Spring 2020 is the future for almost everybody, but in real-world, messy, practical ways, it’s the present for new residential developers and builders.

Land and lot acquisition strategy for builders takes on a different complexion in 2018, even as expectations for the coming 12 months, and the 12 months after that, call for steadily more demand, solid per community absorptions pace, with a bit of price power to boot.

There are a few motivations to keep in mind, but, particularly amidst a heady period of corporate hiring and investment now that taxes and regulatory encumbrances are dropping like heavy shackles, things could steam up pretty fast and make the jobs of land acquisition and M&A specialists tougher than ever.

As we saw with the Lennar-CalAtlantic mega-deal announced in October, and the much tinier Beazer acquisition of 450 home sites from Bill Clark Homes in Raleigh and Myrtle Beach that we just reported on, some of the land portfolio buys don’t so much extend a builder’s lot pipeline as they do redouble the volume and capacity–and, importantly market share and scale–opportunity for now and the next 24 months, largely within the buyer’s original operating footprint.

Other 2017 acquisition ventures, such as CalAtlantic’s buy of Oakpointe in mid-year of last year, were important insofar as they expanded the strategic and operating footprint to new markets that have shown economic momentum and are likely to experience strong demand for some time to come.

A third kind of land acquisition, and one that requires the most care and precision when it comes to front-ending capital resource investment–especially since the bloodbath years of 2008, 2009, and 2010 remain relatively fresh memories in many minds–would telescope the marketing and selling horizon beyond the 24-month “safe” period, to 36-month, 48-month, or even 60-month portfolios.

That’s where it gets dicey, especially when multiple bidders vie for the same tract, a luxury landsellers have these days.

Some enterprises, Toll Brothers for instance, have both the capital structures, the cultural appetite, and the operational, design, and marketing know-how to thrive in a “no-lot-before-its-time” real estate investment model. They’re the exception. Most builders who get too far out over their skis with land are asking for it. As land acq pros tend to agree, there are no bad land parcels, only bad timing.

Now, safeguards, lot options, and risk-reducing land-bank structures that allow builder operators take-down schedules to match operational, sales, and financial timelines abound, and they’ll continue serve as mechanisms to manage and balance exposure vs. opportunity.

As an alternative to the Toll Brothers practice of acquiring parcels and banking them until they time-release optimal value vs. their purchase price, some builders–D.R. Horton and Lennar, for example–have aligned strategically with development companies whose business is to bank land tracts that bridge across from the end of the current recovery to the beginning of the next one. These partnerships–Horton’s with Forestar and Lennar’s with FivePoint Holdings–lock-in a deal framework that gives the builder-operator forward visibility into costs for land, and gives the developer assurance that a big buyer has committed money to keep extending the pipeline into the next 24 month timeframe.

We’ll probably see more of this type of alignment, especially as land-light builders churn through their current lot portfolios and community counts with a healthy amount of momentum through the next 12 to 18 months. Putting new communities on the 2020 horizon is where the science and the math get fuzzy and the art and alchemy of land acquisition come into play.

That said, here’s a few data-evidenced insights into the whys and wherefores of what’s making for America’s healthiest looking home building markets for 2018. Here’s the tip from Ivy Zelman and the Zelman & Associates analysts in the latest The Z Report (which you can try for free by linking here): keep it simple. Don’t overthink demographics. States with the fastest growth in households are where the action is. Here’s a piece in the Wall Street Journal that looks at why some cities are thriving economically, while some are not. The Z Report notes:

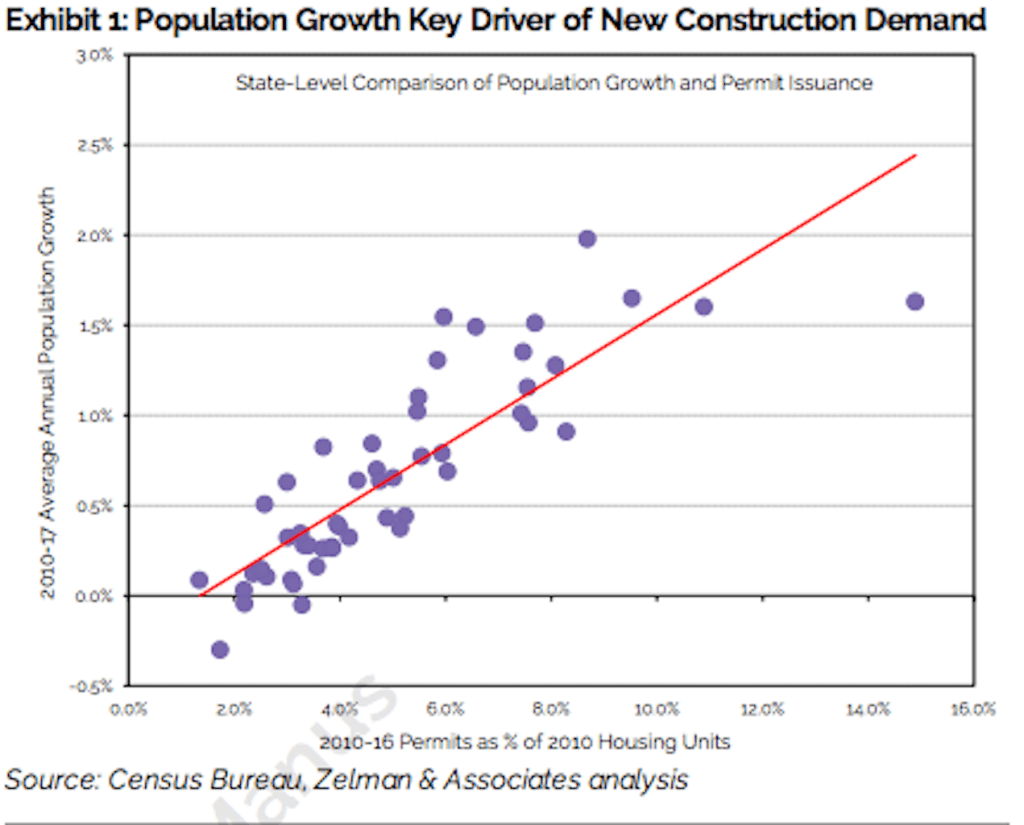

“From 2010-2016 there were approximately 6.5 million single-family and multi-family permits issued for new construction, equaling 4.8% of the housing stock as of the April 2010 Decennial Census. The five strongest areas on this measure were North Dakota (14.9%), Utah (10.9%), Texas (9.5%), the District of Columbia (8.7%) and South Dakota (8.3%). Not surprisingly, while South Dakota ranked 16th in population growth over this time frame, the other four new construction winners were also the four strongest areas for population growth.

This is best shown in Exhibit 1 where the correlation between population growth and permits issued as a percentage of housing stock is a strong 85%.”

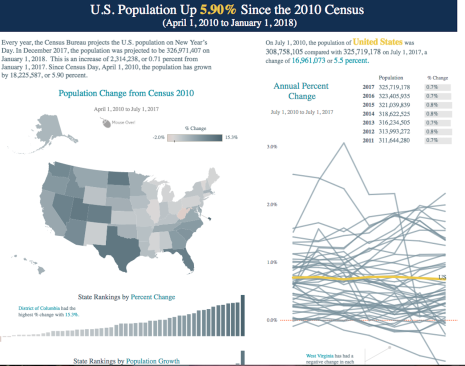

Here, from the U.S. Census is an interactive that allows you to play and zero in on the geographies that most interest you when it comes to the growth (or negative growth) of state populations. All-told, between 2010 and July 2017, the population of the United States grew by 16.96 million, a 5.5% change, to a total of 325.72 million.

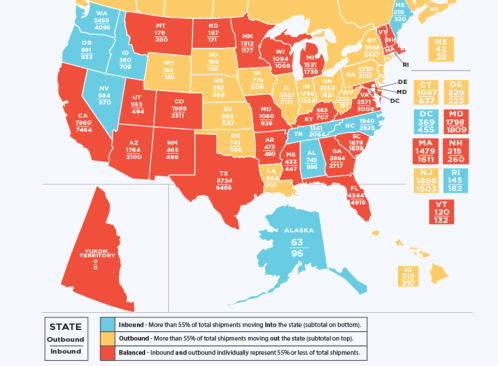

While we’re at it, we’ll share with you the latest information on migration patterns from big interstate moving company, Atlas, which publishes a popular “inbound” and “outbound” moves heat-map that can be a fun, if not helpful, proxy to see where America’s household movers are headed, and where they’re coming from.

Note, however, that while this is all well-and-good as raw, broad-stroke, big-picture data, it’s the submarkets where money is won or lost for home builders. Knowing whether you’re going to get pace on a $425,000 product in a transition entry-level, first-time move-up community to get the profitability and volume you need, vs. generating five or six sales per month per community on your starter-level $295,000 home requires precise, sub-market insight where land acquisition and strategy specialists really earn their stripes.

To support the art and science of those brave souls, read our lips: Metrostudy. Join us next Wednesday morning, Jan. 10, at the Hyatt Regency, Orlando, across from the Orange County Convention Center, for an exclusive outlook on 2018 and beyond. Link here to register if you haven’t.