Drama heightened Friday, as our 2017 Builder of the Year D.R. Horton upped its ante for control of 75% of a coveted land-and-lot source Forestar, by 9%–from $16.25 to $17.75 per share–a successful tactic in its play to outbid Starwood Capital.

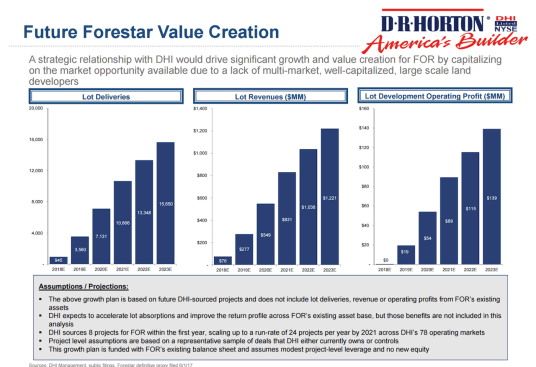

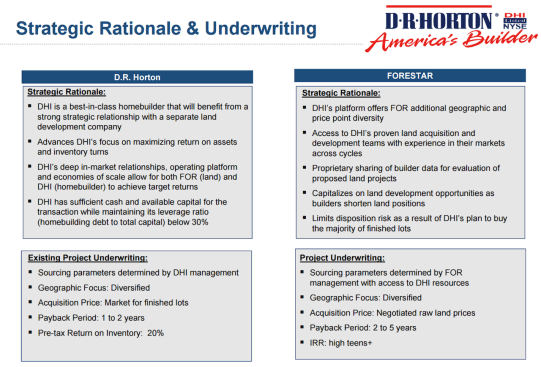

For Horton, a win-win would be that, if it can team up with Forestar as it designs to, it gets super-powered binoculars that allows it to see and access a smoothed-out finished-lot pipeline in to the 2020s, as it nears and ultimately exceeds 45,000 home deliveries annually. Meanwhile, Horton could also avail of its “ownership” of land and lots that would sell, both to itself and others. For Forestar, stakeholders need to weigh the gains of high-teens internal rates of return on current owned assets, and a “trans-cycle” plan to continue earnings on their investment, vs. the one-time exit payout they’d agreed to with Starwood.

Forestar’s board of directors, under obligation to seek the best deal for its shareholders, view Horton’s offer as a “superior proposal” to that offered by Starwood on April 13, and raised Friday morning. Now, Starwood has a four-day right-to-match period, given that its initial 100% bid for Forestar, valuing the multi-regional land development company then at about $605 million, was accepted. Starwood raised its offer on Friday, from $15.50 to $16 per share.

Where the deal stands now is that Starwood has an opportunity to negotiate in earnest with Forestar to try to strike a firm deal that Forestar directors view as equal to or exceeding the value of the D.R. Horton bid before this Wednesday, June 28, close of business. Between that evening and the end of June 30, D.R. Horton will leave its offer on the table.

Here’s the Forestar statement on that:

On June 23, 2017, Forestar notified Starwood that Forestar had received the revised binding proposal from D.R. Horton and that Forestar’s board of directors has determined that D.R. Horton’s revised proposal constitutes a “Superior Proposal” and that Forestar’s board of directors intends to terminate the amended merger agreement with Starwood to enter into a definitive, written agreement with respect to D.R. Horton’s revised proposal. In accordance with the amended merger agreement with Starwood, Forestar will discuss and negotiate with Starwood in good faith (to the extent requested by Starwood) until the end of the business day on June 28, 2017 such adjustments in the terms and conditions of the merger agreement with Starwood as would permit the Forestar board of directors not to terminate the amended merger agreement with Starwood. Subject to limited exceptions, D.R. Horton’s revised offer is irrevocable until 1:00 p.m. on June 30, 2017.

If Forestar’s board doesn’t view Starwood’s negotiated amendment to its offer as equal or better, it will sign a definitive agreement with Horton. If the Forestar board winds up going with Horton, it will owe Starwood a $20 million “kill fee” to exit its prior agreement.

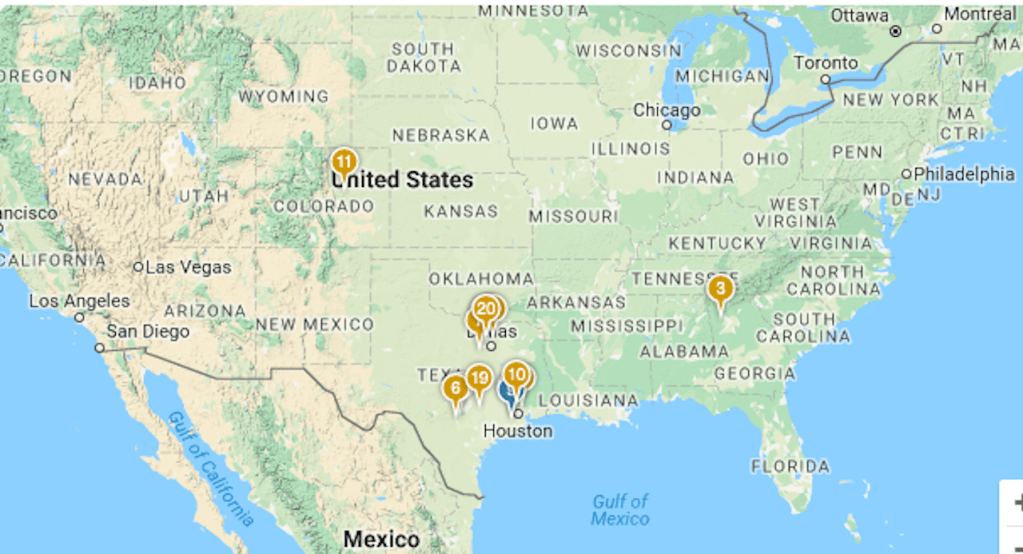

D.R. Horton’s favored-nation relationship with Forestar would begin in markets where Horton has already established No. 1 to No. 3 ranking in marketshare–Texas, Colorado, Georgia, North Carolina, South Carolina, Tennessee, Wisconsin, Arizona, California, Montana, and Utah, and would secure immediate access to lot pipelines that would enable it to build on strength and clout. Forestar owns or has joint venture interests in 49 residential and mixed-use projects consisting of 4,600 acres in 10 states and 14 markets.

We’ve been particularly interested in the deal as a smart, innovative structure, both in capital allocation and land strategy, for a large public builder to keep its focus on its core skill-sets–building and marketing new homes–even as it locks in visibility and predictability for one of its essential, intensely finite resources, land.

Too, given the roller-coaster ride of uncertainty home builders face ahead of them, a Forestar-Horton deal would set up more limited exposures to lost financial value if there’s a downturn, as Horton would only need to consolidate its “owned” portion of Forestar’s lots into its balance sheet.

We’ve noted Susquehanna Financial Group analyst Jack Micenko’s take on the deal’s kinship with the newly reset Lennar-Five Pointe relationship here. Micenko’s comments then noted:

This announcement following on the heels of the successful Five Points IPO may be coincidental, but it shows smart builders remain disciplined and committed to a more “land-light” strategy coming out of the last downturn. While it’s unclear whether the company will be successful in their pursuit, it’s another tangible piece of evidence the US homebuilding industry is maintaining their discipline in the current housing recovery, with smart builders looking to own considerable stakes in land development companies with their own access to capital. Timing wise, what’s changed for DHI since prior conversations is that FOR has made material progress divesting much of its non-housing related assets, making them more of a pure play land developer. While the deal is small relative to DHI today (current lot position is less than 25% of annual DHI home deliveries), it’s the future platform that holds value in management’s view. Specifically, it allows DHI a “captive” land development arm that insulates the company from incremental land risk in a future economic downturn. Leveraged land positions put many builders out of business in the downturn, and this transaction would help insulate DHI from outsized risk while providing the company a pipeline for future development, as FOR will remain a public company with its own debt and equity capitalization.

So, by the end of this week, it should be clear whether D.R. Horton’s strategic Forestar play will prevail or not. What the initiative–and Lennar’s structured deal with Five Pointe, as well as CalAtlantic’s recent deal in the Northwest with Oakpointe–show is that a “lock-in” with land sellers and developers is currently regarded among the larger publics as a smart “wholesale price” land deal, leaving other competitors to pay retail prices in an ever more volatile land asset acquisition environment. NVR has been masterful at structuring such deals with land developers in its operating arenas for years.