TRI Pointe Group, Inc. (NYSE:TPH), Irvine, California on Thursday reported net income of $62.9 million, or $0.44 per diluted share, for its third quarter ended September 30. The gain compared to $64.0 million, or $0.43 per diluted share, a year earlier. Analysts were looking for a gain of $0.36 per share.

Among the results:

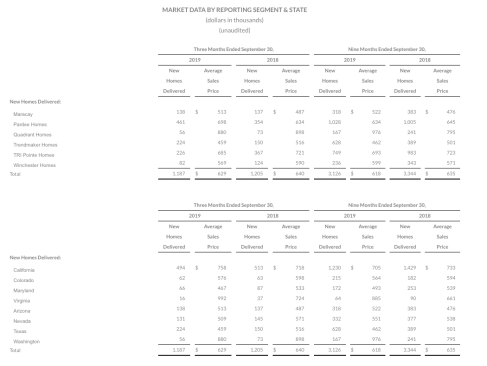

- Home sales revenue of $746.3 million compared to $771.8 million, a decrease of 3%

- New home deliveries of 1,187 homes compared to 1,205 homes, a decrease of 1%

- Average sales price of homes delivered of $629,000 compared to $640,000, a decrease of 2%

- Home building gross margin percentage of 22.6% compared to 21.3%, an increase of 130 basis points

- Excluding interest and impairments and lot option abandonments, adjusted home building gross margin percentage was 25.3%*

- SG&A expense as a percentage of homes sales revenue of 11.6% compared to 10.7%, an increase of 90 basis points

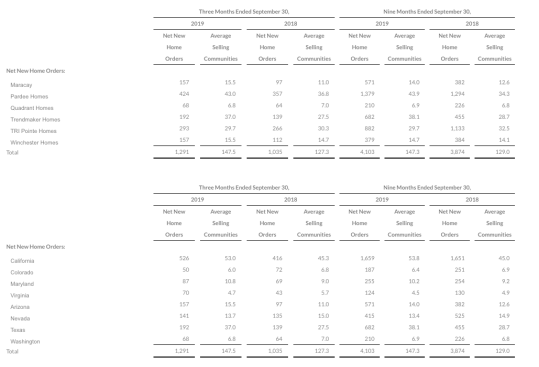

- Net new home orders of 1,291 compared to 1,035, an increase of 25%

- Active selling communities averaged 147.5 compared to 127.3, an increase of 16%

- New home orders per average selling community were 8.8 orders (2.9 monthly) compared to 8.1 orders (2.7 monthly)

- Cancellation rate of 17% compared to 19%

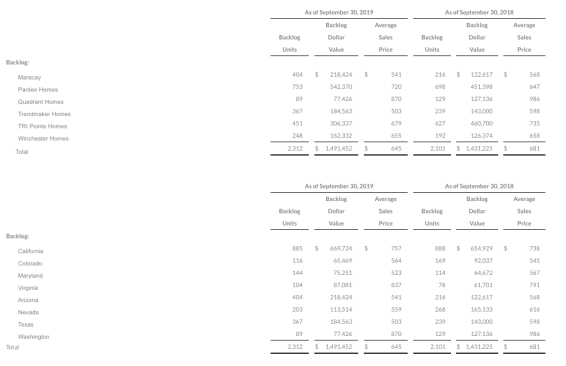

- Backlog units at quarter end of 2,312 homes compared to 2,101, an increase of 10%

- Dollar value of backlog at quarter end of $1.5 billion compared to $1.4 billion, an increase of 4%

- Average sales price of homes in backlog at quarter end of $645,000 compared to $681,000, a decrease of 5%

- Ratios of debt-to-capital and net debt-to-net capital of 40.4% and 38.2%, respectively, as of September 30, 2019

- Repurchased 3,035,420 shares of common stock at a weighted average price per share of $13.75 for an aggregate dollar amount of $41.7 million in the three months ended September 30, 2019

- Ended the third quarter of 2019 with total liquidity of $548.9 million, including cash and cash equivalents of $130.3 million and $418.6 million of availability under the company’s unsecured revolving credit facility

Said TRI Pointe Group CEO Doug Bauer. “We continue to see healthy demand trends across our product portfolio, as evidenced by our 25% increase in orders as compared to the third quarter of 2018. In addition, home building gross margin improved 130 basis points year-over-year to 22.6%. Our operations in California continue to perform extremely well for us, thanks to our sizable market presence, our differentiated product focus and our emphasis on value for each market segment, with orders in California increasing 26% year-over-year.”

“At TRI Pointe Group, we pride ourselves on being at the forefront of homebuilding design and innovation, but we also recognize the importance of providing value for the consumer,” said TRI Pointe Group president and COO Tom Mitchell. “That is why we’ve made a concerted effort to bring our average selling prices down in several of our markets through higher density projects and smaller floor plans. These projects have all the hallmarks of a typical TRI Pointe community, but at a more affordable price point.”