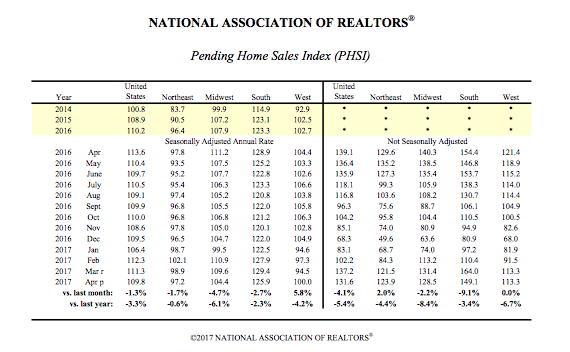

The Pending Home Sales Index decreased 1.3% to 109.8 in April from a downwardly revised 111.3 in March, the National Association of Realtors reported Wednesday. After last month’s decline, the index is now 3.3% below a year ago, which is the first year-over-year decline since last December and the largest since June 2014 (7.1%).

The PHSI in the Northeast decreased 1.7% to 97.2 in April, and is now 0.6% below a year ago. In the Midwest the index fell 4.7% to 104.4 in April and is now 6.1% lower than April 2016. Pending home sales in the South declined 2.7% to an index of 125.9 in April and are now 2.3% below last April. The index in the West jumped 5.8% in April to 100.0 but is still 4.2% below a year ago.

Lawrence Yun, NAR chief economist, says contract activity is fading this spring because significantly weak supply levels are spurring deteriorating affordability conditions. “Much of the country for the second straight month saw a pullback in pending sales as the rate of new listings continues to lag the quicker pace of homes coming off the market,” he said. “Realtors are indicating that foot traffic is higher than a year ago, but it’s obviously not translating to more sales.”

Added Yun, “Prospective buyers are feeling the double whammy this spring of inventory that’s down 9.0% from a year ago and price appreciation that’s much faster than any rise they’ve likely seen in their income.”

Unfortunately, Yun believes there is little evidence these astoundingly low supply levels are going away soon. Home building activity has not picked up enough this year and too few homeowners are listing their home for sale.

“The unloading of single-family homes purchased by real estate investors during the downturn for rental purposes would also go a long way in helping relieve these inventory shortages,” said Yun. “To date, there are no indications investors are ready to sell. However, they should be mindful of the fact that rental demand will soften as the overall population of young adults starts to shrink in roughly five years.”

Yun forecasts existing-home sales to be around 5.64 million this year, an increase of 3.5% from 2016 (5.45 million). The national median existing-home price this year is expected to increase around 5%. In 2016, existing sales increased 3.8% and prices rose 5.1%

.