property owners a big break on property taxes. Bloomberg columnist Virginia Postrel sums up Prop 13 arithmetic like this:

Prop 13 limited local property taxes to 1 percent of purchase price (or of the assessed value in 1975) and capped subsequent increases at 2 percent a year.

What was not known back then that has become abundantly clear over time, as property owners have aged, property values have gone up, and taxes now get fixed on everything that moves or doesn’t move in California, is the behavioral economics impact of Proposition 13 and its legislative offspring.

Meaning this. If people benefit from property tax law by staying put and they not only lose the benefit but get penalized if they move, then behavioral economics suggests that people will stay put. Which is what has happened.

Pair that up with federal capital gains tax laws regarding the sale of a residence, and the truism about death and taxes gets exposed. Bloomberg columnist Postrel notes that:

“Two enormous tax distortions will still encourage California homeowners to stick to the old homestead. One is the federal capital gains tax, which kicks in on any profit of $250,000 or more for an individual or $500,000 for a couple. In a state where tiny bungalows routinely go for well over $1 million, that’s not much of an exemption. “There are people in San Francisco who won’t sell until they die because of the capital gains,” says Kevane.

“Even when they die, their houses may never hit the market. In the same 1986 election in which voters passed Prop 60, encouraging older owners to move, they passed a different measure with the opposite effect. Known as Prop 58, it created a new class of landed aristocrats: the descendants of people who bought their homes at low prices.

The law lets homes (and up to $1 million in other property) pass from parents to children without a step-up in assessed value. Another initiative, Prop 193, does the same for grandchildren when their parents are deceased. Together these exclusions all but guarantee that a significant portion of California homes will never go on sale. They can, however, be rented out at market prices.”

Yesterday, we took a look here at an exploration of how California would look and feel and work if it were split into three separate state entities, a longshot measure that just got removed from the November ballot. Today, we’re checking out another measure, still on the ballot, the Property Tax Fairness Initiative. Unlike the three-state measure–which would have only officially begun what would likely be a long, drawn-out process that would involve an Act of Congress if it even got that far–Proposition 5, the Property Tax Transfer Initiative would go into effect on January 1, 2019, with big implications for home builders because of its potential to release people from being “locked-in” to their current properties, freeing them to buy homes more fitting for their 55+ years.

The measure on California’s November ballot, Proposition 5 reads:

- A “yes” vote supports amending Proposition 13 (1978) to allow homebuyers who are age 55 or older or severely disabled to transfer their tax assessments, with a possible adjustment, from their prior home to their new home, no matter (a) the new home’s market value; (b) the new home’s location in the state; or (c) the buyer’s number of moves.

- A “no” vote opposes amending Proposition 13 (1978) to change how tax assessments are transferred between properties for homebuyers who are age 55 or older or severely disabled.

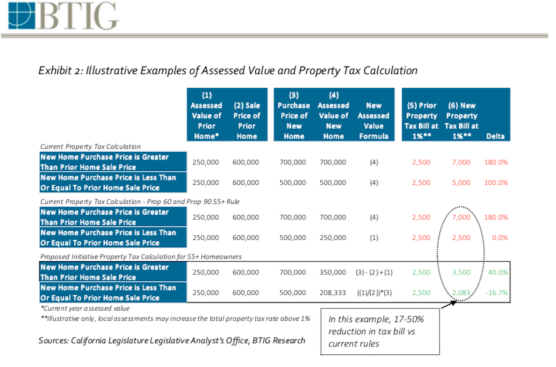

Here, briefly, is the way BTIG equity research analysts Carl Reichardt Jr. and Ryan Gilbert set up the current situation to explore the impacts of the proposed change to the tax law.

“California continues to be an important market for builders, with strong job growth but a limited ability to build. The state represented 12% of the nation’s population in 2017, but had just 7% of its single-family housing permits. Median single family home sales price was $522K in February, 2.1X the national median resale price of $243K. Affordability state-wide is low: 29% of households can afford to purchase the median priced home in CA vs the nationwide percentage of 56%. Current resale inventory sits at 3.9 months’ supply, near an all-time low. Just 1% of the state’s estimated 8.1M single family detached housing units are currently for sale.

“The state’s unique property tax structure, created by voter-approved Proposition 13 in 1978, is an important contributor to California’s housing shortage and consequent high home prices. Proposition 13 limits property tax increases to a max of 2% annually, which over time creates a gap between the market value of a home and the assessed value of a home. Because a homeowners’ property tax assessments are marked to market when they move, long-tenured homeowners are incentivized to stay in their current homes to minimize property taxes.”

Now, broadly, a measure that would encourage more turnover in home properties–effectively allowing market conditions to normalize rather than keeping them in an artificial suspended-state by virtual of tax incentives–would presumably begin to impact home prices overall. More people wanting to sell their homes to move to new or different ones that better met their needs as aging adults would add to the inventory of available homes, and this addition to supply would help to relieve some of the intense pressure on home prices and valuations.

For home builders in particular, here’s Carl Reichardt’s read on the potential–significant–impacts that Proposition 5 would have, ones that might be even more significant factoring in potential negative influence of property taxes in the recent major reforms to income taxes.

- The initiative is significant because 52% of single family owner-occupied households in CA are 55+. Additionally, most 55+ California homeowners have lived in their houses for a lengthy period of time. 63% moved in before 2000, and 78% before 2005, according to the 2015 American Housing Survey.

- Housing turnover rates should increase. The CAR expects an increase of approximately 40,000 sales, or roughly 10% more than current levels, and the California Legislative Analyst expects “as much as tens of thousands” of increased transactions. We would expect 55+ homeowners to increase efforts to purchase move-down and active-adult homes.

- We would expect turnover to be most impacted in areas with relatively high HPA among residents with the longest tenure in-home. These homeowners have the largest spread between market value and assessed value, likely the greatest need to downsize due to age, and are more likely to be on fixed incomes.

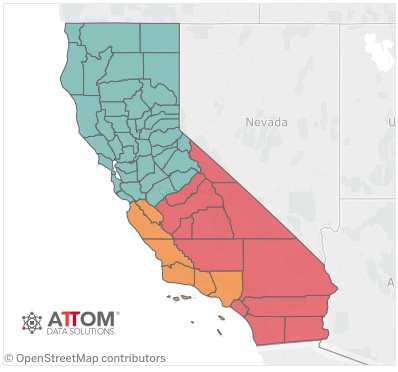

- We believe a larger proportion of these homeowners exist in coastal California counties as opposed to inland counties (see map). Note that the spread between median sales prices in coastal counties and inland counties has widened dramatically over the last six years, in part due to mix, but also due to substantial inventory constraints in coastal markets. Looked at on a mix-adjusted basis using the FHFA Purchase-Only Index (but with a more limited set of metros), we see a similar dynamic with Coastal pricing having increased at almost twice the rate of Inland pricing since 1991.

Net, net, from a strategic standpoint, this tax law has implications not just for land position investments, but also for product and community design and development, especially for 55+ customer segments. Increasingly, 55+, like many segments, does not behave as a heterogeneous whole, but as series of opportunity areas that map to sub-cohorts and modern-day tribes whose consumer behaviors create a scale-able pattern.

The likelihood of the world’s 6th largest economic entity’s dividing–like Gaul–into three parts in the near-term political horizon is slim. However, Proposition 5, which would at least begin to restore faith in the equal certainty of death and taxes, stands a much better chance of happening, and it’s a scenario every builder with California operations and interests needs to get out ahead of today.