M/I Homes (NYSE:MHO), Columbus, on Wednesday reported record first-quarter 2020 net income of $31.7 million ($1.09 per diluted share), a 79% increase compared to $17.7 million ($0.63 per diluted share) in the 2019 quarter.

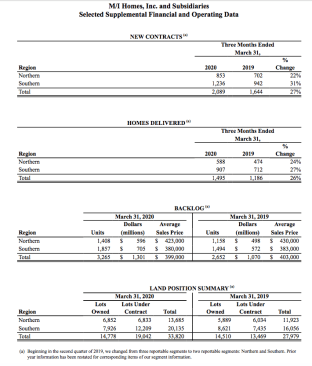

Revenue increased 20% to a first quarter record of $577.6 million. Homes delivered increased 26% to a first-quarter record of 1,495. This compares to 1,186 homes delivered in 2019’s first quarter. New contracts for the first quarter of 2020 were an all-time quarterly record 2,089, a 27% increase over 2019’s 1,644 new contracts. Homes in backlog at March 31, 2020 had a total sales value of $1.3 billion, a 22% increase from a year ago and an all-time quarterly record. Backlog units at March 31, 2020 increased 23% to a first quarter record 3,265 homes, with an average sales price of $399,000. At March 31, 2019, backlog sales value was $1.07 billion, with backlog units of 2,652 and an average sales price of $403,000. M/I Homes had 223 active communities at March 31, 2020, an increase of 4% over our 214 communities at March 31, 2019. The company’s cancellation rate was 11% in the first quarter of 2020 compared to 12% in the first quarter of 2019.

M/I’s home building debt to capital ratio was 39% compared to 47% at March 31, 2019.

Robert H. Schottenstein, CEO and president, said, “The world is in the midst of an unprecedented battle with the COVID-19 pandemic; our primary concern continues to be the health and well-being of our employees, our trade partners, our customers, the communities in which we do business and all of those impacted by this highly contagious virus. In most of the markets in which we operate, housing construction and mortgage services have been deemed essential businesses and we’re doing everything we can to safely continue selling, building and delivering our homes. We have adapted our operations and business to safeguard our various work environments, while closely monitoring updates and guidelines from the CDC and other state and local government and public health agencies.”

Schottenstein concluded, “The pandemic first began impacting our results in the second half of March. New contracts in the last of half of March were 50% below prior year levels. New contracts during the first three weeks of April have improved and are 35% below the comparable period in 2019. We are reviewing all aspects of our operations and adjusting our business as needed. We entered 2020 in the best financial condition in company history. With our experienced leadership team, record quarter-end backlog, and nearly $450 million of available liquidity, we are confident that we will navigate through this very challenging environment.”