Toll Brothers, Inc. (NYSE:TOL), Horsham, Pa. after market close Monday reported net income of $202.3 million or $1.41 per share diluted for its fiscal fourth quarter ended Oct. 31, compared to net income of $311.0 million and $2.08 per share diluted in FY 2018’s fourth quarter. Wall Street was expecting a gain of $1.29 per share.

The results included pre-tax inventory impairments totaling $10.7 million, compared to FY 2018’s fourth quarter pre-tax inventory impairments of $6.4 million.

Among the results:

• Pre-tax income decreased 31% to $272.6 million, compared to $396.5 million in FY 2018’s fourth quarter.

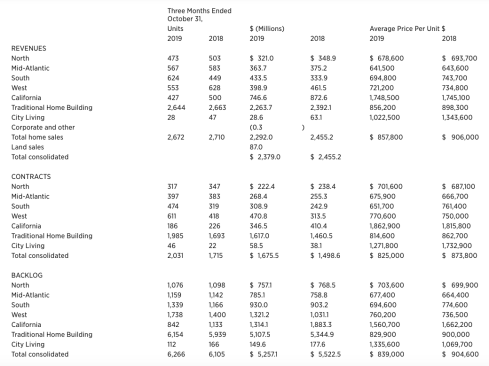

• Home sales revenues were $2.29 billion, down 7%; home building deliveries were 2,672, down 1%.

• Net signed contract value was $1.68 billion, up 12%; contract units were 2,031, up 18%.

• Backlog value at fourth-quarter end was $5.26 billion, down 5%; units in backlog totaled 6,266, up 3%.

• Home sales gross margin was 18.8%; Adjusted Home Sales Gross Margin, which excludes interest and inventory write-downs (“Adjusted Home Sales Gross Margin”), was 21.9%.

SG&A, as a percentage of home sales revenues, was 9.0%.

• Income from operations was 9.5% of total revenues.

• Other income, income from unconsolidated entities, and land sales gross profit was $48.4 million.

• The company repurchased approximately 1.85 million shares of its common stock during the quarter at an average price of $35.66 per share for an aggregate purchase price of approximately $66.0 million.

Full FY 2019 Highlights (Compared to Full FY 2018):

• Net income and earnings per share were $590.0 million and $4.03 per share diluted, compared to net income of $748.2 million and $4.85 per share diluted, in FY 2018.

• Pre-tax income decreased 16% to $787.2 million, compared to $933.9 million in FY 2018.

• Home sales revenues were $7.08 billion, down 1%; home building deliveries were 8,107 units, down 2%.

• Net signed contract value was $6.71 billion, down 12%; contract units were 8,075, down 5%.

• Home sales gross margin was 19.8%; Adjusted Home Sales Gross Margin was 23.0%.

• SG&A, as a percentage of home sales revenues, was 10.4%.

• Income from operations was 9.4% of total revenues.

• Other income, income from unconsolidated entities, and land sales gross profit was $120.3 million.

• The company repurchased approximately 6.6 million shares at an average price of $35.28 per share for a total purchase price of approximately $233.5 million.

Financial Guidance:

• First quarter deliveries of between 1,650 and 1,850 units with an average price of between $800,000 and $820,000.

• First quarter Adjusted Home Sales Gross Margin of approximately 21.25%, which is projected to be the low point of the fiscal year.

• First quarter SG&A, as a percentage of home sales revenues, of approximately 13.5%. First quarter SG&A includes approximately $10 million of G&A expense that is not expected to occur in subsequent quarters of fiscal 2020.

• First quarter other income, income from unconsolidated entities, and land sales gross profit of approximately $15 million.

• First quarter tax rate of approximately 26.5%.

• FYE 2020 community count growth of approximately 10%.

Douglas C. Yearley, Jr., Toll Brothers’ chairman and CEO, stated: “Fiscal 2019 ended on a strong note. Building on steady improvement in buyer demand throughout the year, our fourth quarter contracts were up 18% in units and 12% in dollars, and our contracts per-community were up 10% compared to one year ago. Through the first six weeks of fiscal 2020’s first quarter, we have seen even stronger demand than the order growth of fiscal 2019’s fourth quarter. This market improvement should positively impact gross margins over the course of fiscal 2020.

“We are positioning ourselves for growth as we expand our luxury brand to new price points, product lines, and geographies. Our land position and 10% increase in projected fiscal 2020 community count reflect this strategy, and, we believe, provide the platform for continued growth in coming years.

“We are focused on improving our capital efficiency in our land acquisition process. Additionally, in fiscal 2019 we repurchased $234 million of stock, and paid dividends totaling $0.44 per share. As we begin fiscal 2020, we have over $3 billion of liquidity through cash and un-drawn bank credit facilities with no public or bank debt maturities in the next 24 months.

He concluded, “October housing starts were at the highest level since July of 2007, while the months’ supply of homes on the market remains constrained. Consumer confidence is healthy, household formations are strong, and interest rates and unemployment remain low. With this positive environment as a backdrop, we are excited by our prospects for fiscal 2020.”