TRI Pointe Group (NYSE:TPH), Irvine, late Thursday reported net income of $31.9 million, or $0.24 per diluted share, for the first quarter ended March 31, 2020. The gain compared to $71,000, or $0.00 per diluted share, in the prior-year quarter.

Among the reported results:

- Home sales revenue of $594.8 million compared to $492.7 million, an increase of 21%

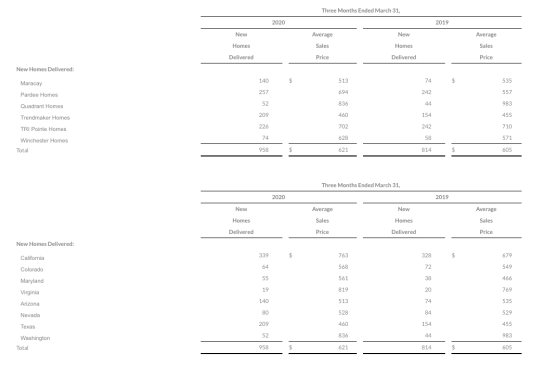

- New home deliveries of 958 homes compared to 814 homes, an increase of 18%

- Average sales price of homes delivered of $621,000 compared to $605,000, an increase of 3%

- Home building gross margin percentage of 20.5% compared to 14.4%, an increase of 610 basis points

- Excluding interest and impairments and lot option abandonments, adjusted home building gross margin percentage was 23.4%*

- SG&A expense as a percentage of homes sales revenue of 13.9% compared to 15.7%, a decrease of 180 basis points

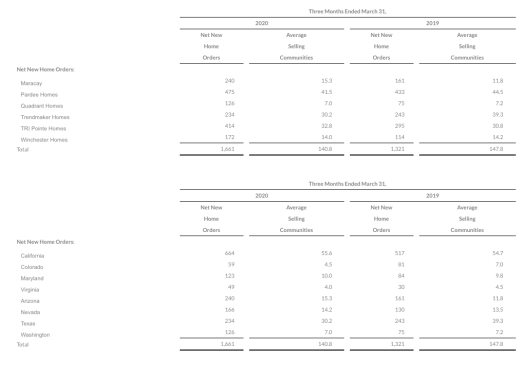

- Net new home orders of 1,661 compared to 1,321, an increase of 26%

- Active selling communities averaged 140.8 compared to 147.8, a decrease of 5%

- New home orders per average selling community were 11.8 orders (3.9 monthly) compared to 8.9 orders (3.0 monthly)

- Cancellation rate of 13% compared to 15%

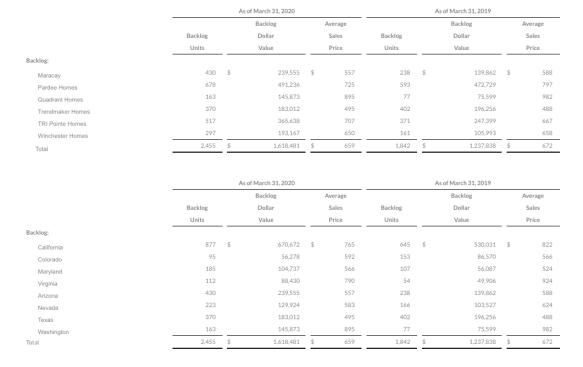

- Backlog units at quarter end of 2,455 homes compared to 1,842, an increase of 33%

- Dollar value of backlog at quarter end of $1.6 billion compared to $1.2 billion, an increase of 31%

- Average sales price of homes in backlog at quarter end of $659,000 compared to $672,000, a decrease of 2%

- Ratios of debt-to-capital and net debt-to-net capital of 45.8% and 35.4%*, respectively, as of March 31, 2020

- Repurchased 6,558,323 shares of common stock at a weighted average price per share of $15.55 for an aggregate dollar amount of $102.0 million in the three months ended March 31, 2020

- Ended the first quarter of 2020 with total liquidity of $677.5 million, including cash and cash equivalents of $624.1 million and $53.4 million of availability under the Company’s unsecured revolving credit facility

“While I am extremely pleased with our results this quarter, TRI Pointe Group’s primary focus over the past several weeks has been the health and well-being of its employees, trade partners and customers since the outbreak of COVID-19,” said TRI Pointe Group CEO Doug Bauer. “As soon as the threat of the virus became evident, we adjusted our business practices to substantially limit in-person interaction and promote social distancing. Overcoming this pandemic will require everyone’s collective efforts to stop the spread of the virus, and TRI Pointe is dedicated to doing its part.”

Bauer continued, “The measures we’ve taken as a nation to combat the virus will no doubt have a lasting impact on the economy and our industry. Fortunately, TRI Pointe enters this period of uncertainty in a position of relative strength, with a quarter-end net debt-to-net capital ratio of 35.4% and over $670 million in cash and available liquidity. This financial strength, coupled with the experience of our seasoned leadership team in navigating through difficult times, gives me confidence that TRI Pointe is well positioned to deal with the current market environment.”

Bauer concluded, “From a macro perspective, I remain optimistic about the long-term outlook for our industry post COVID-19. The demographic shifts occurring in this country have created a need for more housing, while the supply of existing homes remains low. These two factors, along with my belief in the resiliency of the American economy, give me confidence in the future of our industry and TRI Pointe in particular.”