With the release of our latest annual Local Leaders list—the ranking of the top 50 new-home markets ranked by closings, and the top 10 builders in each market—BUILDER takes a closer look at a few of this year’s fastest-growing markets on the list. Today we focus on Miami and Orlando.

Thanks to a booming job market, zero state income tax, sunny weather, and beautiful beaches, Florida is one of the country’s fastest-growing areas of the country. With huge influxes of foreign buyers, families, and retirees, two of its largest cities are leading the way.

Miami, which saw a 34% increase in closings last year compared to the year before, is enjoying notoriety as one of the world’s most cosmopolitan cities. With a population of 2.5 million, the Miami/Dade County area is a prime destination for Latin American, Cuban, and South American immigrants. In fact, 65% of the market’s residents are Hispanic, says Metrostudy regional director David Cobb. Many of these immigrants are professionals or entrepreneurs looking for a stable market to invest in. They find it in Miami’s (relatively) inexpensive housing prices.

“It’s really a global city and when you look at the cost of housing in Miami compared to other global cities like Los Angeles, Hong Kong, Tokyo, and New York, it’s much more affordable,” Cobb says, even though prices for the city’s ubiquitous condos can start at $3,000 a square foot.

The luxury vibe is enhanced by new retail developments featuring world-renowned stores and restaurants on par with those found on Rodeo Drive or Fifth Avenue. High-rise condos dominate the skyline here, but the boom could be slowed by weakening South American currency, particularly in Venezuela, Cobb notes. “The net effect of that is the same thing you would see with rising interest rates,” he says. “It prices these buyers out of the market.”

In response, Cobb says he has seen smaller condo projects take hold, many of them under 10 stories with units as small as 600 square feet, selling in the $250-per-square-foot range. “These developers are going after the local domestic buyer who is currently renting,” he says.

Lennar's Spanish-influenced Bonterra community near Miami features walking trails, bike paths, natural preserves. and lakes.

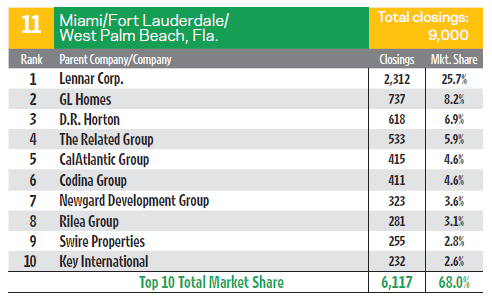

The city is home to the country’s second-largest builder, Lennar, which enjoys a 26% market share in the Miami area, far ahead of the second-largest builder, GL Homes at 8%. “They literally dominate the market here,” says Cobb, with about 2,300 closings of single-family and attached product last year, most of them focused on domestic buyers in outlying subdivisions with homes ranging from $300,000 to $400,000. “These are people who live and work in Miami and Dade County,” he says. One of the firm’s newest local projects, Bonterra, had 800 starts last year.

The production giant leverages its size to keep construction costs down, Cobb says. For instance, its “Everything’s Included” branding pleases customers while making it easier for the firm to negotiate volume discounts on products and materials.

About 230 miles to the southeast, the booming city of Orlando–known for its amusement parks and family-friendly attractions—is attracting job seekers as well as vacationers. It grew 28% in closings from 2015 to 2016. Its world-class university and medical systems, tech-related companies like Martin Marietta, and a new Amazon distribution center make it a burgeoning employment center. Foreign migration comes into play here as well in Miami. For example, Puerto Rico’s recent economic woes have spurred many families to relocate to the area.

“Job growth is enormous down here,” says RJ Marshall, executive officer of the Greater Orlando Builders Association. “The economy is booming and it’s driving home building because all these new workers need places to live. Everybody is busy with more work than they can handle.”

There is also no end in sight for the area’s population explosion. Orange, Osceola, Lake, and Seminole counties in Central Florida are home to nearly 2.4 million residents, a number that is expected to grow to 3.7 million by 2045, according to projections by University of Florida. The city’s central Florida location means there is room to grow and buyers aren’t hesitant to purchase homes in more affordable outer ring locations from production builders like CalAtlantic. “The city’s outlying areas are exploding,” Marshall says. “There is no coastline or swamp to hold back growth.”

Home prices are rising, too, and were up nearly 10% last year according to Forbes, which ranked Orlando as the second fastest-growing city in the country.

Mattamy Homes, the eighth largest builder in the Orlando market based on Local Leaders data, is seeing an increase in sales for a number of factors: job growth, the strong economy, new household formations, limited resale inventory, and the desire for second homes in close proximity to the area’s theme parks, says Alex Martin, Mattamy’s Orlando division president. The builder closed 504 homes last year in the area.

The firm is bullish on Orlando, says president Jim Leiferman.“We believe that Southeast Florida is a highly desirable and active geographic area, and will nicely complement our other divisions in terms of strategic growth in the U.S.,” says Leiferman.