When I speak to builders and developers across the country, the common theme is growth, not only in sales projections but also out of their current loan capacities. Many builders are seeking larger lines, increased facilities, more equity, and a diversification of relationships.

As U.S. single-family home building continues to surge, builders and developers are seeking new capital beyond their needs of the past. Why? The pace of single-family starts in September was the highest production rate since summer 2007, with October not far behind. Sales are outpacing home starts by an unprecedented margin due to record low interest rates, a migration to the suburbs, millennials starting families, and supply of new homes remaining historically low. Builders can’t keep up with demand as many buyers engage in bidding wars. Home builders have become the unexpected leaders of the pandemic economic recovery.

Builders Growth

Builders are expanding their product offerings to meet different types of demand. Single-family detached home builders are diversifying into townhomes to meet the more affordable buyer price point. For-sale home builders are developing build-to-rent communities, another surging and emerging market segment with high demand.

Builders are contacting me with large growth in their pipelines. One builder I work with in the Southeast that typically closes 70 homes per year is on pace for 200 closings in 2021. Another builder in the Southwest, which has closed 120 homes each of the past few years, anticipates 300 to 400 closings in 2021 and 2022. And in the South, another builder that closes 250 homes per year is projecting 500-plus for the next couple of years. These are real numbers from builders I speak to seeking additional capital and new relationships. These large increases in home closings are fueled not only by home buyer demand and low supply but also from private equity’s appetite to own new construction rental communities. The impact of this demand for build-to-rent communities by consumers and investors can’t be stressed enough as builders are opting to develop properties on a fee basis for large private equity groups, or they are holding them for their own rental portfolio.

Builders are seeking new relationships for a variety of reasons. Of course they need more capital, both debt and equity, or land banking, to finance their growth, but other underlying reasons exist as well. Builders felt a pinch when the COVID-19 pandemic began as funding sources reacted with extreme caution. Even as demand was robust, most financing sources shut down entertaining new builder relationships and some temporarily halted funding for existing projects mid-construction, or were very slow to act, which caused disruption. (Lenders still have vivid memories of large-scale defaults during the recession a decade ago). Capital came back in late summer/early fall at different paces with restrictions, which are now unwinding—some being more optimistic than others. With the pandemic still underway and some uncertainty existing, if a capital pullback occurs again, builders want to have multiple financing relationships and options.

Capital’s Recovery

Capital is being called upon to grow as well, and I am seeing sources continue to raise funds institutionally to bolster their capacity and embrace today’s opportunities. As funding continues to recover from its recent tightening, it’s a competitive landscape once again with modest term modifications for some and more optimistic underwriting for others.

Cost of capital remains low, with a few examples of moderate upward pressure. Some capital sources took advantage of their spring/summer slowdowns by streamlining and automating their loan processes, creating a more user-friendly environment for borrowers. And why not? Pre-pandemic economic factors were exceptional for home building, and, even during the high-anxiety months of March to June, builders were beating their sales numbers during the same months from 2019, with some setting company records. They did this with virtual sales centers and other virtual means, a tribute to their creativity.

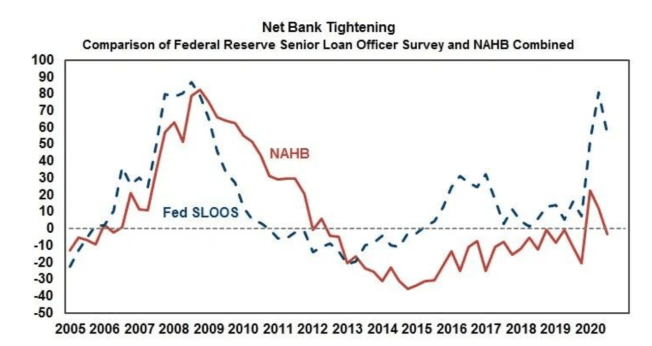

Courtesy NAHB

The above graph by NAHB indicates how AD&C loans tightened in the second quarter of 2020 and eased in the third quarter. Tightening are positive numbers, easing negative. I continue to see some easing in the fourth quarter.

Capital Today and Its Future

How are funding sources handling the increase in loan requests? Is there enough liquidity if the housing market continues its strength? Are there limits putting pressure on pricing, underwriting parameters, lending capacity, processing time, and, eventually, builder growth?

The home building industry is in an enviable position right now, relative to other real estate sectors, as capital is accessible and available from a variety of sources. One reason is paydowns. Demand is strong, and absorption rates are beating estimates. Builders are completing projects promptly and paying down loans as they seek more funds for new opportunities. The net increase of loan requests are within the industry’s current capital capabilities. Large capital sources have recently told me they need to increase loan balances as significant payoffs continue to occur.

Although an increase in capital requests exists for AD&C loans from recent years, lending still remains reduced from years past. The current amount of existing residential AD&C loans now stands 60% lower than the peak level of residential construction lending of $204 billion reached during the first quarter of 2008, per FDIC data. A big difference today from the overbuilding of the 2000s is the lack of speculative projects by builders and more diligent underwriting by lenders. Today, pre-sales are strong while capital is seeking more certainty in their exit strategies—beneficial to all in the industry. As lenders regain their footing, I see a good opportunity to negotiate terms as many are looking to make up for lost time and are seeking quality builders with good projects in strong locations.

Heading into 2021, builders are seeking diversification in their financing relationships and structures as a means to expand and be smart for the future. As demand outpaces supply, builders continue to increase their land and construction pipelines, and capital is prepared to provide the resources.