KB Home (NYSE:KBH) late Thursday reported that its net income increased 27% to $123.2 million in its fiscal fourth quarter ended November 30 from the same period a year earlier. Diluted earnings per share increased 36% to $1.31. Analysts were expecting a gain of $1.28.

Among the results for the three months ended November 30, 2019 (comparisons on a year-over-year basis):

- Revenues grew 16% to $1.56 billion.

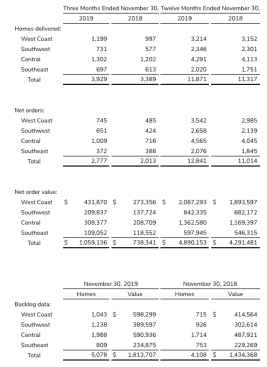

- Homes delivered increased 16% to 3,929.

- Average selling price of $392,500 declined slightly.

- Home building operating income increased 33% to $162.5 million. Home building operating income margin was 10.5%, up 140 basis points. Excluding inventory-related charges of $4.1 million in the quarter and $9.1 million in the year-earlier quarter, this metric was 10.7%, compared to 9.7%.

- Housing gross profit margin improved 150 basis points to 19.6%. Excluding inventory-related charges, housing gross profit margin increased to 19.9% from 18.7%.

- The housing gross profit margin improvement primarily reflected the favorable impacts of lower amortization of previously capitalized interest and the Company’s adoption of a new accounting standard (ASC 606) in fiscal year 2019, which were partly offset by a mix shift of homes delivered from certain West Coast region communities with relatively high average selling prices and housing gross profit margins.

- Selling, general and administrative expenses as a percentage of housing revenues rose 10 basis points to 9.1%, with the impact of the company’s adoption of ASC 606 partly offset by improved operating leverage from higher housing revenues.

- As a result of its adoption of ASC 606, the company changed the classification and timing of recognition of certain model complex costs. In the quarter, these changes favorably impacted the Company’s housing gross profit margin by approximately 70 basis points and negatively impacted its selling, general and administrative expense ratio by approximately 60 basis points.

- Housing gross profit margin improved 150 basis points to 19.6%. Excluding inventory-related charges, housing gross profit margin increased to 19.9% from 18.7%.

- The company’s financial services operations generated pretax income of $9.3 million, up from $6.5 million, mainly due to an increase in income from its mortgage banking joint venture, KBHS Home Loans, LLC (KBHS).

- KBHS originated 74% of the residential mortgage loans the Company’s homebuyers obtained to finance their home purchase, compared to 62%.

- Total pretax income grew 28% to $165.0 million, which included a $6.8 million charge for the early extinguishment of debt further described below. Excluding this charge, the Company’s pretax income was $171.8 million, up 33% year over year.

- The Company’s income tax expense was $41.8 million, compared to $32.1 million. The Company’s effective tax rate was approximately 25% in each of these periods.

- Net income increased 27% to $123.2 million, and diluted earnings per share increased 36% to $1.31.

Backlog and Net Orders (comparisons on a year-over-year basis)

- Net orders for the quarter increased 38% to 2,777, with net order value up 43% to $1.06 billion.

- Company-wide, net orders per community averaged 3.7 per month, compared to 2.9 per month.

- The cancellation rate as a percentage of gross orders improved to 22% for the quarter from 28%.

- The company’s ending backlog rose 24% to 5,078 homes. Ending backlog value grew to $1.81 billion, up 26% from $1.43 billion, with increases in all four regions.

- Average community count for the quarter increased 9% to 253. Ending community count grew 5% to 251.

Twelve Months Ended November 30, 2019 (comparisons on a year-over-year basis)

- Total revenues of $4.55 billion were about the same.

- Homes delivered rose 5% to 11,871.

- Average selling price decreased 5% to $380,000.

- Pretax income was $348.2 million, compared to $368.0 million.

- The company’s income tax expense and effective tax rate were $79.4 million and approximately 23%, respectively. For the year-earlier period, the company’s income tax expense of $197.6 million and effective tax rate of approximately 54% primarily reflected a non-cash charge of $112.5 million for the impact of the Tax Cuts and Jobs Act of 2017 (“TCJA”). Excluding this charge, the company’s adjusted income tax expense and adjusted effective tax rate for the 2018 period were $85.1 million and approximately 23%, respectively.

- Net income grew to $268.8 million, or $2.85 per diluted share, compared to $170.4 million, or $1.71 per diluted share, which reflected the TCJA-related charge.

Balance Sheet as of November 30, 2019 (comparisons to November 30, 2018)

- The company had total liquidity of $1.23 billion, with $453.8 million of cash and cash equivalents and $781.1 million of available capacity under its unsecured revolving credit facility. There were no cash borrowings outstanding under the facility.

- On October 7, 2019, the company completed an amendment to its unsecured revolving credit facility, increasing its borrowing capacity to $800.0 million from $500.0 million and extending its maturity by more than two years to October 2023.

- Net cash provided by operating activities in 2019 increased to $251.0 million. During the year, the company used net cash of $330.4 million for financing activities, primarily to reduce debt, which contributed to a decrease of $120.5 million in the company’s cash and cash equivalents.

- Inventories totaled $3.70 billion, up 3%.

- Investments in land acquisition and development totaled $1.62 billion in 2019.

- Lots owned or under contract increased to 64,910.

- This total includes 9,212 lots under contract with refundable deposits. Approximately 59% of the total lots were owned and 41% were under contract.

- The company’s 38,039 owned lots represented an approximately 3.2 years’ supply based on homes delivered in 2019.

- Notes payable decreased by $311.5 million to $1.75 billion, primarily reflecting the repayment of convertible senior notes in the 2019 first quarter and financing transactions completed in the 2019 fourth quarter.

- On November 4, 2019, the company completed the public offering of $300.0 million in aggregate principal amount of its 4.80% senior notes due 2029. On November 22, 2019, the Company used the proceeds from this offering, together with cash on hand, to redeem all $350.0 million in aggregate principal amount of its 8.00% senior notes due March 15, 2020.

- The company’s debt to capital ratio of 42.3% improved 740 basis points. The Company’s net debt to capital ratio was 35.2%.

- Stockholders’ equity increased to $2.38 billion from $2.09 billion.

- Book value per share grew by $2.59 to $26.60.

“The fourth quarter marked an excellent finish to fiscal 2019, with particular strength in two key metrics – net order growth and housing gross profit margin,” said Jeffrey Mezger, chairman, president and CEO. “Our net orders advanced 38% year over year, reflecting strong demand for our built-to-order product at affordable price points, together with limited inventory in our served markets. This substantial growth was driven by an increase in our community absorption pace to 3.7 net orders per month, our highest fourth quarter pace in many years, together with a 9% rise in our community count. Alongside our solid net orders was a robust gross margin, which expanded 120 basis points year over year, coming in just shy of 20%. This result was fueled, in part, by a continued reduction in our interest amortization – a significant achievement from executing on our Returns-Focused Growth Plan.”

He continued, “With the conclusion of the third year of this Plan, our 2019 results reflect incredibly strong progress relative to 2016 when we launched the Plan and set the stage for the new year. We have begun 2020 on sound footing, with a 26% year-over-year increase in our backlog value to $1.8 billion, and the composition of both our backlog and community portfolio reflecting higher margins. As such, we believe we are well positioned to further expand our profitability this year and meaningfully grow our return on equity.”