M.D.C. Holdings, Denver (NYSEMDC) on Thursday reported net income of $24.6 million, or $0.42 per share, for the 2017 fourth quarter ended December 31. The gain compares with $40.4 million, or $0.72 per diluted share for the 2016 fourth quarter. Net income for the 2017 full year was $141.8 million, or $2.48 per diluted share, versus $103.2 million, or $1.85 per diluted share*, for the 2016 full year. Net income and diluted earnings per share for the fourth quarter and year ended December 31, 2017 were impacted by the following tax-related items:

- The enactment of the Tax Cuts and Jobs Act in December 2017, which required a re-measurement of the Company’s deferred tax assets, resulted in a charge of $10.0 million for both the 2017 fourth quarter and full year.

- The company’s January 1, 2017 adoption of Accounting Standard Update 2016-09, which resulted in the Company recognizing an income tax charge of $2.8 million related to tax deficiencies from stock option expirations for both the 2017 fourth quarter and full year.

- The company realized income tax benefits of $3.5 million for the 2017 fourth quarter and $7.2 million for the 2017 full year from the release of a portion of its deferred tax asset valuation allowance relating to the sale and valuation of certain assets.

Operating metrics included:

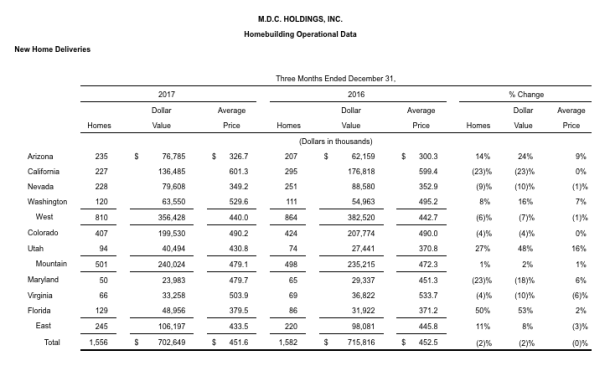

- Home sale revenues of $702.6 million versus $715.8 million

- Home deliveries of 1,556 versus 1,582

- Approximately 35 home deliveries delayed to later periods due to Weyerhaeuser joist issue (net of Weyerhaeuser closings originally scheduled for the third quarter that closed in the fourth quarter)

- Gross margin from home sales percentage up 120 basis points to 17.3% from 16.1%

- Impairments of $0.6 million vs. $3.9 million

- Selling, general and administrative expenses as a percentage of home sale revenues (“SG&A rate”) of 11.6% versus 9.5%

- Includes $5.4 million of infrequent charges to general and administrative expenses for accrual adjustments and tax planning strategies

- Financial services segment income of $11.5 million versus $11.4 million

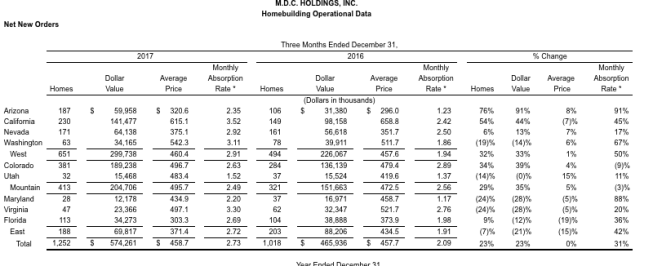

- Dollar value of net new orders of $574.3 million, up 23% from $465.9 million

- Absorption rate increased by 31%

- Lot purchase approvals up 64% to 2,566 lots in 38 communities

2017 Full Year Highlights and Comparisons to 2016 Full Year:

- Home sale revenues up 11% to $2.50 billion from $2.26 billion

- Home deliveries of 5,541 increased from 5,054

- Approximately 120 home deliveries delayed to 2018 due to Weyerhaeuser joist issue

- Gross margin from home sales percentage up 50 basis points from 16.1% to 16.6%

- Selling, general and administrative expenses as a percentage of home sale revenues (“SG&A rate”) of 11.5% versus 11.1%

- Realized gains from the sale of investments of $54.0 million versus $1.1 million

- Financial services segment income of $43.8 million versus $36.4 million

- Dollar value of net new orders of $2.70 billion, up 6%

- Lot purchase approvals up more than 100% to 10,382 lots in 144 communities

- Pretax return on equity improved 510 basis points to 16.9%

2018 Outlook – Selected Information

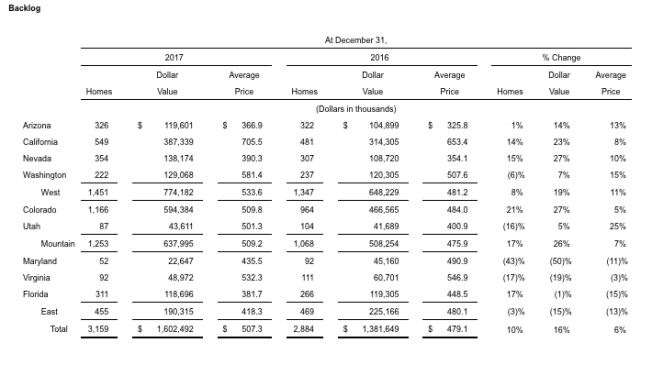

- Backlog dollar value at 12/31/2017 up 16% year-over-year to $1.60 billion

- Gross margin from home sales percentage in backlog at 12/31/2017 exceeds 2017 fourth quarter closing gross profit margin of 17.3%

- Backlog conversion ratio (home deliveries divided by beginning backlog) for Q1 2018 estimated to be in the 38% to 40% range

- Active subdivision count at 12/31/2017 of 151, down 8% year-over-year

- Targeting a 10% year-over-year increase in active subdivision count from 151 at 12/31/2017 to at least 166 at 12/31/2018

- Lots controlled of 19,312 at 12/31/2017, up 32% year-over-year

- Quarterly dividend of $0.30 ($1.20 annualized) declared in January 2018, up 20% sequentially

- Preliminary estimate for full year 2018 effective tax rate of 25% to 27%, excluding impact of any potential discrete items

Larry A. Mizel, chairman and CEO, said, “We ended the year on a strong note, with fourth quarter net home orders surging 23% year-over-year. We believe the robust demand is not only the result of solid economic fundamentals, but also our focus on affordable product. At the center of our emphasis on affordability is our SeasonsTM collection, which accounted for 15% of our fourth quarter net orders. Because of our strong sales performance, our yearend backlog value is 16% higher than a year ago, setting the stage for growth in 2018. Given our positive outlook and strong financial position, we enhanced our industry-leading dividend program with an 8% stock dividend in the fourth quarter and a 20% increase in our cash dividend declared at the start of the 2018 first quarter, reflecting our confidence in the prospects for growth against the backdrop of solid industry conditions.”