Something’s got to give. Something will.

Rising interest rates will inflict pain at the monthly-payment level that’s worked so persuasively as a lever of homeownership affordability. So, what happens next?

All things being equal, one of the three scenarios here below are likely, especially as labor costs kick upward on reflex, materials grip onto long-awaited pricing power, and lot prices continue to spiral north:

- Pace of sales, and the trajectory of recovery, will slow.

- Prices will flatten, and the rate of home values will slow.

- Profits will evaporate as builders try to hold prices and maintain pace at the expense of margins.

Four-plus years into this housing recovery, a plot line typical of recoveries past has not materialized. What production builders were able to do in the early rebound days of past housing recessions was to crank up the volume, producing new houses and communities that approached and even sank lower than the cost of existing homes in nearby markets.

That option wasn’t an option after all. Household balance sheets were too beat up among those who owed, and those who’d need to borrow mostly couldn’t. Also, skilled work forces were depleted, and builders needed, finally, after several years of operating in the red, to make money, so they tended to do that by delivering homes and communities for discretionary buyers, ones with cash, ones who could afford upgrades, ones who were buying because they could, not because their lives made buying a new home necessary.

Now, too few new homes for too long, especially in the lower tiers, has driven up prices. And just at the moment builders have mobilized their entry-level operations to begin a concerted push into farther-out land positions to offer $200,000 to $250,000 homes, interest rates threaten to mess with the monthly payment math that validated these strategic initiatives in the first place.

What will give?

- Prices?

- Pace?

- Profit?

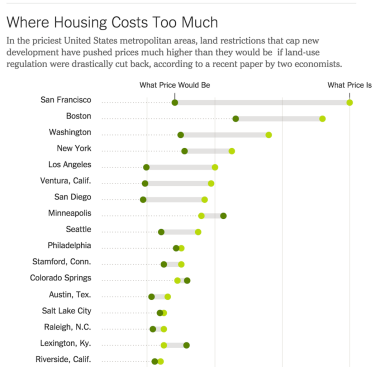

Here, New York Times economics staffer Conor Dougherty writes of “Why Falling Home Prices Could be a Good Thing,” for housing, for people, for economies, local and national. He suggests what housing and the economy might look like if more of it were available at less expensive prices, specifically in desirable coastal areas:

“While the older homeowners there would most likely be resentful of all the new apartments, condos and townhomes that caused their home equity to shrivel, younger people would have an easier time getting started.”

The challenge Dougherty explores so well exposes why something’s got to give, soon, in the housing economy. Dougherty acknowledges that too few new homes being produced in our economy is throwing it out of whack, impacting social and geographical mobility, and very possibly suppressing a broader sense that America can be “great again.” He asks his readers to imagine a housing landscape where people looked at their homes’ value only in the sense of their livability and present value to them, not as investments, noting:

The point of this thought experiment isn’t to embrace it full-on, but to open our eyes to the negatives of the national obsession of owning a home, expecting its value to rise, and using the levers of local government to keep neighborhoods as they are.

When it comes to fees, regulations, delays, entitlement costs, hook-up charges, etc., Dougherty rightfully points out, the enemy is not “them,” it’s us, the citizens currently living and owning in a neighborhood, and wanting to see the value of our properties go up.

Will the force of pent-up demand overcome higher per-monthly payment expense, barely-improving household incomes, greater monthly expenses on travel to and from work, etc.?

Will deregulation of banks suddenly free up capital for them to plunge aggressively back into mortgage lending, allowing more buyers into the credit box?

For house prices–resale and new–more new homes need to come on the market. Builders are doing their part. They’re taking on the risk. Will policy–particularly mortgage lending and finance policy–justify that risk or punish those taking it?