Big moonshot companies out of nowhere are becoming bigger and bigger players in the U.S. and world economies, generating value out of non-rival “goods and services” that never get used up. Companies like Google, and Facebook, and Amazon. Users of their goods and services do not take away other users’ ability to consume the same goods and services at the same time, nor do atom-based resources get used up or diminished with each use.

Home building and residential real estate development is the polar opposite of these non-rival, non-expiring business models. It’s all about durable, finite, exclusive, constrained resources–land, capital investment, materials, labor, home buyers, etc. Squeeze one or more of these resources, and conditions automatically ripen for the buying and selling of home building entities.

Yesterday, we looked at reasoning, rationales, and motivating factors among big public home builders as they look to produce growth in a post-low-hanging-fruit era. These strategic buyers grew quickly off very low baselines coming out of the Great Recession, but now they’re trying to follow their own act with a round-two growth scenario in circumstances where lots are hard to come by and are caked with local, regional and national fees, taxes, and regulatory encumbrances, and where labor is iffy, and where home buyers are playing harder to get.

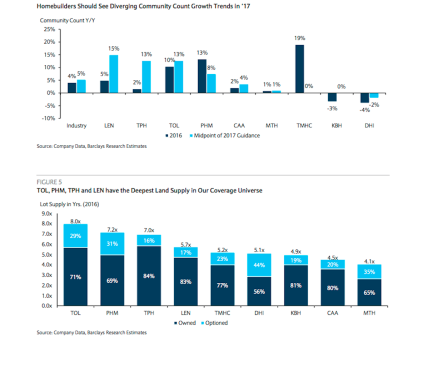

Here’s a look, from Barclays home building and home building products company analyst Michael Dahl at two charts that illustrate public home builders’ land and community growth challenges.

So, they’re motivated to increase their profitable volume, and these publics have mostly recognized that going deeper in their current operating zones and divisions may be a surer way to achieve profitable volume growth than to spread the footprint further into secondary and tertiary new markets.

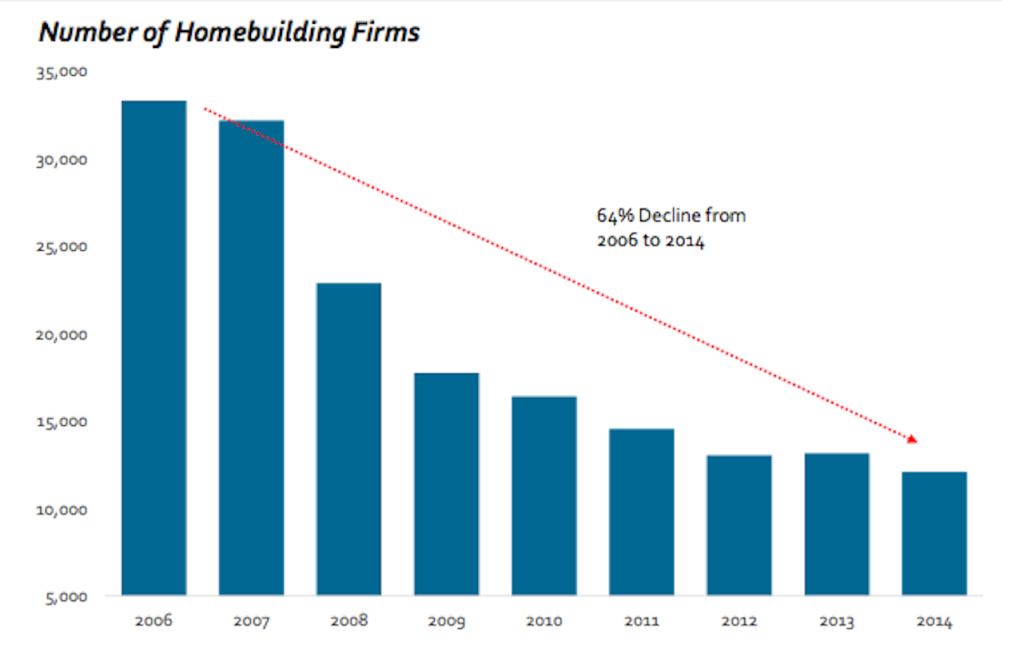

Publics strategically scarfing up private home builders will certainly play out as the landscape of volume builders continues to consolidate into fewer, larger actors. But, the m&a landscape here in the United States is far more interesting than to have only the “usual suspects” trolling for target acquisition opportunities.

Hence, the meteoric emergence in the past 36 months or so, of a breed of global strategics, Asia-based real estate, home building, and residential development enterprises who’ve begun to put their collective and individual imprint on m&a in the business community. The operative term here is “begun,” as we have every reason to believe we’re in the first-third of the cycle in terms of what will net out as a major insurgency across U.S. home building’s landscape. If Asian companies collectively have committed about $1 billion in U.S. single-family operators to date, we’d guess there’s at least another $1 billion poised for further investment by Asia-based companies in the single-family for-sale space alone.

Barclay’s Dahl focused an entire report on three Japanese organizations we’ve been writing a lot about–Daiwa House, Sekisui House, and Sumitomo Forestry–as collectively they’ve ingested a half-dozen privately-held home building operators [or major shares of them], representing 6,000-plus annual single-family home closings in markets ranging from the Northwest, to Colorado, Utah and the Southwest, Texas, and the Middle Atlantic region into the Southeast.

All of these foreign investors have plans to meaningfully grow U.S. operations. We think the main implication is that the land environment may become even more competitive in the coming years, especially as these foreign parent companies have both lower return thresholds (typically ~10% ROE target vs. our coverage universe current average of ~12%) and lower financing costs.

Here’s a look at Michael Dahl’s take comparing Japan-based home builders’ borrowing costs with those of a few America-based counterparts, showing the advantage foreign players have in their financing expense.

What Dahl gives glancing mention, if any note at all, are a couple of more “motivators” for these global strategics. Low-to-no household growth in Japan, inimical political and economic conditions for sovereign wealth holders, an appreciating dollar valuation, and the continued impact of the easing of Foreign Investment in Real Property Tax, all of which give Japan and China-based companies plenty of incentive to place investment in “safe haven” U.S. dirt and vertical development.

Whereas U.S. public home builders have some pretty stiff internal rate of return hurdle standards constraining them, which narrows the deal field materially in an environment where land sellers are said to be standing firm on high prices for their parcels, Asia-based players troll for deals on a playing field tipped to their advantage.

What hasn’t gotten a whole lot of attention, however, is how fundamentally–and helpfully– involved the new ownerships have been in their U.S. acquisitions’ daily and long-term operations. It’s not simply about a placement of capital.

What U.S. operators who’ve become part of the Sumitomo, Daiwa, and Sekisui House families are saying is that trips over to assembly plants, test labs, and development operations in Japan have exposed them to operational and construction technology insights and practices that are quite far advanced vs. most of what goes on here in the United States.

Sekisui House, for instance, tests its construction engineering under simulated earthquake conditions to understand and improve durability, flexibility, and resilience, and is also said to have common energy performance protocols and baselines that are well-ahead of North American practices and certification levels.

Net, net, it’s going to be tougher-going for U.S.-based strategic public home builders to hit their growth targets with mega players from Asia patrolling the same landscape.