Lennar Corporation (NYSE: LEN and LEN.B), Miami, on Wednesday reported net earnings of $309.6 million, or $1.29 per diluted share, for its fiscal fourth quater ended Nov. 30, compared to $313.5 million, or $1.31 per diluted share in the fourth quarter of 2016. Net earnings for the year ended November 30, 2017 were $810.5 million, or $3.38 per diluted share, compared to $911.8 million, or $3.86 per diluted share for the year ended November 30, 2016.

Wall Street was expecting a gain of $1.47. The earnings miss was attributable to the shifting of a strategic transaction that could have been booked in the fourth quarter to calendar 2018 in order to benefit from the lower corporate tax rate that took effect Jan. 1.

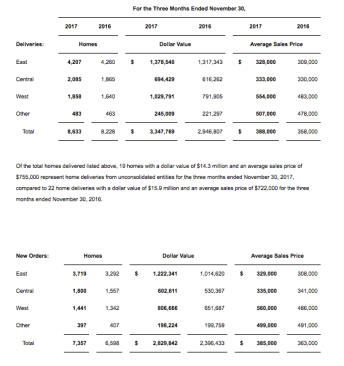

Revenues from home sales increased 14% in the fourth quarter of 2017 to $3.3 billion from $2.9 billion in the fourth quarter of 2016. Revenues were higher primarily due to a 5% increase in the number of home deliveries, excluding unconsolidated entities, and an 8% increase in the average sales price of homes delivered. New home deliveries, excluding unconsolidated entities, increased to 8,614 homes in the fourth quarter of 2017 from 8,206 homes in the fourth quarter of 2016. There was an increase in home deliveries in all of the Company’s Homebuilding segments and Homebuilding Other, except Homebuilding East that was slightly down from prior year due to the impact of Hurricane Irma on deliveries in the fourth quarter. The average sales price of homes delivered, excluding unconsolidated entities, increased to $387,000 in the fourth quarter of 2017 from $357,000 in the fourth quarter of 2016. Sales incentives offered to home buyers were $23,500 per home delivered in the fourth quarter of 2017, or 5.7% as a percentage of home sales revenue, compared to $23,700 per home delivered in the same period last year, or 6.2% as a percentage of home sales revenue. The improvement in sales incentives was primarily due to the Homebuilding West segment.

Gross margins on home sales were $747.5 million, or 22.4%, in the fourth quarter of 2017, compared to $683.5 million, or 23.3%, in the fourth quarter of 2016. Gross margin percentage on home sales decreased compared to the fourth quarter of 2016 primarily due to an increase in land and construction costs per home, partially offset by an increase in the average sales price of homes delivered.

Selling, general and administrative expenses were $281.0 million in the fourth quarter of 2017, compared to $256.2 million in the fourth quarter of 2016. As a percentage of revenues from home sales, selling, general and administrative expenses improved to 8.4% in the fourth quarter of 2017, from 8.7% in the fourth quarter of 2016, primarily due to a decrease in external broker commissions as a percentage of revenues from home sales and improved operating leverage.

Gross profits on land sales were $21.0 million in the fourth quarter of 2017, compared to $24.3 million in the fourth quarter of 2016.

Lennar Homebuilding equity in loss from unconsolidated entities was $19.0 million in the fourth quarter of 2017, compared to $24.6 million in the fourth quarter of 2016. In the fourth quarter of 2017, Lennar Homebuilding equity in loss from unconsolidated entities was primarily attributable to the Company’s share of valuation adjustments related to assets of Lennar Homebuilding’s unconsolidated entities. In the fourth quarter of 2016, Lennar Homebuilding equity in loss from unconsolidated entities was primarily attributable to the Company’s share of net operating losses associated with the new FivePoint unconsolidated entity formed as the result of the FivePoint combination in the second quarter of fiscal 2016.

Lennar Homebuilding other income, net, was $10.4 million in the fourth quarter of 2017, compared to $9.7 million in the fourth quarter of 2016.

Lennar Homebuilding interest expense was $81.7 million in the fourth quarter of 2017 ($73.4 million was included in costs of homes sold, $5.9 million in costs of land sold and $2.4 million in other interest expense), compared to $73.3 million in the fourth quarter of 2016 ($69.4 million was included in costs of homes sold, $2.6 million in costs of land sold and $1.3 million in other interest expense). Interest expense included in costs of homes sold increased primarily due to an increase in home deliveries.

Operating earnings for the Lennar Financial Services segment were $42.1 million in the fourth quarter of 2017, compared to $51.4 million in the fourth quarter of 2016. Operating earnings decreased primarily due to decreased profitability in the segment’s mortgage operations as a result of a significant decline in refinance transactions, which led to both lower origination volume and profit per loan.

Operating earnings for the Rialto segment were $2.2 million in the fourth quarter of 2017 (which included $12.0 million of operating loss and an add back of $14.2 million of net loss attributable to noncontrolling interests). Operating earnings in the fourth quarter of 2016 were $8.0 million (which included $0.2 million of operating loss and an add back of $8.2 million of net loss attributable to noncontrolling interests). The decrease in operating earnings was primarily due to a decrease in Rialto Mortgage Finance (“RMF”) securitization revenues as a result of lower volume and an increase in REO and loan impairments, partially offset by an increase in interest income, incentive income related to carried interest distributions from the Rialto real estate funds and a decrease in general and administrative expenses.

Operating earnings for the Lennar Multifamily segment were $38.6 million in the fourth quarter of 2017, compared to $41.4 million in the fourth quarter of 2016. The decrease in profitability was primarily due to the segment’s $43.8 million share of gains related to the sale of two operating properties by Lennar Multifamily’s unconsolidated entities in the fourth quarter of 2017, compared to the segment’s $47.2 million share of gains related to the sale of four operating properties by Lennar Multifamily’s unconsolidated entities in the fourth quarter of 2016.

Corporate general and administrative expenses were $85.6 million, or 2.3% as a percentage of total revenues, in the fourth quarter of 2017, compared to $67.9 million, or 2.0% as a percentage of total revenues, in the fourth quarter of 2016. The increase was primarily due to personnel and related expenses and professional expenses related to technology investments.

Net loss attributable to noncontrolling interests was $11.8 million and $3.0 million in the fourth quarter of 2017 and 2016, respectively. Net loss attributable to noncontrolling interests during the fourth quarter of 2017 and 2016 was primarily attributable to a net loss related to the FDIC’s interest in the portfolio of real estate loans that the Company acquired in partnership with the FDIC in 2010, partially offset by net earnings related to the Lennar Homebuilding consolidated joint ventures.

The company ended the quarter and the fiscal year with cash and cash equivalents of $2.3 billion, no outstanding borrowings under the $2.0 billion credit facility and debt to total capital, net of cash and cash equivalents of 34.4%.

Stuart Miller, Lennar CEO, said, “We are pleased to announce a strong fourth quarter and fiscal 2017, as we continued to execute on our strategies in all of our operating businesses. Although we missed fourth quarter, bottom-line guidance because a single, strategic transaction shifted into the first quarter of 2018, our core operating performance exceeded expectations. The proceeds from the shifted transaction will now benefit from a much lower federal tax rate.”

Mr. Miller continued, “Our fourth quarter operating success was driven by focused execution in the field, favorable economic conditions in our markets and by managing a quick rebound from the two major hurricanes we experienced at the beginning of the quarter. Our results also benefitted from strong demand for homes, low unemployment, favorable interest rates and increased consumer confidence. General enthusiasm for the strength of the economy, combined with the added tailwinds of recent tax law changes, continue to propel the housing market forward.”

Miller concluded, “Our company is very well positioned for future growth and we look forward to another strong year in 2018. Our pending strategic combination with CalAtlantic, which is scheduled to close on February 12, 2018, will add to the future growth of our company as we strategically combine two great companies in markets that we know well with products that we know well, to create the leading home builder in the country.”