Freddie Mac today released the results of its Primary Mortgage Market Survey, showing that the 30-year fixed-rate mortgage averaged 3.5%.

“The Federal Reserve’s swift and significant efforts to stabilize the market were much needed and helped mortgage rates drop for the first time in three weeks,” said Sam Khater, Freddie Mac’s chief economist. “Similar to other segments of the economy, real estate demand is softening. However, the combination of the Fed’s actions and pending economic stimulus will provide substantial support to the mortgage markets.”

News Facts

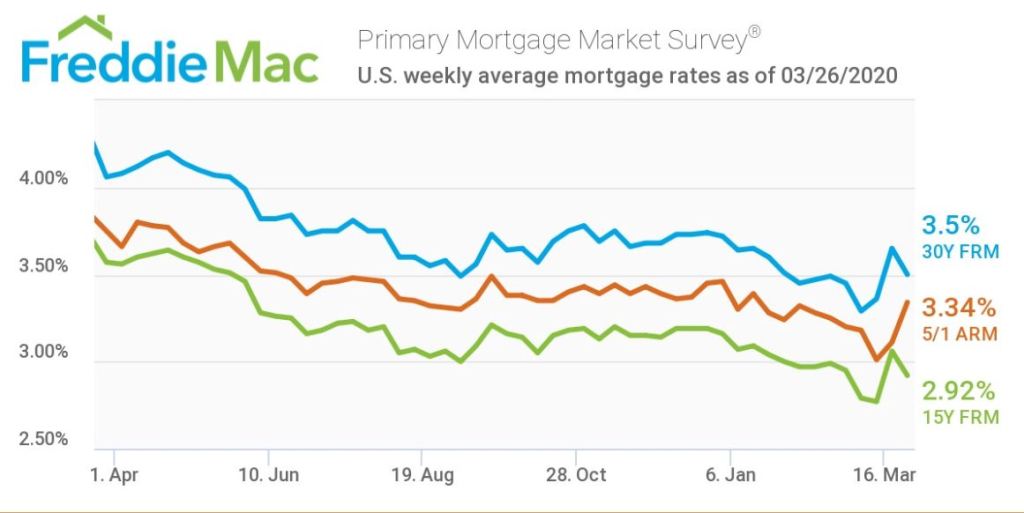

- 30-year fixed-rate mortgage averaged 3.50% with an average 0.7 point for the week ending March 26, 2020, down from last week when it averaged 3.65%. A year ago at this time, the 30-year FRM averaged 4.06%.

- 15-year fixed-rate mortgage averaged 2.92% with an average 0.6 point, down from last week when it averaged 3.06%. A year ago at this time, the 15-year FRM averaged 3.57%.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage averaged 3.34% with an average 0.3 point, up from last week when it averaged 3.11%. A year ago at this time, the 5-year ARM averaged 3.75%.