Meritage Homes Corporation (NYSE: MTH) late Tuesday reported net earnings of $71.2 million, or $1.83 per diluted share, for the first quarter ended March 31. The gain compared to $25.4 million ($0.65 per diluted share) for the first quarter of 2019. The 182% increase in diluted EPS reflected the combination of increases in home closing revenue, gross margins and greater overhead leverage, in addition to lower interest expense and income taxes in the first quarter of 2020. Wall Street was expecting a gain of $1.21 per share.

Shares of MTH closed up 8.17% at $48.33 on Tuesday and added another 6.54% to $51.49 in after-market trading.

Among the results:

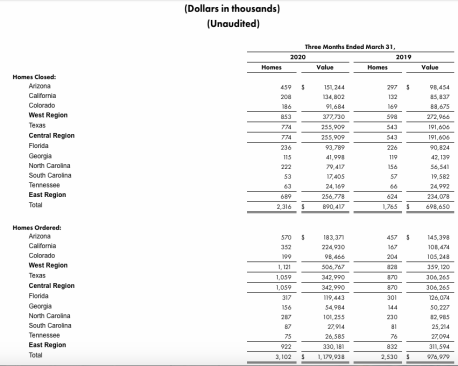

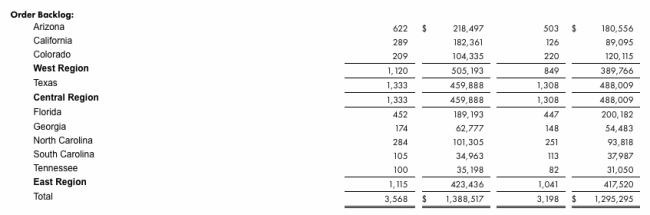

- Total orders for the first quarter of 2020 increased 23% year-over-year, driven by a 35% year-over-year increase in absorptions. Order trends during the quarter, compared to a year ago, were up 38% in January and 51% in February, but down 8% in March.

- Absorptions were up 41% in the West and Central regions, and 20% in the East region, primarily due to strong demand for our entry-level homes. Community count declined sequentially to 241 at March 31, 2020, from 244 at December 31, 2019, and 260 at March 31, 2019.

- Order cancellation rates were relatively flat at 13% for the first quarter, with an increase in March cancellations to 16% in 2020, compared to 12% in 2019. Absorptions have slowed and cancellation rates have increased as conditions have deteriorated since mid-March.

- Entry-level orders grew to 61% of total orders for the first quarter of 2020, compared to 45% in the first quarter of 2019, and represented 51% of total active communities at March 31, 2020, compared to 36% a year earlier. Orders from non-strategic communities made up just 6% of first quarter 2020 total orders, compared to 13% of first quarter 2019 orders.

- The 27% increase in home closing revenue for the quarter reflected a 31% increase in home closing volume, which was partially offset by a 3% year-over-year reduction in ASP due to the shift in product mix toward lower-priced entry-level homes. The West region led with home closing revenue up 38% year-over-year, followed by a 34% increase in the Central region and 10% increase in the East region.

- Home closing gross margin improved 330 bps to 20.0% from 16.7% a year ago, contributing to a 53% increase in total home closing gross profit over the prior year’s first quarter.

- Selling, general and administrative expenses totaled 10.7% of first quarter 2020 home closing revenue, compared to 12.3% in the first quarter of 2019. The year-over year improvement was primarily driven by greater leverage from higher home closing revenue and continuing cost controls in 2020, in addition to higher brokerage commissions and severance expenses in 2019, resulting from the tougher housing market conditions exiting 2018.

- Interest expense decreased $4.1 million year-over-year, reflecting a reduction in total interest incurred due to the December 2019 early redemption of $300 million 7.15% senior notes due in 2020. Nearly all interest incurred was capitalized to assets under development in the first quarter of 2020.

- First quarter 2020 pre-tax margin increased 500 bps to 9.6% compared to 4.6% in 2019.

- Effective income tax rates were 18.1% in the first quarter of 2020 and 21.5% in the first quarter of 2019. The tax rate in 2020 benefited from energy efficient homes credits from the enactment of the Taxpayer Certainty and Disaster Tax Relief Act on December 20, 2019, as well as a larger tax benefit from equity-based compensation for stock awards that vested in the first quarter of 2020.

- Cash and cash equivalents at March 31, 2020 totaled $797.3 million, compared to $319.5 million at December 31, 2019, including $500 million borrowed against the Company’s $780 million Revolving Credit Facility to provide additional flexibility during this period of uncertainty.

- Real estate assets were relatively flat at $2.8 billion on March 31, 2020, compared to $2.7 billion at year-end and one year ago. As a result of market conditions being negatively impacted by the pending health crisis, the Company has significantly slowed investments in land acquisition and development, as well as spec inventory, to preserve cash. Meritage ended the first quarter of 2020 with approximately 41,500 total lots owned or under control, compared to approximately 33,800 total lots at March 31, 2019. Total inventory of spec homes at the end of the first quarter was 2,703 in 2020, compared to 2,205 in 2019.

- Total debt-to-capital ratio increased to 43.3% at March 31, 2020 from 34.0% at December 31, 2019, reflecting the $500 million of borrowings on the Credit Facility. Net debt-to-capital remained low at 26.6% at March 31, 2020, compared to 26.2% at year-end 2019.

- The company repurchased one million shares of stock for a total $60.8 million during the first quarter of 2020. Share repurchases have since been halted indefinitely.

“We reported select preliminary operating results for the first quarter of 2020 on April 6, which reflected stronger-than anticipated market demand through early March, followed by significant declines through the end of the month, which have continued to deteriorate in April as the coronavirus pandemic spread across the U.S. and severely impacted the economy,” said Steven J. Hilton, chairman and chief executive officer of Meritage Homes. “Though our net earnings for the first quarter more than doubled and every key operating metric showed significant year-over-year growth, we are expecting much weaker results for at least the next couple of quarters due to large parts of the economy being shut down, causing record job losses, fear and uncertainty about the future. Our hearts go out to all those impacted directly and indirectly.”

He added, “With shelter-in-place orders in effect across most of our markets, we are seeing customers either virtually or by appointment in our sales offices and Studio M design centers. Those we see tend to be serious buyers ready to commit to a new home purchase, so while our traffic has understandably decreased, our conversion rates on the traffic we do see have increased. Using our 24/7 mortgage pre-approval tools on-line, our customers are able to move through the process of purchasing a home more quickly, and we can even process earnest money deposits on debit or credit cards remotely, through a secure emailable link. All of these tools are designed to make it more convenient and safer for our home buyers to work with us.”

Hilton concluded, “Because home building is currently recognized as an essential service in most locations, our construction crews have been working steadily, following social distancing guidelines, to ensure that we deliver completed homes on schedule for those who are eager to move into their new home.”