As we approach the end of the year, it is always important to start to imagine what next year will look like for housing. I think about that question every day, debating it, analyzing it, looking at the data, and imagining different scenarios.

Over the past few years the public builders have been announcing that they have wanted to increase their community counts. To that end, large amounts of land were bought in 2012 and 2013 that are now being seen in the data as new lot “deliveries.” “Lot deliveries” means the number of lots brought to the stage where they are ready for a builder to begin construction— roads and infrastructure in place. We are seeing strong increases in new lot development in markets all around the country.

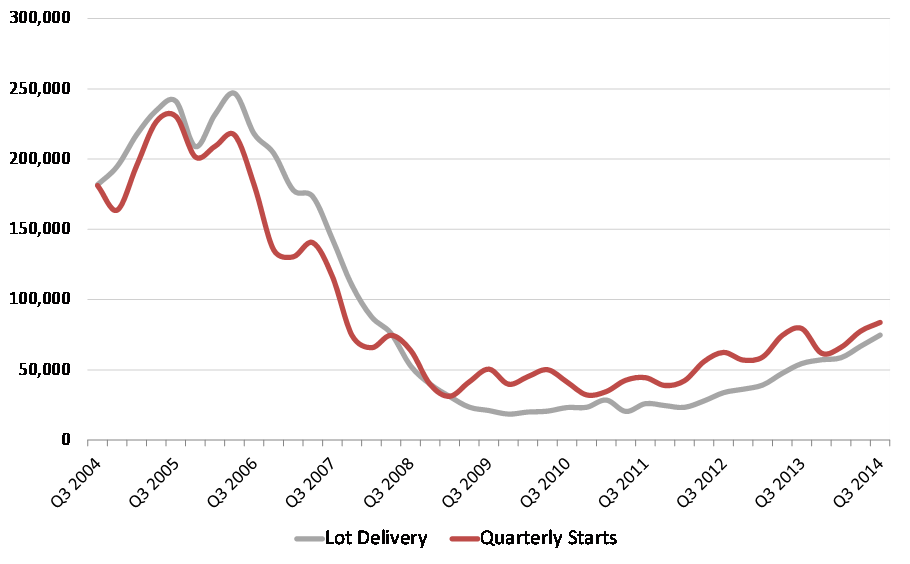

Lot Deliveries Catch up with Demand

Let’s take a look at some national trends as well as some specific local market trends, which can lend a glimpse into the direction of single-family housing starts for 2015.

Nationwide, lot deliveries are still trailing housing starts by a tiny margin, but the gap has finally nearly closed as lot deliveries rise sharply. In some markets, the lines have crossed (meaning that lot deliveries are now running at a pace higher than starts), and that is a bullish sign for starts in 2015.

In the broad area we call “Southern California,” lot deliveries are running at an annual pace of 17,587 (during the four quarters ending 3Q14), and that is well above the pace of a year ago (11,784), and is also above the annual pace of housing starts (15,817). These factors both suggest immediate plans to increase home construction volume.

In Salt Lake City, annual lot deliveries are up slightly, to 7,905 in the four quarters ending 3Q14. This level is also higher than the last four quarters worth of starts (7,739).

In Tampa, lot deliveries have totaled 7,301 during the past year, up from an annual pace of 3,926 a year ago. This level is far higher than annual starts, now running at 5,995.

In Northern California, lot deliveries are running 13,098 annually, up from 8,826 four quarters ago. The pace of lot deliveries has been outrunning starts, which are at 10,918, but very likely to move higher, based upon these new communities and lots.

These examples might not have been too surprising, but here is one that is— or maybe I should say encouraging: Phoenix. Lot deliveries are running at 14,914, up versus 8,608 a year earlier. This recent pace is in excess of the pace of housing starts, which has run 13,460 over the past four quarters.

What to make of this:

* On the demand side, the “case” for an elevated level of production hinges on higher job growth, which should bring with it better consumer sentiment and the release of more pent-up household formations.

* On the supply side, builders have been pushing for higher community count, and that means more lot development.

This surge in lot development will very likely result in an increase in the pace of home building next year. The trajectory of housing demand is flatter, however, than when the builders bought the raw land that is now being turned into these lots. In some cases, builders will have to price their homes at a level lower than what they had assumed when they originally underwrote the land purchase, or face a slower absorption pace.

That said, the long-term trajectory is decidedly upward.