Interest rates–at least temporarily–are the lightning rod getting the blame for softer sales pace, creating air pockets of weakening or lost momentum in parts of the market since the beginning of Summer 2018.

On the one hand, increased mortgage financing costs go hand-in-hand with an accelerating economic backdrop that should continue to solidify fundamental demand for new homes. On the other, after years of dirt-cheap mortgage rates effectively masking a widening gap between household wage and earnings and home prices, now that mask is off.

Earnings have at last gained some ground.

But interest rates keep rising, testing both monthly payment tolerance points and consumer sentiment. Here’s the latest reading on rates and the pressures building underneath them, from Zillow senior economist Aaron Terrazas.

Mortgage rates rose for the third consecutive week, riding an exceptionally strong jobs report to their highest levels in over a month.

After last week’s release of robust manufacturing data, the strength of the American economy was reaffirmed when the jobs report exceeded analysts’ expectations and showed that wages are growing at their fastest annual pace since 2009. The news followed months of positive employment data and was seen by the markets as a sign of impending inflation. Rates ascended as a result, and markets will likely to keep a keen eye on this coming Thursday’s release of inflation data. A strong release should result in additional upward pressure on rates.

Those who look at today’s new home market through the lens of a still-constructive narrative see the summer pause as a cocktail blend of seasonality and reflexive push-back to rising rates. In other words, a pause rather than a signal of the end of the run.

Once the seasonal context shifts, a clearer view of rising rates’ impact will emerge, and, if past is a prelude, recovery’s fundamentals–a buoyant economy, jobs growth, low unemployment, rising household incomes, and a truckload of supported demographic trends–should outweigh the impact of higher financing costs.

A great analysis of housing recovery resiliency in the face of interest rate spikes in recent history appears in the latest installment of The Z Report, available as a free trial subscription by linking here.

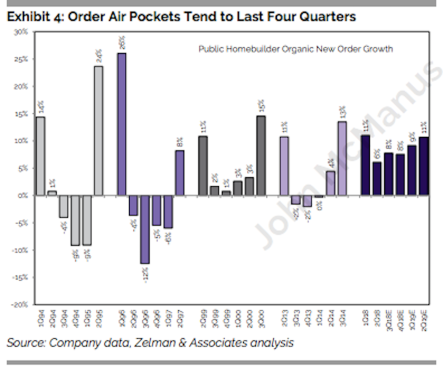

Zelman & Company’s drill-down looks at the data benchmarks from 12 quarters–since 1989–when 10-year Treasury yields spiked by more than 50 basis points over the trailing 12-month period. The pattern that emerges is pretty clear and pretty optimistic.

As shown, the softness tended to last for almost exactly four quarters each time. After the “pause”, growth returned to a level equal to or better than the existing growth rate in three of the four periods…. If history is an appropriate gauge, another quarter of modest deceleration should be expected. However, assuming long-term interests rates remain relatively stable over the subsequent few quarters, modest re-acceleration could resurface thereafter, and double-digit growth would seemingly be back in reach in either 1Q19 or 2Q19, at the latest.

The Zelman team further notes that this expectation jives precisely with a collective view of public builders’ guidance for the start of next year–their outlook for orders tallies to 9% in 1Q19 and 11% 2Q19.

Okay, this outlook–for continued price-point or submarket or customer segment or product style softness in the months ahead, followed by a resumption of a fundamentals-fueled broad-based draw-through of new-home volume–suggests immediate-term challenges, longer-term opportunities, and, for leaders and managers, the need for a roadmap through the next several months.

It matters to have such a roadmap, especially because it’s not just rates, but also materials and labor cost volatility adding uncertainty to the planning process.

Still, rates are where monthly payment math is the trickiest, especially since improved household incomes have been lagging house price increases for such an extended period of time.

Key to a roadmap will be your reliable and real-time access to data decision-support to ensure your own pricing can stay in sync with market elasticity and rigidity on a community by community basis. If you want to keep pace consistent, or even improve it heading into 4Q18, price tactics, incentives, and down payment assistance programs will be critical tools, which of course, comes down to a submarket by submarket discipline.

For an overview of how to look at when and where your operating areas shift from undervalued to overvalued measures on the price spectrum, have a look at Metrostudy chief economist Mark Boud’s latest market outlook here.