Consistent with the slowdown in April’s closed escrow sales, which declined from the previous month and year, low housing inventory and eroding affordability suppressed pending home sales for the fourth straight month, the CALIFORNIA ASSOCIATION OF REALTORS (C.A.R.) said today.

Based on signed contracts, year-over-year statewide pending home sales declined for the fourth straight month in April on a seasonally adjusted basis, with the Pending Home Sales Index (PHSI)* declining 7.4% from 122.8 in April 2016 to 113.7 in April 2017. On a monthly basis, California pending home sales increased 5.9% from the March index of 107.4.

April’s year-over-year pending sales decline is the largest since July 2014, when sales decreased 9.1% from the previous year. The quickening pace of pending sales declines provides further evidence that the typically busy spring home buying season may underperform, primarily due to demand outstripping the supply of active listings, which was 10.5% lower than in April a year ago.

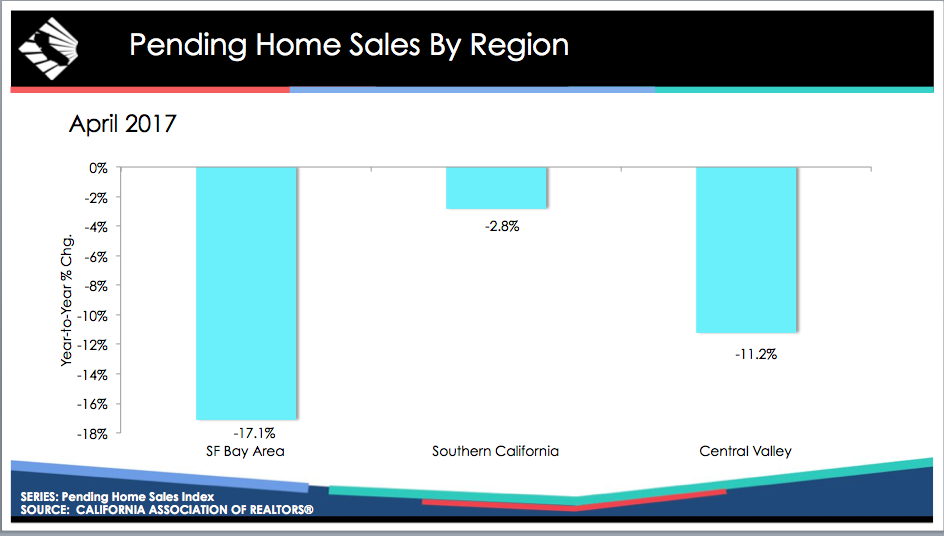

At the regional level, Southern California was the most resilient region in the state, where pending sales held on for a modest decline of 2.8%, aided in large part by a 2% increase in Riverside County and a 1.1% uptick in Orange County. San Diego posted a double-digit decline of 11.1%. Los Angeles County saw pending sales decline 4.7%, and San Bernardino pending sales fell 4%

.

At the opposite end of the spectrum, the San Francisco Bay Area bore the brunt of the slowdown. On a year over year basis, pending sales in April were 17.1% below where they were in April 2016. San Francisco, San Mateo, and Santa Clara all posted double-digit declines in pending sales (down 16.1%, 12.2%, 14.6%, respectively) as inventories remained between 1.8 and 2 months of supply with median prices of more than $1 million.

The Central Valley also posted a double-digit decline of 11.2% in April. Despite the rebounding energy sector and relative affordability, Kern County saw pending sales shrink by 15.5% from April 2016. However, Fresno, Kings, Madera, and Mercedwere already seeing closed sales begin to stumble back in March, and this weak reading on pending sales suggests that the sluggishness of sales will persist in the Central Valley over the near term as well.

In C.A.R.’s newest market indicator of future price appreciation, Market Velocity – home sales relative to the number of new listings coming on line each month to replenish that sold inventory – suggests that price growth will begin to accelerate this summer. With demand remaining strong and inventories tightening further, price pressure will get more intense over the next six months and that median price growth may accelerate into the high single digits through the fall. Market Velocity is strongly correlated with increases/decreases in price growth with a roughly three- to six-month lag time.