M/I Homes, Inc. (NYSE:MHO) on Wednesday reported net income of $27.9 million, or $0.96 per diluted share, for the second quarter ended June 30, 2018. The gain compares to net of $15.8 million, or $0.55 per diluted share, for the second quarter of 2017. The results met analyst expectations.

The results include a $3.0 million pre-tax purchase accounting charge ($0.08 per diluted share) related to the acquisition of Pinnacle Homes in Michigan in the first quarter of 2018. The second quarter of 2017 included an $8.5 million pre-tax charge ($0.18 per diluted share) for stucco-related repair costs in certain Florida communities.

Year-to-date in 2018, the Company incurred $5.6 million of pre-tax acquisition-related charges ($0.14 per diluted share) and, in the same period of 2017, incurred $8.5 million ($0.18 per diluted share), for pre-tax stucco-related repair costs. Exclusive of these charges in both periods, year-to-date net income to common shareholders was $50.1 million in 2018 compared to $36.9 million in 2017’s same period, a 36% increase.

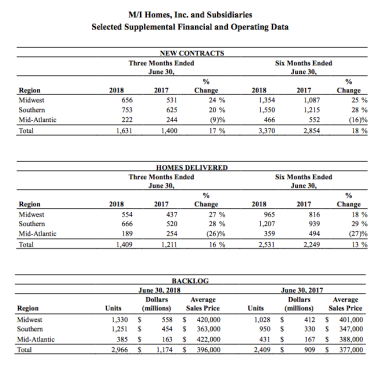

Homes delivered in 2018’s second quarter reached a second quarter record of 1,409, increasing 16% from the 1,211 deliveries in 2017’s second quarter. Homes delivered for the six months ended June 30, 2018 increased 13% to 2,531 from 2017’s deliveries of 2,249.

New contracts for 2018’s second quarter were a record 1,631, an increase of 17% over 2017’s second quarter. For the first six months of 2018, new contracts increased 18% to 3,370 from 2,854 in 2017.

Homes in backlog increased 23% at June 30, 2018 to 2,966 units, with a sales value of $1.2 billion (a 29% increase over last year’s second quarter), and an average sales price of $396,000. At June 30, 2017, the sales value of homes in backlog was $909 million, with an average sales price of $377,000 and backlog units of 2,409.

M/I Homes had 209 active communities at June 30, 2018 compared to 187 at June 30, 2017. The company’s cancellation rate was 14% in the second quarter of 2018 and 13% in 2017.

Robert H. Schottenstein, CEO and president, commented, “We reported another strong quarter highlighted by all-time second quarter records for new contracts, homes delivered, and revenue. We also achieved an all-time quarterly record of backlog sales value, reaching $1.2 billion – a 29% increase over 2017’s second quarter. Our second quarter new contracts of 1,631 increased 17% over last year, and despite margin pressures, our pre-tax income for the second quarter increased to $33.5 million. The increase in pre-tax income, combined with a significantly lower tax rate and improved operating expense leverage, resulted in a dramatic increase in net income to common shareholders from $15.8 million in last year’s second quarter to $27.9 million.”

Schottenstein continued, “We ended the quarter with record-high shareholders’ equity of $816 million, an increase of 18% from 2017’s second quarter, book value per share of $28.56, and a home building debt to capital ratio of 47%. With the strength of our backlog and planned new community openings, we are positioned to have a very good 2018. We will continue to focus on increasing profitability, growing our market share, and investing in attractive land opportunities.”