Realtors are a sunny lot, so, naturally, at their annual meeting in Orlando Friday they put out a forecast for fair skies if not brilliant sunshine in 2017: Existing home sales will be up 2% from 2016’s pace of 5.36 million to 5.46 million. The gain will be driven by more millennials entering their prime home-buying years, rising household formation, and continued job gains, according to Lawrence Yun, chief economist of the National Association of Realtors®.

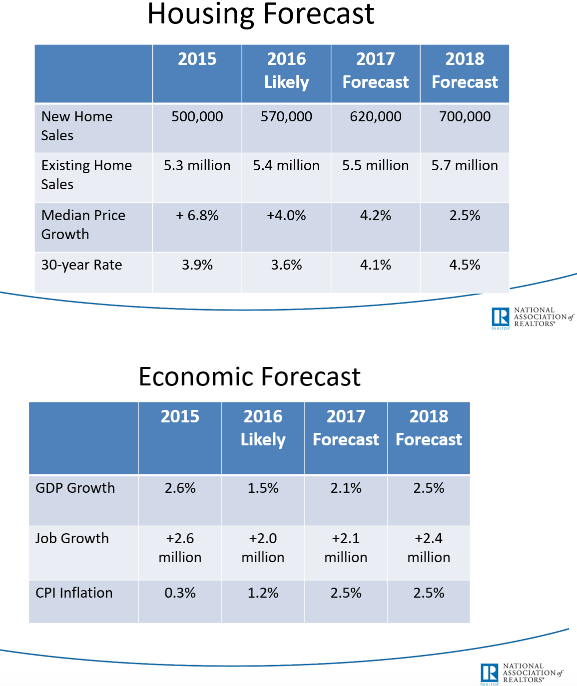

Things get better in 2018, Yun said, as he expects a more prominent jump of 4% in 2018 to 5.68 million home sales. The national median existing-home price is expected to rise to around 4% both this year and in 2017.

“The gradually expanding economy, multiple years of steady job creation and mortgage rates under 4 percent all contributed to sizeable interest in buying a home this year,” said Yun. “However, it’s evident that demand and sales slightly weakened over the summer as stubbornly low supply limited buyers’ choices, accelerated price growth and hindered some consumers’ belief that now is a good time to buy a home.”

Looking to next year, Yun said he thinks the tight supply and affordability issues affecting buyers in many markets will very slowly start to abate. As housing starts steadily increase, both he and Dennis Lockhart, president and CEO of the Federal Reserve Bank of Atlanta, who accompanied Yun for the presentation, are optimistic that housing demand will include leading-edge millennial households finally dipping their toes into the market at a growing rate.

In NAR’s recently released 2016 Profile of Home Buyers and Sellers, the median age of first-time buyers was 32. According to Yun, while repaying student debt, shaky job prospects after the recession and marrying and having children later in life have delayed first-time buyers’ ability and willingness to buy, the wave of potential buyers entering their 30’s is increasing considerably in coming years.

“NAR surveys from both current renters and recent buyers prove that there’s an overwhelmingly strong desire among the younger generation to own a home of their own,” said Yun. “The housing market over the next couple of years should get a big lift in demand from these new buyers. The one caveat is it’s essential that there’s enough new and existing supply at entry-level prices for them to reach the market.”

Lockhart remarked, “The coming years of housing demand will be millennial-driven and will support the single-family sector.”

Yun anticipates housing starts to jump 5.3% next year to 1.22 million. However, this is still under the 1.5 million new homes needed to make up for the shortfall in recent years and keep up with the growing demand. New single-family home sales are likely to total 570,000 this year and rise to around 620,000 in 2017, he said.

“Multi-family housing construction has dominated the building landscape in recent years and only recently started to level off,” said Yun. “Hopefully this is a sign that home builders will begin to significantly shift their focus to single-family housing. Both a large bump in new homes and homeowners selling is needed to get supply levels at healthier levels.”

Commenting on the overall health of the U.S. economy, Yun noted that continued overseas instability and flat business investment will lead to an unsatisfactory year of expansion. Although a boost in exports fueled economic growth to just a tick under 3% in the third quarter (first estimate), GDP for all of 2016 is still expected to be under 3% for the eleventh straight year.

“While the gains have been uneven by state, region and even gender, the 15 million jobs created since 2010 have bolstered consumer spending and housing demand,” said Yun. “Over the next two years, the economy will likely stay on a path of around 2% growth with a tightening labor market and stronger inflation.”

“The pace of job gains has been stronger than economic growth the last two years,” remarked Lockhart. “The housing sector has challenges, but the industry’s near-term outlook is one of continued improvement.”

Yun foresees a gradual uptick in borrowing costs heading into next year. By the end 2017, he expects rates to be around 4.5%. Lockhart also anticipates a gradual uptick in rates in the next two years, but said the economy currently does not call for a quickly rising rate environment.

“Increasing mortgages rates have the potential to further dent affordability in markets where supply struggles to recover to more balanced levels,” said Yun. “Despite these likely pressures, the increase in home sales next year will be supported by the continued release of pent-up demand and the beginning of stronger participation from first-time buyers.”