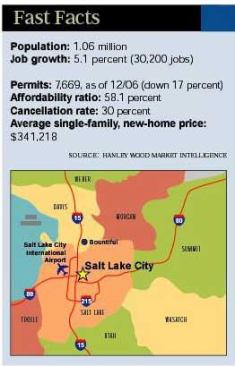

When America’s top 10 home builders together own a 10 percent smidgen of a top 50, $2-billion-plus, new-home market, it tells you something. Nary a market under the sun could have escaped the ravenous scrutiny of the publics and their well-capitalized private builder counterparts. So, wouldn’t 5 percent to 10 percent of a 9,000-new-home-a-year market a division make in the nation’s fourth-fastest-growing state in the nation?

And when you look at the Salt Lake City market’s prospects, it might make you scratch your head even more about why only one of the top 10 publics–M.D.C. Holdings’ Richmond American Homes–has a committed strategic presence.

“You have to understand the conservative nature of the people in the market. Not everyone is going to be able to thrive here,” says John Stubbs, president of Richmond American’s Utah division. “Our company’s very conservative and methodical, and the people, right up to the governor, are conservative. It’s a match made in heaven.”

Still, there’s scarcely two months’ supply of new-home inventory, an enviously large youthful adult population, business expansion; and marginally favorable affordability, even after you bake in a 22 percent median price increase from 2005?2006. What can the big barrier to entry be for players who have made an art of becoming as local as the locals? Salt Lake’s track record is of having attracted, and then repulsed, the advances of some of home building’s deftest expansionists–KB Home and Centex Corp., made a go and couldn’t make it work, and D.R. Horton hangs on with a bare bones operation.

“The big reason the biggest players are not in there right now is the general market conditions,” says John Fioramonti, managing director for HWMI. “While you might have seen interest a couple of years ago, and while you might see interest in Salt Lake return in a couple of years, it’s all quiet now.”

Fioramonti recently conducted a deep-dive analysis that forecasts demand potential for new homes in the market to continue at a healthy clip of 750 to 800 a month right through 2011, given household growth, income and wealth parameters, historical data on plans to buy, and existing households in turnover. While the rate of growth has slowed, he observes, the Salt Lake metro area is “poised for an above average performance over a long term, and should offer a solid opportunity,” particularly for suppliers looking for volume, architects versed in the market’s local preferences, and engineering firms.

Learn more about markets featured in this article: Salt Lake City, UT.