LGI Homes, Inc., The Woodlands, Texas (NASDAQ: LGIH) on Tuesday reported net income for the first quarter of 2020 ended March 31 was $42.8 million, or $1.69 per basic share and $1.67 per diluted share, an increase of $24.5 million, or 133.7%, from $18.3 million, or $0.81 per basic share and $0.73 per diluted share, for the first quarter of 2019. Analysts were expecting a gain of $1.25 per share.

The increase in net income was primarily attributed to an increase in the number of homes closed with an overall higher gross margin percentage, largely as a result of higher average home sales price realized, during the first quarter of 2020 as compared to the first quarter of 2019.

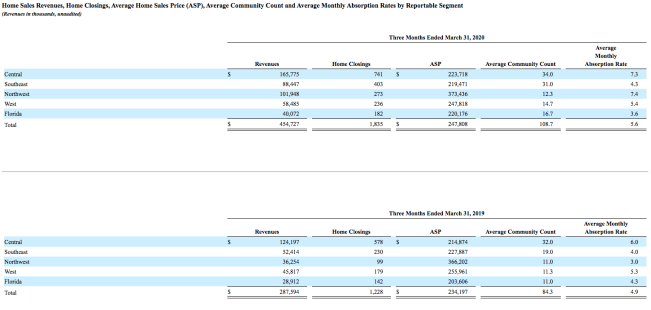

Home closings during the first quarter of 2020 totaled 1,835, an increase of 49.4%, from 1,228 home closings during the first quarter of 2019. At the end of the first quarter, active selling communities increased to 113, up from 87 communities at the end of the first quarter of 2019.

Home sales revenues for the first quarter of 2020 were $454.7 million, an increase of $167.1 million, or 58.1%, over the first quarter of 2019. The increase in home sales revenues was primarily due to the increase in home closings and an increase in the average home sales price during the first quarter of 2020.The average home sales price for the first quarter of 2020 was $247,808, an increase of $13,611, or 5.8%, over the first quarter of 2019. This increase in the average sales price per home was primarily due to changes in product mix and higher price points in certain new markets, partially offset by additional wholesale home closings.

Gross margin as a percentage of home sales revenues for the first quarter of 2020 was 23.4% as compared to 23.1% for the first quarter of 2019. Adjusted gross margin (non-GAAP) as a percentage of home sales revenues for the first quarter of 2020 was 25.5% as compared to 25.1% for the first quarter of 2019. The increase in gross margin and adjusted gross margin as a percentage of home sales revenues is primarily due to higher average sales price fueled by our product mix, favorable pricing environments and operational leverage obtained, partially offset by an increase in wholesale home closings as a percentage of total home closings in the first quarter of 2020 as compared to the first quarter of 2019.

“Coming into the first quarter we saw continued strong demand for LGI Homes supported by an attractive interest rate environment and a limited supply of affordable new homes in the markets where we operate,” said Eric Lipar, the CEO and chairman. “We delivered record-breaking closings in January and February and had significant momentum going into March. However, efforts to control the spread of COVID-19 resulted in a global economic slowdown, motivating us to take proactive measures to position our business for the coming uncertainty. The combined impacts of social distancing, stay-at-home orders and other COVID-19 related dynamics in our markets slowed our pace of sales. Despite these headwinds, our pipeline remained strong and the efforts of our dedicated employees enabled us to close 795 homes in the month of March and deliver a record-breaking 1,835 home closings in the first quarter.”

Said Lipar, “Despite the challenging environment we encountered at the end of the first quarter, our business was stronger in April than we had originally expected and we are seeing positive momentum in recent sales trends that leads us to believe the impact from the COVID-19 pandemic may be less severe than we had originally expected. We are building, selling and closing homes across the nation every day and our customers are telling us that they are more ready than ever to move out of densely populated living situations and into homes that offer more space and privacy. As a result, our outlook for the coming months is tempered, but positive.”

Later Tuesday, LGI reported 605 home closings in April 2020, compared to 612 home closings in April 2019. The company ended the first four months of 2020 with a total of 2,440 home closings, a 32.6% increase over 1,840 home closings during the first four months of 2019.

As of the end of April 2020, the company had 115 active selling communities.