Accounting normally involves matching revenue from the sale of an object with all the costs of producing and delivering that object within a specific time period. For industries other than construction, this matching process is relatively straightforward. In the building business, however, the one distinguishing characteristic that makes accounting different is that the object that is sold does not exist at the time of sale, and the ultimate cost to produce it is not yet known.

Special rules apply to matching the custom builder’s revenue, costs, and profit on contracts to the periods during which he performs his obligations. There are four different methods to do this: cash, accrual, completed contract, and percentage of completion. Here’s how they work.

Cash Method. Under the cash method, income is recognized when cash is received and expenses are recognized when cash is disbursed. Although this method may have tax advantages, it is not recommended for management reporting. Since transactions are not entered until cash is received or disbursed, and bills are usually not paid as soon as they are received, accounting information under the cash method is not timely.

Accrual Method. The accrual method works well for time and material or cost-plus contracts. Under this method income is recognized when an invoice is prepared, and expenses are recorded when invoices are received. This method provides more timely accounting information than the cash method, but for most custom builders it won’t give a true picture of the company’s financial position.

Completed Contract Method. Under this method, revenue and expenses are not recorded until the contract is complete. This method may enable a builder to defer paying taxes on a project’s profit until the job is completed, but for management purposes, it does not give the tools a custom builder needs to run his business. Under this method, costs incurred during construction are considered as assets (work in process) while customer payments are recorded as liabilities.

Percentage-of-Completion Method. The percentage-of-completion method recognizes gross profit, cost, and revenue throughout the life of each contract based upon a periodic measure of progress. The rationale behind this method is that the contractor and the customer have obtained enforceable rights relating to the performance of the contract, so the job must be under contract. The customer’s rights include specific performance of the terms of the contract, while the contractor’s rights include periodic payments which provide evidence of the customer’s ownership in the construction in progress.

This method also requires that the contract be properly estimated, and that the job cost system be accurate, up-to-date, and easily comparable to the estimate. The builder must have the ability to produce the information necessary to make a reasonable estimate as to the progress of the job. The percentage-of-completion method is most desirable for pre-sold homes because it more accurately matches costs with revenues and, therefore, profit for a given period. However, the costs and revenues calculated in this method are at best still estimates of the true outcome of the job. For this reason, care should be taken when determining the progress of the job.

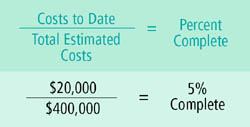

In the simplest sense, a ratio of the percentage of completion is determined and applied to the expected gross profit on the contract to come up with the gross profit and revenue to be recognized in the financial statements. To best explain the differences between these accounting methods, let’s look at the following example:

Custom Builder just got a contract for $500,000 to build a new house for Mr. & Mrs. Johnson. The president of Custom Builder estimates his total direct costs on the job will be $400,000. During the first month of the job, the following transactions occur:

- A deposit of $50,000 is received.

- Cash of $10,000 is paid for permits, fees, and other start-up costs.

- An invoice is received from the excavation contractor for $10,000.

- The first progress billing is prepared for $40,000.

If the above transactions were the only ones that Custom Builder had for the month, its income statements under each method would look as follows:

Under the cash method, revenue is equal to the deposit received, and costs are equal to the amount of cash paid for permits, fees, and other start-up costs. Under the accrual method, revenue earned equals the amount that was invoiced on the first progress billing ($40,000) plus the deposit that was received. Costs on the accrual basis include the cash paid plus the amount due to the excavation contractor. Revenue under the percentage-of-completion method was computed as follows (right):

By examining the four income statements you will see that the percentage-of-completion method best reflects the company’s revenue, costs, and gross profit for the period. If the president of Custom Builder received an accrual basis statement, he may think that the company is really prospering (the job is only 5% complete, and they’ve already made $70,000). However, this statement does not give a true picture of the company’s profitability as of the end of the month. Since the job was only 5% completed, only 5% ($20,000) of the total projected gross profit ($100,000) has been earned. For those custom builders who also build spec homes, these homes must be excluded from the percentage-of-completion calculation until they come under contract, since having a solid contract is one of the criteria in using the percentage-of-completion accounting method.

Under the accrual method of accounting, all costs and progress billing against a contract are accumulated in revenue and cost accounts of the general ledger and the job cost ledger. This differs from the completed contract method in which costs and billings are accumulated in the balance sheet until the period in which the contract is completed.

In computing percentage of completion there are only four items that need to be pulled from your job cost accounting records.

- Cost to Date: total costs incurred on the job from inception through the end of the accounting period.

- Billings to Date: total billings (draws) taken on the job from inception through the end of the accounting period.

- Current Contract: original contract plus change orders executed through the end of the accounting period.

- Total Estimated Costs: current estimate of total anticipated costs on the job. This estimate should be updated to account for any projected budget over- or under-runs as well as estimated costs on all change orders included within the current contract amount.

In the simplest sense, a ratio of the percentage of completion is determined and applied to the expected gross profit on the contract to determine the gross profit and revenue to be recognized in the financial statements.

With the above information you can develop a spreadsheet to compute the amounts needed for the adjusting entry from accrual or cash to percentage of completion, as well as provide other information that will assist in analyzing your jobs in progress.

The percentage-of-completion method of accounting provides two great advantages to custom builders. First, it forces a custom builder to take a second look at his or her estimate on a monthly basis. Second, it allows a builder to measure production and productivity because every month he analyzes costs incurred and gross profit earned during the month. Costs are not buried in a balance sheet. You’re seeing it every month on the income statement.

Steve Maltzman, CPA, is president of SMA Consulting in Colton, Calif.

If you would like to receive a copy of a sample work-in-process spreadsheet that you can implement in your company, visit www.sma consulting.net and go to the section on articles within Recent News and Articles or send an e-mail to smaltzman@smaconsulting.net.