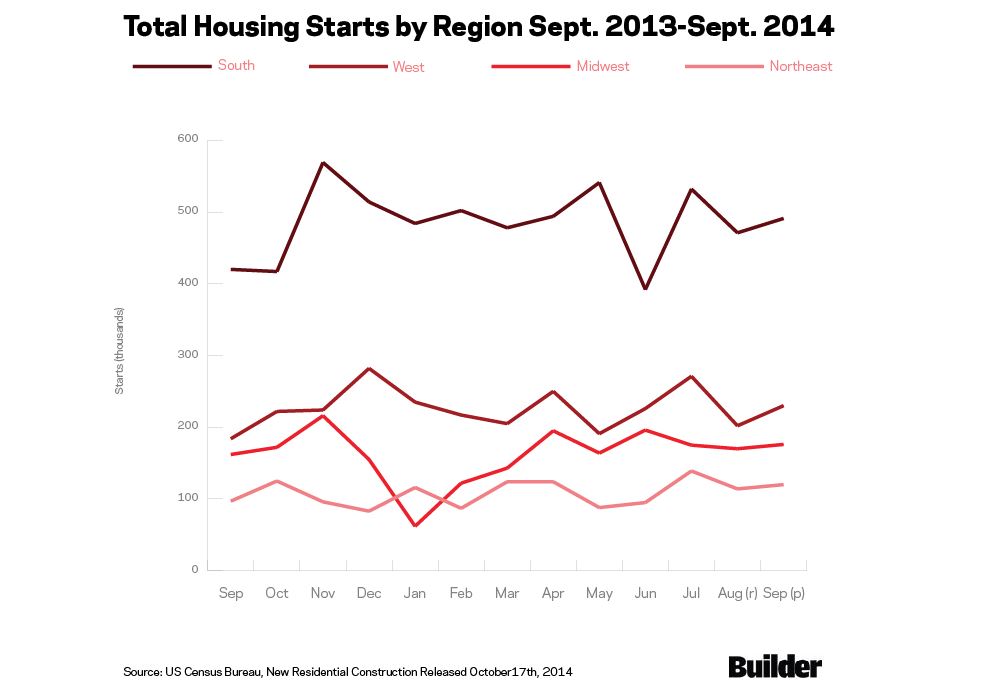

Housing starts rose by 6.3% in September, which places activity 17.8% above September of last year, according to the government report just released at 8:30.

Metrostudy’s view about the housing recovery remains unchanged. The total for 2014 will be little changed from 2013, but activity should increase in 2015.

The Top 4 Obstacles

Mortgage Availability

There are still people who *should* be able to get mortgages who cannot (particularly those who work on commissions or bonuses, or are self-employed).

Rental Millennials

They have yet to help household formation rates, because those who move out of their parents’ homes tend to rent, and to take roommates, which turns two potential households into one.

Global Economic Slowdown

No recession is imminent, but growth is slowing in many economies around the world, which can only be a drag on the U.S. economy.

Land Prices

Builders are faced with record land and lot prices in many hot areas, and that is giving them pause about certain expansion plans.

The Top 4 Boosters

They are likely to remain low, only drifting marginally higher (and that drift can push some buyers off the fence).

Job Markets

Employment growth is generally improving, but we need to root for a sustained rate well above 200,000 per month in order to maintain momentum.

Active Adult Demand

Retiree demand is picking up, and should accelerate in the next five years; in many areas, this group is under-served by new housing.

Household Formations

They will increase, in spite of the point above about the millennials. Even if they don’t return to normal, they can still easily double in the next year or two from their now-depressed rates.

Lower oil prices should help housing everyplace except Texas. Texas will feel a noticeable hit to demand based upon the reduction of prices that is occurring right now.

Builders have already purchased land, and intend to open additional communities next year. My research suggests a 15% increase in total single-family volume (starts and sales) in 2015, compared with full-year 2014.

Parting thought: surveys show that millennials will start to embrace the suburbs once they have children, and their fertility rates are starting to rise; a study by the Demand Institute shows that 36% of millennials will rent when they get their next home but an equal 36% say they will buy a single-family home (the remaining 26% say they will rent a single-family home).