When shutdowns from the COVID-19 pandemic struck Southwest Florida’s second-home market this spring, Stock Development had been having a banner year.

The Naples-based firm, which builds luxury residences under its Stock Signature Homes brand with an average sales price of around $1.4 million, had weathered a blip in sales and activity at the beginning of 2019, when buyers and builders alike were fretting about the possibility of a recession ahead.

When that recession never materialized, sales took off. The result was a frenzied period for most of 2019 going into 2020 that saw Stock—ranked No. 162 on the latest Builder 100 list—struggling to meet demand. With a history of spec homes accounting for nearly 50% of its sales, the company ratcheted spec inventory down to just 30%, as custom builds dominated the remaining 70% of its book.

“From February 2019 on, we probably had the strongest 13 months we’ve ever had as a company,” says Claudine Léger-Wetzel, Stock’s vice president of sales and marketing. “We were dramatically shifting our business model to 70% custom builds, because we just couldn’t keep up.”

But when the novel coronavirus hit America’s shores hard in March 2020, that sales momentum fell off a cliff.

“For a six-week period from March 20 through the end of April, we saw a huge downturn,” Léger-Wetzel says. “Going into 2020, my projection for April was 27 sales. Instead, we ended up doing three.”

The impact was so swift and dramatic that when Stock shut down its offices March 20, Léger-Wetzel, a 20-year employee of the firm, teared up during a companywide conference call to prepare the business to go dark. “We had no idea when we were going to see each other again,” she says. “It was quite emotional.”

The Sandpiper model has proved popular at Evergreene Homes’ Ocean View, Del., Tidal Walk community.

Home of the V-Shaped Recovery

What a difference a few months makes.

Going into July, as many states continued to open back up even as the number of COVID cases across the U.S. surged, Stock was doing blistering business once again. With a goal of 21 sales in June, it approached the end of the month having executed on 32 deals to blow past its benchmark.

Further, at Isles of Collier Preserve, a 2,400-acre master-planned community just south of Naples’ highly sought-after 5th Avenue shopping and entertainment district, Stock was closing in on its full-year 2020 goal of selling 55 lots in the community, with 50 signings in the first six months. The firm has even been able to institute price increases, announcing a $20,000 base price increase at the beginning of July, which was quickly followed by a $30,000 increase scheduled for mid-month. Even with those rising prices, the sales have kept coming in.

“It has become a phenom, and we really can’t believe it,” Léger-Wetzel says. “We’re now seeing this frenzy because folks are like, ‘I’m going to miss out.’”

Léger-Wetzel and Stock Development are not alone. The steep sales dive and whipsawing resurgence of buyer activity the firm saw is emblematic of builders’ experiences selling into the high-end, luxury second-home and vacation market in a post-COVID-19 world. While that hasn’t been the case across all sectors of the second and vacation home market—there are still signs of trepidation at the lower end—if the V-shaped recovery is happening anywhere in home building in 2020, it’s occurring in this segment. The revamped momentum highlights a shift in the attitude of high-end buyers who have made it through the initial anxiety and uncertainty of COVID, only to emerge with a live-in-the-present and act-now attitude on the other end.

Carpe Denizens

“After the initial phase, when everyone was unsure of what was going to happen and there was no activity on the market for four to six weeks, things got compressed,” says Michael Ziman, founder of Long Beach Island, N.J.–based Ziman Development, which builds approximately a dozen high-end custom second or vacation homes annually with multimillion-dollar price tags for ultrahigh net worth individuals. “Then, you had people living in Manhattan or other cities who felt like they had to get out to feel safe. So after the first wave, those people who were sitting on the sidelines realized life is short. They started asking, ‘What am I waiting for?’”

The result was a two- to three-time surge in interest and demand for the homes Ziman builds. “People are making that decision based on possibly not traveling to Europe or traveling overseas for an extended period, and being able to have a house within an hour or two of their primary residence,” he notes.

On the other side of the country, the pace has picked up considerably as well. “The second-home market is hot,” says Dave Nielsen, president of Southwest Utah–based Cole West Home, which closed 180 homes in 2019. “The excess elbow space has promoted Southern Utah as a place of safety for many during the pandemic.”

But it isn’t just on the ultrahigh end that builders are seeing a resurgence of activity among potential second and vacation home buyers. At Chantilly, Va.–based Evergreene Homes, where second and vacation homes account for roughly one-third of the company’s sales mix and start as low as the mid $500s at the Delaware beaches and Virginia and North Carolina lake communities, buyers are also back.

“I’d say seven out of the 10 people I talked to on March 15 when things shut down have already called me back in the last two weeks to try to get things going again,” says Tim Naughton, president of Evergreene’s Delaware and Maryland division. The firm ranks No. 159 on the latest Builder 100. “The second-home market is somewhat tied to the stock market, so as everybody’s portfolios came back, they got more comfortable with looking at a second home again.”

For Evergreene CEO Robert Cappellini, that reemergent wave of interest in June, coming on the heels of COVID-19’s initial outbreak, as well as widespread protests over George Floyd’s death, seemed to originate as much from buyers’ crisis fatigue as it did from their rebounding stock positions.

“It just seems that people are really a little bit overwhelmed with everything going on in the world, whether it’s the politics, or COVID, or both,” Cappellini says. “I think they’re saying, ‘You know what? Let’s do this.’ Interest rates are low. It’s a good time to make a move if they have the means.”

With mortgage rates hovering at or below 3%, that’s true even for buyers who otherwise would pony up millions of dollars in cash to buy a home outright.

“When you’re dealing with buyers at this level, it’s not like they don’t have the cash,” says Ziman. “But I have a deal that’s closing next week where the client is getting money at 2.25%. He doesn’t need it, but he told me if they want to give him money at 2.25%, he has to take it. That’s the nature of a lot of our buyers who have accumulated millions of dollars to be able to buy a second home. There’s a certain level of sophistication, and they realize when to and when not to take advantage of those rates.”

Island Inspiration – Ziman Development primarily builds high-end custom second homes (above) in Long Beach Island, N.J.

A Broader Appeal

The surge isn’t just happening in traditional vacation home havens up and down the East Coast, either. At Beverly Hills, Calif.–based The Agency, a high-end brokerage that boasts 650 agents in 32 offices worldwide, founder and CEO Mauricio Umansky notes a reprioritization in his clients’ lives that has led to increased activity from Malibu to Colorado, Utah, South Florida, and even the Caribbean, where he has a stockpile of transactions that are pending physical inspections of buyers once travel restrictions are lifted.

Observers say the crisis has spurred a different outlook among buyers in this segment, much like the changed perspectives of soldiers coming back from World War II, or people making pivotal life-event decisions post 9/11.

“A change in what we value in life has really come to the forefront,” Umansky says. “That means more time with friends, family, and enjoying the great outdoors.”

The result, he says, is an increase in sales of second homes in markets that are drivable from major cities, an uptick in higher-priced rentals, and people planning late summer and fall escapes, while booking lavish vacation homes.

“It started with people looking for vacation rentals, but as inventory has shrunk, it’s prompted a buying mode,” Umansky says. “The big question has become, ‘Where do you want to sequester with your family in the event that this ever happens again, or continues for the unforeseeable future?’”

Doldrums on the Lower End

Not all second-home geographies and market segments are going gangbusters, however. At Costa Mesa, Calif.–based new-home consulting firm Meyers Research, second and vacation home expert Adam McAbee says the market is highly destination dependent.

“The degree of impact varies by market,” says McAbee, vice president of advisory at Meyers Research, a BUILDER sister company. “In Hawaii and in similar destinations where air access is a requirement, second homes are being hit harder than drive-to markets that can be accessed as a weekend getaway. The Florida Keys or the Carolinas are good examples of a market buyers can get to by car.”

He also says that despite increased desire for a refuge during the pandemic, the economic unknowns of COVID may cause some wealthy buyers to take a pause. “Cash preservation is king in the near term, so even ultrahigh net worth individuals will take a second look before making a buying decision,” McAbee says. He notes that a few developer clients who were seeking consulting services on second-home communities prior to COVID have put those discussions on hold for now.

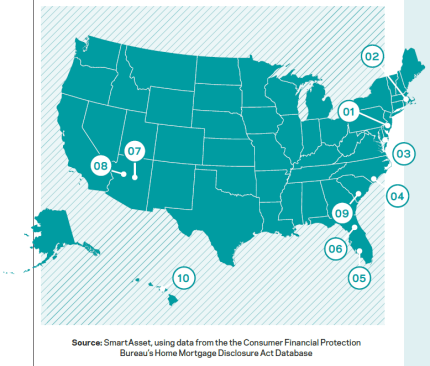

Hottest Second Home Markets

Almost 70% of approved mortgages in Ocean City, N.J.—ranked No. 1 below—are for secondary residences. No other metro area in this SmartAsset study cracks 40% for that metric. To find the hottest secondary home markets in the U.S., SmartAsset compared data for 400 metro areas across two metrics: number of mortgages for secondary residences and total number of mortgages approved in 2018.

1. Ocean City, N.J.

2. Barnstable Town, Mass.

3. Salisbury, Del.-Md.

4. Myrtle Beach-Conway-North Myrtle Beach, N.C.-S.C.

5. Naples-Immokalee-Marco Island, Fla.

6. The Villages, Fla.

7. Flagstaff, Ariz.

8. Lake Havasu City-Kingman, Ariz.

9. Hilton Head Island-Bluffton-Beaufort, S.C.

10. Kahului-Wailuku-Lahaina, Hawaii

“For the most part, developers and capital sources still want to see how the next few months play out,” McAbee says. At the same time, he concedes “some opportunistic groups will consider a move if the price is right.”

The Highs and Lows of Second Homes

For Joseph J. Zoppi, managing partner at Princeton, N.J.-based brokerage Templar Real Estate Enterprises, second and vacation homes currently represent a tale of two markets. “It’s kind of a mixed bag,” Zoppi says. “The luxury home market for second homes is very strong, but houses outside that category are seeing lower demand.”

He points to data from realtor.com, which showed a 7.3% year-over-year increase in searches for $1 million homes in May, and calls out markets such as Palm Springs, Calif., Greenwich, Conn., the Hamptons in New York, and Wyoming, Idaho, and Montana for seeing an increase in activity at those price points.

“But lower-priced vacation homes have a decrease in demand, even with limited inventory,” Zoppi says. “As the COVID scare subsides, more houses will come on the market, especially vacation houses, which will result in a possible glut and lower prices.”

Adds Cole West Home’s Nielsen, “Class A vacation rental projects will thrive, and Class C vacation rental projects will struggle.”

Another area that observers see as potentially vulnerable is the condo sector. “Condos and high-rises have been negatively affected, since people are moving away from vertical and communal living,” Umansky says, even though developers and property managers have quickly put enhanced cleaning protocols in place to keep residents safe.

Still, as Jeff Lichtenstein, owner of Jupiter, Fla.–based brokerage Echo Fine Properties puts it, “Who wants to ride down from the 38th floor with four other people who aren’t wearing a mask? People in condos, in particular, are looking to move into single-family homes.”

Even in the condo segment, however, there’s a difference between a run-of-the-mill two-bedroom, second-home unit, and a second-home condominium that encompasses the entire floor of a building and has plenty of space of its own.

“While some vacation home shoppers opted for single-family homes over condos, we didn’t see any drop-off,” says Louis Birdman, co-developer of One Thousand Museum, a 60-floor, Zaha Hadid–designed uber luxury tower in downtown Miami. “Our floor plans run upward of 10,000 square feet of interior space, and include the benefits and conveniences of condo living. The second-home market, specifically at the high end, is seeing a lot of demand right now.”

Curated Views – In Southwest Florida, the Clairborne II model by Stock Signature Homes offers indoor-outdoor living.

A Great Market, Until It’s Not

For experienced home builders enjoying a sales uptick in the sector now, the bifurcation in the second and vacation home market demands their respect.

“When it’s good, it’s real good,” says Evergreene’s Naughton. “But if the market goes south, it shuts off real quick. You’ve got to run lean precisely because it’s a second-home market, which means it’s the first thing that’s going to go away when things slow down.”

At Evergreene, that means keeping a close eye on the firm’s project size—50-unit developments are its upper limit—while also watching head count. Debt is another area where builders targeting the second and vacation market need to tread lightly.

“You have to be able to endure a down cycle,” Cappellini says. “Because if you’re leveraged to the hilt when one starts, it’s already too late to take corrective action.”

There’s also a lot more concentrated risk than selling primary homes in terms of marketing to a smaller pool of buyers, with each home having potentially a lot more capital tied up in it.

“You’ve got to be careful about how much speculative inventory you have,” says Stock’s Léger-Wetzel. “We have a home in Port Royal going up that’s going to be $18 or $19 million. We have a home on the East Coast of Florida that’s going to be in the $50 million range. So obviously, there’s a lot of risk in that.”

Thinking strategically, in terms of both the product and the market, is a must for success.

“We try not to get too far ahead of ourselves, and we spend a lot of time on product design and interior selections to really make sure we’re hitting the market right, so that we can react to whatever comes our way,” Léger-Wetzel says. “I mean, who could have predicted COVID, as fast and hard as it came? How we’re doing now is a testament to our company and our product.”

Not Like Selling in the Suburbs

That product, second and vacation home builders say, varies in specific ways from primary homes. For instance, while bedrooms don’t necessarily need a lot of square footage, there should be more of them to accommodate the extended family and friends who come to visit, especially as social distancing mandates are relaxed.

“These homes have at least two more bedrooms than the number of immediate family members,” Ziman says. “People want to interact, and invite their other family and friends to the beach.”

In search of a refuge-like feel, buyers currently are seeking generally larger homes, as well as lot sizes.

Other standouts include large open spaces for entertaining, multiple laundry rooms to accommodate visitors’ wash loads, and plenty of outdoor space. “People love their outdoor showers, outdoor fire pits, bocce courts, and outdoor kitchens,” Ziman says. “We do a lot of pools, too, even though the ocean is right there, as well as covered decks.”

Along with office nooks for remote working, which have gained increased importance since the coronavirus, covered outdoor space is becoming more of a premium in second and vacation homes as people want space where they can gather, but also maintain social space.

“The biggest thing that we focus on in our market is the really open great room plans, high volume ceilings, and a lot of undercover lanai space,” Stock’s Lèger-Wetzel says. “One of our most popular plans has over 1,000 square feet of covered lanai, plus a nice sized pool.”

As with any home, area amenities are also important, including distance to natural features like the beach or lakefront. But second and vacation home buyers also put an emphasis on area infrastructure that’s in stark contrast to the primary home market.

“People buying their primary home are looking at school districts and shopping centers, things like that,” says Evergreene’s Naughton. “But schools don’t matter to a second-home buyer. That’s completely out of the equation. Instead, you’ve got to look at the proximity to restaurants, parks, and the boat launch.”

Those are exactly the types of amenities Shane Dutka, owner of Washington, D.C.–based Review Home Warranties, which analyzes different product types for the homes it warranties, is seeing appeal to buyers now.

“Overall, secondary home markets in more secluded areas where nature is the largest draw stand to bounce back stronger than ever,” Dutka says. “Think cabins or waterfront properties in semi-remote locations, especially ones with updated home amenities, plenty of outdoor space, and sizable lots protecting the investment.”

Sounds like a first-rate formula for success in building, and selling into, the second and vacation home markets.