Taylor Morrison Home Corporation (NYSE: TMHC) on Wednesday reported net income of $54.6 million, or $0.51 per diluted share, for its fourth quarter ended December 31. The gain compared with net income of $9 million, or $0.08 per diluted share, in the prior year quarter. Analysts were expecting a gain of $1.01.

Dave Cone, executive vice president and CFO, explained the earnings miss. “We experienced certain unusual items during the quarter that impacted many of our key metrics. The impact to earnings before taxes included almost $50 million for an increase in our reserve related to remediating a warranty issue that impacted our central region, $13 million for the write-off related to our Chicago exit, almost $11 million for transaction expenses related to both AV Homes and William Lyon Homes, $9 million for inventory impairments and almost $6 million related to the loss on extinguishment of debt due to the refinancing transactions earlier in the year. With all of this behind us, we’re confident in how this positions the business and strengthens the balance sheet for the future.”

Here’s what the company reported:

Fiscal Year 2019 Highlights:

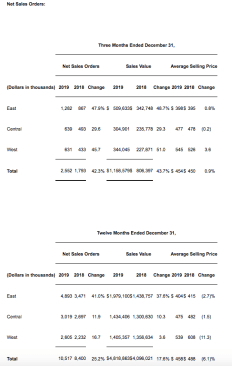

- Net sales orders were 10,517, a 25% increase over the prior year

- Average monthly sales pace per community was 2.5, compared to 2.3 for 2018

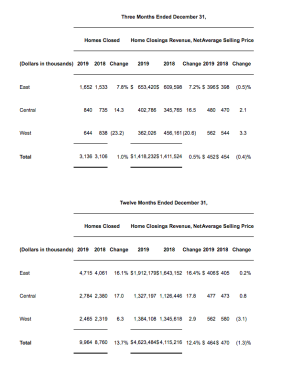

- Home closings were 9,964, an almost 14% increase over the prior year

- Total revenue was $4.8 billion, a 13% increase over the prior year

- Home closings gross margin adjusted for unusual items was 18.2%, while GAAP home closings gross margin was 17.0%

“To say that 2019 was a pivotal year in Taylor Morrison’s history would be an understatement,” said Sheryl Palmer, Chairman and CEO of Taylor Morrison. “We surpassed 10,000 sales orders for the first time, marking a significant milestone for us, and the sales momentum we saw build in 2019 has continued into 2020.”

The company finished Q4 with sales orders of 2,552, which was a 42% increase from the prior year quarter, a sales pace per community for the quarter of 2.6, which was tied with Q2 as the highest pace for the year. Sales orders for fiscal year 2019 were 10,517, which represented a sales pace per community of 2.5 for the year.

“The strength in sales orders during the fourth quarter was consistent across all geographies and consumer groups led by entry-level, first move-up and second move-up each seeing at least a 50 percent increase,” said Palmer. “We’re thrilled to see the sales success continuing into 2020, with a 46% growth in orders and a sales pace of more than 3.0 for January.”

“We delivered 9,964 closings in 2019, an almost 14% increase over our results for the prior year and in-line with our most recent guidance,” added Palmer. “I’m proud of the teams’ ability to deliver such strong sales and closings amidst a transformational acquisition in the works.”

The company said it expects the acquisition of William Lyon Homes to close this week.

“To support our continued growth we must think differently, operate differently and use our resources differently,” added Palmer. “Effective upon closing, we’ve announced a new organizational structure that will provide greater line of sight into our corporate functions and help us streamline the regional areas given the added scale from William Lyon. Our regional structure will move from three to five and be led by area presidents from both Taylor Morrison and William Lyon. Through thoughtful and deliberate efforts, we’ve been able to outline an extremely strong combined business and assure that we’ll have the best organizational structure and portfolio in place for a positive future.”

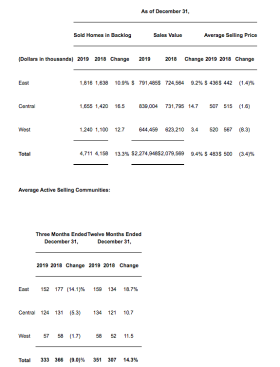

Home building inventories were nearly $4.0 billion at the end of the year, including 5,728 homes in inventory, compared to 6,014 homes in inventory at the end of the prior year. Homes in inventory at the end of the quarter consisted of 3,450 sold units, 504 model homes and 1,774 inventory units, of which 361 were finished. The company ended the year with 4,711 units in backlog, a year-over-year increase of 13 percent, with a sales value of approximately $2.3 billion.

The company finished the year with $326 million in unrestricted cash and a net homebuilding debt to capitalization ratio of 37.2 percent. As of December 31, 2019, Taylor Morrison owned or controlled approximately 54,000 lots, representing 5.4 years of supply based on a trailing twelve months of closings and the Company is focused on securing land for 2021 and beyond.

Preliminary fourth quarter 2019 results for William Lyon included sales orders of 802 and home closings of 1,294. Backlog at the end of the year included 876 units with a sales value of $382 million.