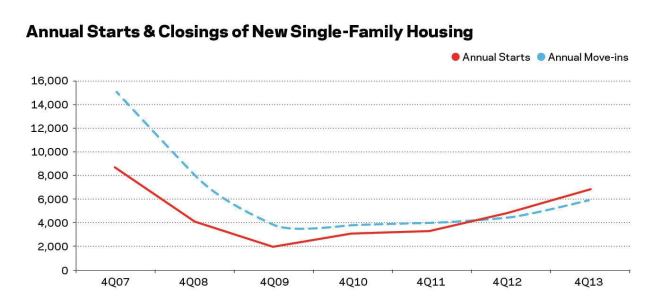

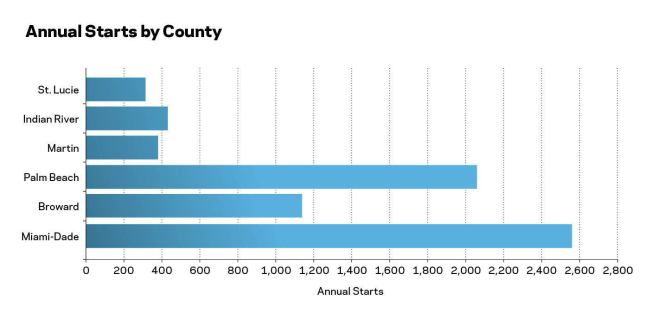

South Florida has been one of the most dynamic U.S. home building markets for the past 30 years. It was once labeled “ground zero” (along with Las Vegas and Phoenix) for the housing collapse, with home production dropping by 90 percent from the peak levels. But for the past three years it’s been rebounding, and builders are barely able to keep up with demand.

Home sales slowed in the second half of 2013, thanks to a rise in mortgage rates and a surge in new-home prices that left buyers with sticker shock. The pace of new-home construction in South Florida slowed by 20 percent in the fourth quarter of 2013, with 1,437 housing starts versus 1,799 in the prior quarter. This level of home building is 4.7 percent higher than in the fourth quarter of 2012, but 29 percent off the 2013 peak attained in the second quarter. With that pause behind us, new-home activity has been gaining in 2014.

The resilience of home building in South Florida has been remarkable in the face of a once huge inventory of bank-owned properties, called REO (real estate owned) by the banks. Today, those REOs are no longer a competitive threat to new-home builders.

In this market, lot shortages are a serious issue. Builders are having to pay peak prices again for developed lots in high-demand areas. Land developers and investors are looking for ways to reuse golf course land for residential development to meet demand.

South Florida’s housing outlook is strong, both in terms of builder pricing power and future demand. Active adult buyers are coming down from the north in larger numbers, and working-age buyers are buying as their incomes improve.

Learn more about markets featured in this article: Miami, FL, Orlando, FL.