A sharp change in new home searches–reflected in the latest real-time search data captured by BDX’s New Home Source— flashes a big red flag that home builders can either ignore or use as a signal to pivot on their 2020 planning and execution.

Consumer online housing search behavior–to a material extent–shows a pervasive 180-degree turn in their sentiment and confidence about conditions that had been bouying market momentum through the end of February and into the first week of March.

The breakneck speed of the about-face in consumer confidence–thanks to economic shocks concurrent to the spread of COVID-19’s public health menace–will catch many builders in the middle of initial hopes and assertions that home buying behavior would continue at a strong clip, fueled by Fed interest rate reductions.

“Pause and pivot” is what BDX and New Home Source ceo Tim Costello cautions home building enterprise partners to adopt–calmly and decisively–to embrace a new level and a new mode of opportunity in home building, even as the two concurrent crises continue to unfold.

Here’s the story in the BDX new home search data from mid-week this week.

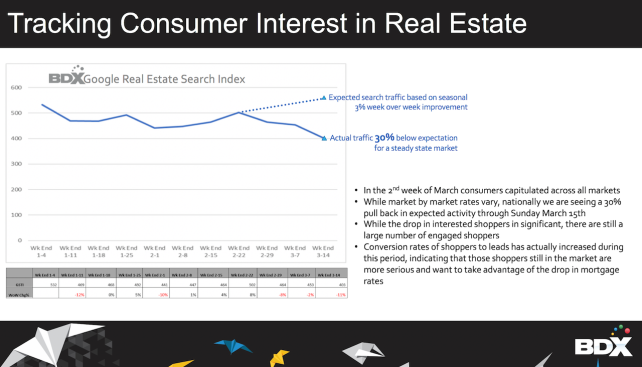

You can look at potential housing activity–Google searches, traffict to hundreds of home builder client websites, sensitive consumer behavior data indices, etc.–in two glaring stages, one, toward the end of February as news of the spread of COVID-19 started to widen domestically, and two, after global financial markets began to collapse as panic investment behavior became its own epidemic.

The two slides show that as the trajectory of consumers’ digital interest in COVID-19 spiked up, corresponding new home search behavior hit a tipping point, and finally captitulated earlier this week.

Here, you see the time-frames and pandemic milestones within which online behavior skyrocketed from low to intense in 21 days as consumers awakened to the risk of COVID-19.

And here, with a broad reflection of interest in real estate as a proxy for eventual new home search behavior, you see what happened. This trend, notes Costello, indicates a momentary stabilizing in search behavior around the time the Federal Reserve took its first action to lower the cost of borrowing in an attempt to ease wobbly corporate and consumer demand.

BDX’s Costello notes that the net swing–from the seasonal lift that new home searches should have been showing during the past couple of weeks, to the actual decline in activity–amounts to about a 25% to 35% deterioration in a matter of a little over three weeks.

While not being all-knowing or prescient, Costello expects the reversal will–like the epidemic–get worse before it gets better.

In looking at the present situation, Costello’s assessment focuses on four key forces driving the dynamics of real estate as we speak. Under normal circumstances, two of them would offset the other two as positives versus negatives. However, these are not normal times. Here’s what’s in play.

- The COVID-19 pandemic

- The profound volatility–and two-week collapse–in the financial markets

- Interest Rates

- Oil Prices

The first two negatives, and the way they’re impacting housing activity on all fronts right now are somewhat self-explanatory. The first positive, low, low, low, low interest rates may eventually be an existentially important driver, especially for people who are cushioned from the worst of the sudden disruption in job security, wages, and daily life outlook.

The second so-called positive force cuts sharply two ways, says Costello.

“Typically, when oil prices go way down it’s time to celebrate, because more consumer households can use dollars for purchases other than filling the gas tank, and that consumer purchase behavior translates into a more robust economy,” Costello notes. “But under these conditions, when oil prices fall as fast and as low as they have, it starts to darken the outlook, because this has immediate impact on a very important source of new home demand–people who work for oil companies–whose jobs are now at risk. So, this could easily turn from being a positive force to strongly negative one if the job losses in the energy sector pile up.”

As for an outlook, Costello is loathe to go into the prediction business. Instead, he views the moment as a time for home builders, and all stakeholders in the residential real estate business community to pivot.

“This business has been through rough moments, from isolated-single market convulsions to terrorist attacks, to a multi-year housing depression,” says Costello. “The people in this community have dealt with adversity before, and they can do it now.”

Here’s the ways Costello would characterize the immediate, intentional, and decisive pivot for volume new-home builders and developers.

- Shift from order-taking to selling: “We’ve been hearing about almost a return to the days of the middle of the last decade with weekly price increases, auctions, demands for $1,000 deposits even to be eligible for one of the newly-released home phases,” says Costello. “That all changes now. Builders must first focus on finding, engaging, nurturing, and closing, doubling-down on the buyers who are still in the market.” He notes that, even in the worst of times during the Great Recession, builders sold 350,000 or so new homes. They need to check back at all the best practices of identifying, competing for, and bringing home buyers who have the ability and the motivation to continue to look in the current market.

- Leverage the new normal of dirt cheap interest rates for all they’re worth. “It’s a perfect time to tell a buyer how much more she can get for her new-home dollar right now thanks to the rates they can lock in now for the duration of their loans.”

- Enable the virtual buyer. “We’ve been selling new homes to remote buyers for 20 years,” says Costello. “The new technologies that take friction out of the process–ones that have been so appealing to millennial buyers during the past several years–will improve exponentially, and that’s a plus. But, we’ve been getting new home contracts to people via email, and processing the entire transaction with some pretty low-tech platforms, the phone, email, faxes, etc., and that will certainly be a way of life through the selling cycle for the near term.”

Most of all, Costello cautions, being calm and decisive doesn’t necessarily mean sugar-coating the outlook.

“I’m not seeing a return to normal for the duration of 2020,” says Costello. “If I’m wrong, I’ll happily admit that. But, I think we’re going to have to at least come face-to-face with worst-case scenario planning, and execute.”

Remember the falling knife?

In case you may be too young to recall the expression, there are two important things to know about it.

One is that it’s falling. Fast.

The other is that it’s a knife.

Your job, if you choose to accept it, is to catch the falling knife at the instant it touches down.

Most builders of an age know this. Opposites attract. Builders and adversity have paired up constantly though the eras, like double-helices. Things get tough. Builders, well, they find a way, if not now, then sometime soon. With steadying confidence, you can tell your teams, “we got this.” And you do.

Please, keep yourselves healthy out there, and your folks. And let us know how you’re doing. jmcmanus@hanleywood.com …. You’re why we’re here.