On one side of the deal’s table, AV Homes, a small but fast-growing public company, anxious to pivot for the first time into the nation’s No. 1 home building market of the moment, with a fifth acquisition since it morphed from being a quasi-land seller and developer into a full-fledged home building operation under the process-driven guidance of CEO Roger Cregg since 2012.

On the other side of the table, a small but fast-growing private company start-up, anxious for access to steadier, deeper, more easily tapped streams of capital to carry out a two-pronged, nimble, process-driven, high-growth strategy under the proven entrepreneurial guidance of Larry Craven.

Both principals had been here before. Each was laser-focused on a specific goal, one to deploy cash to grow and sustain momentum and the other to tap a deep pool of capital to grow and sustain momentum.

“The fit was right at first sight,” according to Michael P. Kahn & Associates’ Bruce Robinson, involved as the seller’s representative in the $42 million deal in which Craven’s Oakdale and Hampton Homes Dallas operations would be acquired by AV Homes, with an expected closing date in early January.

The Oakdale/Hampton acquisition is AV’s second in 2017, and it’s the second deal where the seller’s representatives in dealing with Roger Cregg and his AV Homes acquisitions team were Michael Kahn & Associates. Earlier, in March of this year, AV paid about $50 million to strengthen its operating position and lot pipeline by purchasing Raleigh, N.C.-based Savvy Homes–which together with earlier Bonterra and Royal Oaks acquisitions, gave AV a Southeastern market stronghold, with a DNA of entrepreneurial, boot-straps style fiestiness and operational focus, and a strong emphasis on home-buying customers’ experience of value.

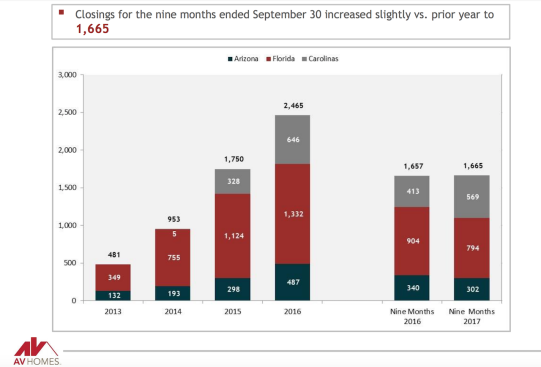

For AV Homes, the new deal runs true to the theme of adding brash, never-say-never, cunning operators, who scout out and seize on ways to thrive in the same geographical turf as behemoth big publics with their seemingly limitless capital clout and grip on local trade crews and the materials channel. With an AV adrenaline-shot of capital into the two fledgling Dallas brands in a market that in 2017 will support more than 31,000 new home closings, one could easily expect AV Homes to move from No. 24 on the Builder 100 rankings to a top-20 position within six to 12 months.

Larry Craven struck lightning in a bottle the first time around with the sale in 2013 of LionsGate Homes–a company he launched in the throes of the Great Recession in 2007–to then-Ryland Homes, which needed to re-enter the Dallas market after exiting in 2011, during the same Great Recession. Then, as now, he’d built LionsGate into a well-run, well-positioned operator, with a value-engineered product line and position that fit Ryland’s disciplined operational model to-a-T. Then, as now, private home builders find themselves at a disadvantage lining up the kinds of acquisition and development capital it takes to do battle with home building’s large enterprises, leveraging public debt and equity and/or foreign company-backed investment. Craven stayed on as Dallas division president until the merger of Ryland and Standard Pacific, after which he took leave to start his latest juggernaut, Oakdale and Hampton Homes, which are on pace to closings of just shy of 150 homes this year, just 24 months after starting up.

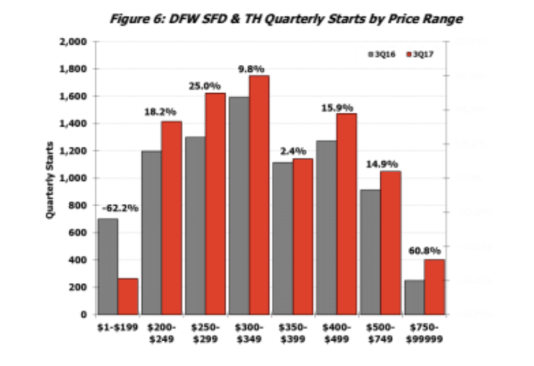

Of particular note, while both nameplates stand for more attainable price ranges in their respective move-up and starter home segments, Hampton Homes, the entry-level platform of the pair is particularly well-positioned for high-velocity volume growth in Dallas and beyond. In third-quarter commentary on the Dallas-Fort Worth market, Metrostudy regional director Paige Shipp noted that the Hampton brand and price-position is right in the sweet spot of no-end-in-sight-demand for product in the $200s to low $300s in North Texas. Shipp said:

“During the third quarter, DFW homebuilders started only 264 homes priced below $200,000 which confirms the near extinction of the sub-$200k new home in DFW,” said Paige Shipp, Director for Metrostudy’s Dallas Ft. Worth market. “However, there is a clear increase in starts for new homes priced between $200,000 and $350,000. Builders report the greatest buyer demand in those price bands, and the increase in starts signals that supply is responding to market demand. Increased starts between $400,000 and $750,000 were similar to historical growth, but starts above $750,000 outpaced 3Q16 by an alarming 60.8%. Closings priced $200,000 to $250,000 and $250,000 to $300,000 rose 5.6% and 13.7% respectively. Starts outperforming closings from $200,000 to $300,000 indicates builders are delivering more affordable product in DFW.”

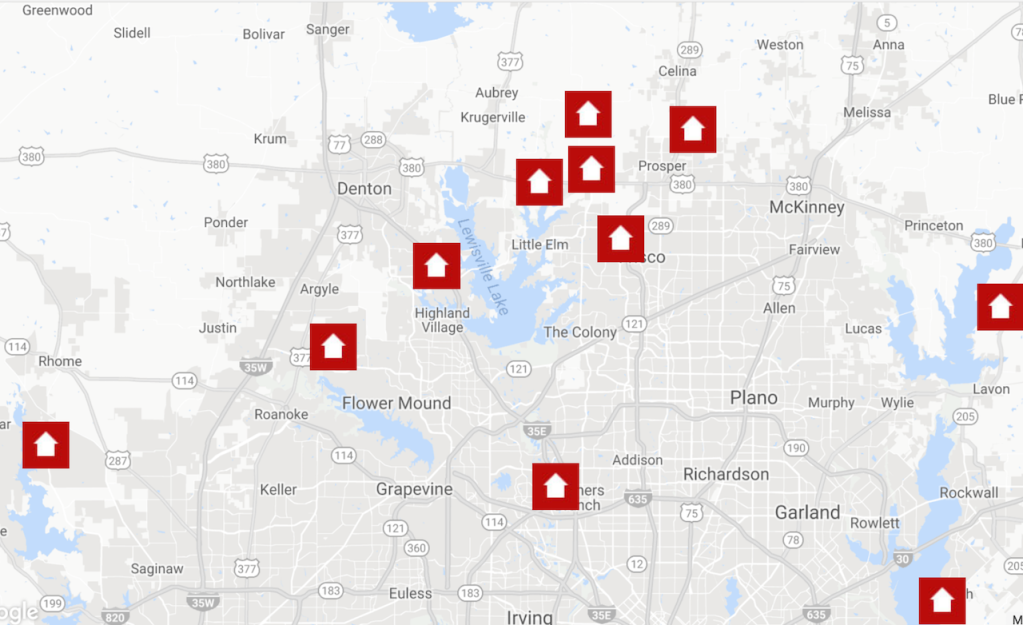

Metrostudy counts about 300 vacant developed lots in Oakdale and Hampton Homes’ currently selling communities, but clearly AV’s Cregg and Oakdale/Hampton’s Craven have visibility into a far-bigger lot pipeline, counting about 1,000 owned and controlled lots in the current Dallas-Fort Worth land portfolio.

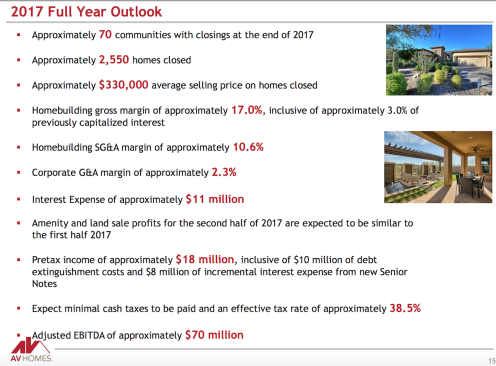

An intriguing area of conjecture, looking into 2018 and beyond–as the housing cycle shifts from an upward trajectory to one that inevitably will flatten and trail back down–is how home building’s ongoing consolidation of power and volume among fewer, bigger players (i.e. Lennar’s purchase of CalAtlantic and WCI in 2017, and DR Horton’s acquisition of megadeveloper Forestar) will impact a second tier of public firms in the Builder 100 ranks--Century Communities (19), William Lyon Homes (20), AV Homes (24), The New Home Company (46), and Green Brick (58)–in terms of either their own continued targeted deployment of capital toward growth, or their desirability as acquisition targets for top-15 ranked publics seeking incremental volume growth, segmentation opportunity, geographical clout, a rich talent pool, or all of the above.

Public to public integration–which had been a real rarity prior to Pulte’s purchase of Centex during the downturn–now has better practice models to follow, with the merger of Ryland and Standard Pacific, the acquisition of UPC by Century Communities, and Lennar’s purchase of WCI and CalAtlantic.

Now that Roger Cregg has elevated the AV Homes operation to a fully-loaded strategic operating company whose capital deployment, growth metrics, and profitability dashboard all prove growing value generation for stakeholders, the company itself may either continue on its explosive expansion course or it may become the Belle of the Ball for a bigger company looking for strong operating and financial discipline in its Southeastern, Arizona, and now, Texas markets.