Demand conditions remain positive for single-family construction. A growing lack of existing-home inventory combined with favorable demographics require single-family construction volume to grow in the years ahead. But, as builders know, supply-side constraints have driven the cost of construction higher, which has resulted in an imbalance with respect to the types of new homes that can be supplied: more higher-end homes and fewer entry-level residences.

The lack of resale inventory and the shift in the market mix for new construction has pushed up home prices in most markets. While these gains represent a windfall wealth gain for existing homeowners (keep in mind the typical homeowner has a net worth of $231,400 compared with $5,200 for the typical renter, according to the 2016 Federal Reserve Survey of Consumer Finances), these price increases have a negative impact on the ability of prospective first-time home buyers to enter the market.

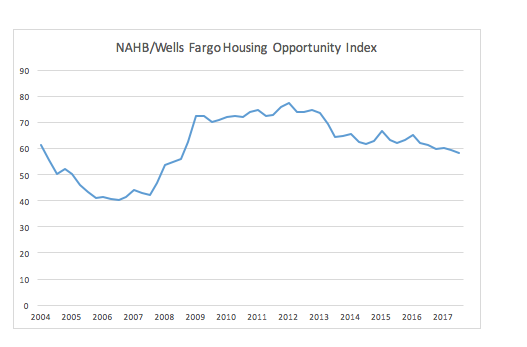

Consider the latest readings from the NAHB/Wells Fargo Housing Opportunity Index (HOI), a quarterly measure of housing affordability. The HOI is scored on a zero to 100 scale, with the number representing the percentage of new and existing home sales that are affordable for a household with median income and standard mortgage qualifying requirements.

For the third quarter of 2017, the HOI came in at 58.3, meaning 58.3% of new and existing homes sold were affordable for a typical household. This is down from a level of 66.5 from the start of 2015, during a period in which mortgage interest rates were relatively unchanged. In other words, all of the measured decline in housing affordability over the past two and half years has been caused by increases in home prices.

Unfortunately, we expect these trends to continue. Interest rates are expected to gradually rise over the next few years as labor market tightness increases inflationary pressures, causing the Fed to continue its short-term interest rate hikes and policy of balance sheet reduction. If economic growth exceeds our current modest expectations, that, too, will raise interest rates and make it marginally more difficult for new-home buyers to purchase their first home.

This challenge is clearly related to geography and local land use policy. For example, Los Angeles currently holds the nation’s status as the least affordable market with a local HOI score of 9.1, with San Francisco running close at 11.1.

Wage gains are the only way to stop the trend toward declines in housing affordability. Income growth that outpaces the expected rise in interest rates could stem and potentially increase a typical family’s ability to purchase a home. While there are no guarantees, the current tight labor market and the possibility of labor-enhancing technological gains on the horizon point to faster income growth than the economy has offered over the past decade. Absent that, local policymakers should take a hard look at their land use and other regulatory policies to ease supply-side cost factors as interest rates rise. Those are the ways to address rising housing affordability burdens.