“The term ‘animal spirits,’ popularized by John Maynard Keynes in his 1936 book ‘The General Theory of Employment, Interest and Money,’ is related to consumer or business confidence, but it means more than that. It refers also to the sense of trust we have in each other, our sense of fairness in economic dealings, and our sense of the extent of corruption and bad faith. When animal spirits are on ebb, consumers do not want to spend and businesses do not want to make capital expenditures or hire people.”

These words apply.

Economics of supply and demand–which suggest today that home builders and their up- and downstream business partners will continue to undergo stress and trauma, but for a limited two- or three-quarter timeframe, and with no serious price deflation–can only take us so far when it comes to real insight.

The words above are part of an essay Robert J. Shiller wrote for the Wall Street Journal, Jan. 27, 2009. A short enough time ago that few of us forget. His essay preceeded talk of “green shoots,” and, preceded Dr. Shiller’s famed shrug later that Spring.

The moment I’m referring to was in May of that same year–11 years ago, when Dr. Shiller keynoted our Builder 100/Housing Leadership Summit in Chicago. The event, all told, was a mess. Distress, chaos, and an inflatable union rat, to boot, trickled through the hotel venue corridors, as Builder 100 company casualties seemed to pile up almost as high as the number of surviving firms.

Dr. Shiller’s keynote came on the final day, a day the remaining executives’ Blackberries delivered clear tidings that whatever hopes there’d been of a “Spring Selling Season” had vanished and been dashed once and for all. Some one of the few dozen stalwart strategic leaders still in the ballroom asked Dr. Shiller his best guess at when the housing market would finally pivot from getting worse to getting better.

That’s when it happened. Dr. Shiller’s face–his eyebrows arched, his mouth shaped into a gentle reproach–said it. His shoulders hunched. His palms turned up at his sides. A professorial shrug.

“I don’t know,” he said. “And if anyone tells you right now they do know, they’re lying.”

Dr. Shiller would go on to win the Nobel Prize for Economics in 2013. Whenever I’ve seen him respond to questions about the direction of the financial or housing markets since then, I flash back to that shrug.

As the hours and days–just under 72 hours, or three days–count down to when the Bureau of Labor Statistics releases its April “employment situation” report, I’ve been thinking of nothing so much as Dr. Shiller’s shrug and his notion of Animal Spirits.

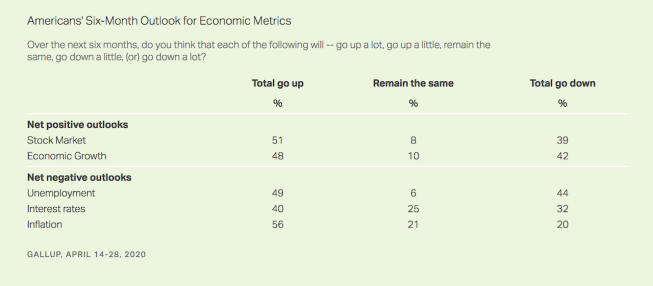

This Gallup analysis, published yesterday, is telling.

“Americans are concerned about the present state of the economy and believe conditions are worsening, but their six-month predictions for specific aspects of the economy are less dire — particularly in terms of the stock market and economic growth.”

In Americans’ mind–and importantly in their “Animal Spirits” behaviors–therefore, is the “worst-case” scenario for a two-quarter mega-shock followed by a rapid snap-back to exuberance and momentum? Gallup analysts note that Americans’ moods have not hit the low-point they did during the grim nadir of the financial meltdown in 2008. However, those same analysts speculate that, perhaps, there may be a further jag downward to come.

Data from research firm the Numerator also reflects a heartbeat of resiliency and optimism in consumer responses within the context of COVID-19 spread, containment, economic distress, and an imminent reboot in social and business activity.

“This week, 90% of consumers said their shopping behavior had been impacted by Coronavirus; in select states that have started reopening, this impact was slightly lower at 86%. Even as we begin to see more states lift stay-at-home orders and get businesses up-and-running again, we expect to see continued elevated levels of impact on consumer behavior given ongoing uncertainties, supply chain disruptions, and risks of potential resurgences.”

The big unknown, of course, is what winds up happening to consumer wherewithal. Psyche and Animal Spirits would tend to correlate with real-world ability to sustain quality of life thanks to visible and reliable paths for livelihood. In 72 hours or so, we’ll start to come face-to-face with the prospect of how visible and reliable–or not–those pathways are for tens of millions of American workers.

Although Dr. Shiller would probably shrug if you asked him right now about how long or what alphabetical shape the current Recession may be, he’d be certain of one thing.

[Our recovery will tie to] “the sense of trust we have in each other, our sense of fairness in economic dealings, and our sense of the extent of corruption and bad faith.”