NVR, Inc. (NYSE: NVR) on Friday morning reported net income for its second quarter ended June 30, 2018 of $203,174,000, or $49.05 per diluted share. Analysts were expecting a gain of $4.21 per share.

Net income and diluted earnings per share for the second quarter ended June 30, 2018 increased 37% and 39%, respectively, when compared to 2017 second quarter net income of $147,877,000, or $35.19 per diluted share. Consolidated revenues for the second quarter of 2018 totaled $1,787,305,000, a 16% increase from $1,544,492,000 in the second quarter of 2017.

Net income and diluted earnings per share were favorably impacted by the reduction in the company’s effective tax rate for the three and six months ended June 30, 2018 to 15.9% and 14.6%, respectively, compared to 29.2% and 26.5% for the three and six months ended June 30, 2017, respectively. The reduction in the effective tax rate was primarily due to the enactment of the Tax Cuts and Jobs Act in December 2017, which lowered the company’s federal statutory tax rate from 35% to 21%. Additionally, the effective tax rate for the three and six months ended June 30, 2018 was favorably impacted by the recognition of an income tax benefit related to excess tax benefits from stock option exercises totaling $26,456,000 and $46,022,000, respectively. For the three and six months ended June 30, 2017, the income tax benefit related to excess tax benefits from stock option exercises totaled $16,464,000 and $36,364,000, respectively.

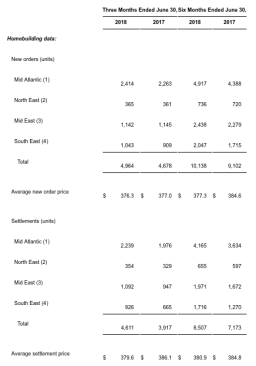

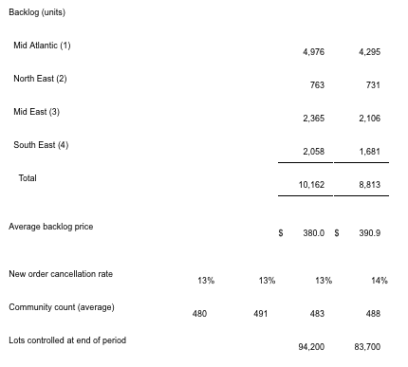

New orders in the second quarter of 2018 increased 6% to 4,964 units, when compared to 4,678 units in the second quarter of 2017. The average sales price of new orders in the second quarter of 2018 was $376,300, which was essentially flat when compared with the second quarter of 2017. Settlements increased in the second quarter of 2018 to 4,611 units, 18% higher than the second quarter of 2017. The company’s backlog of homes sold but not settled as of June 30, 2018 increased on a unit basis by 15% to 10,162 units and increased on a dollar basis by 12% to $3,861,853,000 when compared to June 30, 2017.

Home building revenues in the second quarter of 2018 totaled $1,750,463,000, 16% higher than the year earlier period. Gross profit margin in the second quarter of 2018 decreased to 19.1%, compared to 19.5% in the second quarter of 2017. Income before tax from the homebuilding segment totaled $223,266,000 in the second quarter of 2018, an increase of 17% when compared to the second quarter of 2017.

Mortgage closed loan production in the second quarter of 2018 totaled $1,214,101,000, an increase of 17% when compared to the second quarter of 2017. Income before tax from the mortgage banking segment totaled $18,320,000 in the second quarter of 2018, an increase of 4% when compared to $17,631,000 in the second quarter of 2017.