D.R. Horton, Inc. (NYSE:DHI) on Thursday reported that net income attributable to D.R. Horton for the third fiscal quarter increased 57% to $453.8 million, or $1.18 per diluted share, compared to $289.0 million, or $0.76 per diluted share, in the same quarter of fiscal 2017. Wall Street was expecting a gain of $1.08.

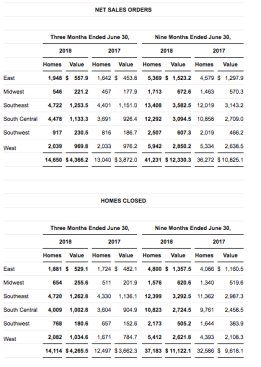

Home building revenue for the third quarter of fiscal 2018 increased 17% to $4.3 billion from $3.7 billion in the same quarter of fiscal 2017. Homes closed in the quarter increased 13% to 14,114 homes compared to 12,497 homes closed in the same quarter of fiscal 2017.

The company’s effective tax rates for the three and nine month periods ended June 30, 2018 reflect a tax benefit from the rate reduction from the December Tax Cuts and Jobs Act of 2017 (Tax Act), an excess tax benefit related to stock-based compensation and the February Bipartisan Budget Act of 2018, which retroactively reinstated the federal tax credit for energy-efficient homes. The nine month period ended June 30, 2018 included a one-time non-cash income tax charge of $108.7 million to re-measure the company’s net deferred tax assets as a result of the Tax Act.

Net sales orders for the third quarter ended June 30, 2018 increased 12% to 14,650 homes and 13% in value to $4.4 billion compared to 13,040 homes and $3.9 billion in the same quarter of the prior year. The company’s cancellation rate for the third quarter of fiscal 2018 was 21%, consistent with the prior year quarter. Net sales orders for the first nine months of fiscal 2018 increased 14% to 41,231 homes and 14% in value to $12.3 billion compared to 36,272 homes and $10.8 billion in the same period of fiscal 2017.

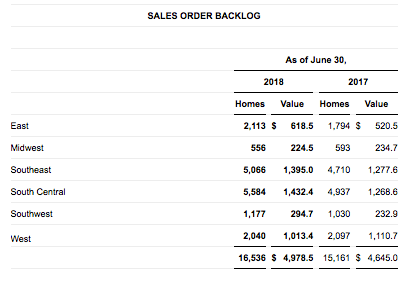

The company’s homes in inventory at June 30, 2018 increased 8% to 29,800 homes compared to 27,600 homes at June 30, 2017. The company’s home building land and lot portfolio at June 30, 2018 increased 10% to 277,700 lots, of which 44% were owned and 56% were controlled through option contracts, compared to 252,100 lots at June 30, 2017, of which 50% were owned and 50% were controlled through option contracts.

The company ended the third quarter with $748.0 million of home building unrestricted cash and a home building debt to total capital ratio of 22.2%.

Donald R. Horton, chairman of the board, said, “The D.R. Horton team is producing strong results in fiscal 2018. Net income for the quarter increased 57% to $453.8 million on a 17% increase in consolidated revenues to $4.4 billion. Our pre-tax profit margin improved 210 basis points to 13.9%, and the value of our net sales orders increased 13%. For the nine months ended June 30, 2018, consolidated pre-tax income, home building revenues and homes closed increased 30%, 16% and 14%, respectively. These results reflect the strength of our experienced operational teams, diverse product offerings from our family of brands and solid market conditions across our broad national footprint.

“Our balance sheet strength, liquidity and continued earnings growth are increasing our strategic and financial flexibility, and we plan to maintain our disciplined, opportunistic position to enhance the long-term value of our company. We continue to expect to grow our revenues and pre-tax profits at a double-digit annual pace, while generating increasing annual operating cash flows and returns. With 29,800 homes in inventory at the end of June and 277,700 lots owned and controlled, we are well-positioned for the fourth quarter and fiscal 2019.”