Hovnanian Enterprises, Red Bank, N.J. (NYSE:HOV) Thursday reported a net loss of $30.8 million, or $0.21 per common share, in the first quarter of fiscal 2018 ended Jan. 31. The loss compares with a net loss of $0.1 million, or $0.00 per common share, during the same quarter a year ago. Analysts were expecting a loss of $0.07 per share. Shares of HOV lost more than 6% to $2.15 in heavier-than-average trading mid-morning Thursday.

Among the metrics reported by the company:

● Total revenues decreased 24.4% to $417.2 million in the first quarter of fiscal 2018, compared with $552.0 million in the first quarter of fiscal 2017.

● Home building revenues for unconsolidated joint ventures decreased 9.8% to $58.6 million for the first quarter ended January 31, 2018, compared with $64.9 million in last year’s first quarter.

● Home building gross margin percentage, after interest expense and land charges included in cost of sales, was 14.8% for the first quarter of fiscal 2018 compared with 13.5% in the prior year’s first quarter.

● Home building gross margin percentage, before interest expense and land charges included in cost of sales, was 17.9% for the first quarter of fiscal 2018 compared with 17.2% in the same period one year ago.

● Total SG&A was $62.4 million, or 14.9% of total revenues, in the first quarter of fiscal 2018 compared with $60.1 million, or 10.9% of total revenues, in the first quarter of fiscal 2017.

● Interest incurred (some of which was expensed and some of which was capitalized) was $41.2 million for the first quarter of fiscal 2018 compared with $38.7 million in the same quarter one year ago.

● Total interest expense was $41.4 million in the first quarter of fiscal 2018 compared with $40.9 million in the first quarter of fiscal 2017.

● Loss before income taxes for the quarter ended January 31, 2018 was $30.5 million compared to income before income taxes of $0.3 million during the first quarter of fiscal 2017.

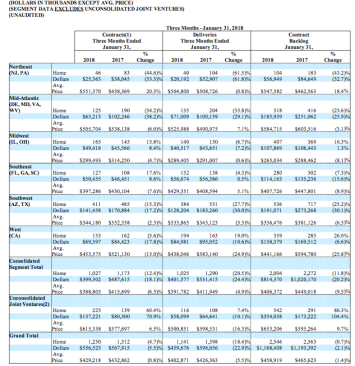

● Contracts per community, including unconsolidated joint ventures, increased 2.7% to 7.6 contracts per community for the quarter ended January 31, 2018 compared with 7.4 contracts per community, including unconsolidated joint ventures, in last year’s first quarter. Consolidated contracts per community decreased 2.7% to 7.3 contracts per community for the first quarter of fiscal 2018 compared with 7.5 contracts per community in the first quarter of fiscal 2017.

● For February 2018, contracts per community, including unconsolidated joint ventures, increased 6.5% to 3.3 contracts per community compared to 3.1 contracts per community for the same month one year ago. During February 2018, the number of contracts, including unconsolidated joint ventures, decreased 6.0% to 528 homes from 562 homes in February 2017 and the dollar value of contracts, including unconsolidated joint ventures, decreased 3.2% to $227.8 million in February 2018 compared with $235.3 million for February 2017.

● As of the end of the first quarter of fiscal 2018, community count, including unconsolidated joint ventures, was 165 communities. This was a 5.1% sequential increase compared with 157 communities at October 31, 2017 and a 6.8% year-over-year decrease from 177 communities at January 31, 2017. Consolidated community count decreased 10.8% to 140 communities as of January 31, 2018 from 157 communities at the end of the prior year’s first quarter.

● The number of contracts, including unconsolidated joint ventures, for the first quarter ended January 31, 2018, decreased 4.7% to 1,250 homes from 1,312 homes for the same quarter last year. The number of consolidated contracts, during the first quarter of fiscal 2018, decreased 12.4% to 1,027 homes compared with 1,173 homes during the first quarter of 2017.

● The dollar value of contract backlog, including unconsolidated joint ventures, as of January 31, 2018, was $1.17 billion, a decrease of 2.1% compared with $1.19 billion as of January 31, 2017. The dollar value of consolidated contract backlog, as of January 31, 2018, decreased 20.2% to $814.4 million compared with $1.02 billion as of January 31, 2017.

● For the quarter ended January 31, 2018, deliveries, including unconsolidated joint ventures, decreased 18.4% to 1,141 homes compared with 1,398 homes during the first quarter of fiscal 2017. Consolidated deliveries were 1,025 homes for the first quarter of fiscal 2018, a 20.5% decrease compared with 1,290 homes during the same quarter a year ago.

● The contract cancellation rate, including unconsolidated joint ventures, was 20% in both the first quarter of fiscal 2018 and the first quarter of fiscal 2017. The consolidated contract cancellation rate for the three months ended January 31, 2018 was 18%, compared with 19% in the first quarter of the prior year.

● The valuation allowance was $661.1 million as of January 31, 2018, after adjusting for the Tax Cuts and Jobs Acts of 2017. The valuation allowance is a non-cash reserve against the tax assets for GAAP purposes. For tax purposes, the tax deductions associated with the tax assets may be carried forward for 20 years from the date the deductions were incurred.

● Total liquidity at the end of the first quarter of fiscal 2018 was $292.0 million.

● As of January 31, 2018, consolidated lots controlled increased sequentially to 27,183 from 25,329 lots at October 31, 2017 and increased year over year from 26,234 lots at January 31, 2017. The total consolidated land position was 27,183 lots, consisting of 14,260 lots under option and 12,923 owned lots, as of January 31, 2018.

● In the first quarter of fiscal 2018, approximately 3,400 lots were put under option or acquired in 39 communities, including unconsolidated joint ventures.

● Paid off $56.0 million principal amount of debt that matured on December 1, 2017.

● Refinanced $133 million of 7.0% senior notes due 2019, with a 5% unsecured term loan maturing in 2027 from GSO Capital Partners LP, Blackstone’s credit platform, and certain funds managed or advised by it (collectively the “GSO Entities”).

● Accepted $170 million of 8.0% senior notes due 2019 tendered in an exchange offer for the issuance of $91 million of 13.5% unsecured notes due 2026, $90 million of 5.0% unsecured notes due 2040 and $27 million of cash for the purchase of $26 million of the tendered 8.0% senior notes. An additional 5.0% unsecured term loan commitment from GSO Entities will be used to refinance $66 million of 8.0% senior notes.

● Commitment for $125 million senior secured revolver/term loan from GSO Entities, which we intend to draw in September 2018 to repay the $75 million super priority term loan due in 2019 and to provide $50 million of incremental liquidity.

● In January 2019, additional liquidity provided by $25 million commitment from GSO Entities to purchase additional 10.5% senior secured notes due 2024, at a price approximating the then prevailing yield, which today would be approximately 8%.

● Received consent from 10.5% senior secured note holders to eliminate restrictions on our ability to repurchase or acquire our unsecured notes.

“For the first time in two years, we increased the number of total lots we controlled, which should ultimately lead to community count, revenue and profit growth,” stated Ara K. Hovnanian, chairman, president and CEO. “Hovnanian’s position is further strengthened by our recent financing transactions with GSO, along with a commitment for an additional $216 million of capital from GSO which together extend our debt maturities and provide additional stability to our capital structure.”

“The company remains in a transition period due to the adverse impacts from having to pay off $320 million of debt in late 2015 and 2016 when the high yield market was closed to us and other companies with similar credit ratings. As a result, we were unable to replenish our land position sufficiently in 2016 and 2017. This led to a reduction in community count and revenues, impacting our overall profitability. We are confident the most challenging quarter for fiscal 2018 is behind us and we expect future quarters this year should yield improved operating results, as we continue to rebuild our company,” concluded Hovnanian.