D.R. Horton, Inc. (NYSE:DHI), Arlington, Tx. Wednesday morning reported that net income for its third fiscal quarter ended June 30, 2017 increased 16% to $289.0 million, or $0.76 per diluted share, from $249.8 million, or $0.66 per diluted share, in the same quarter of fiscal 2016. The gain met analyst expectations.

Home-building revenue for the quarter increased 17% to $3.7 billion from $3.1 billion in the same quarter of fiscal 2016. Homes closed in the quarter increased 16% to 12,497 homes compared to 10,739 homes in the prior year quarter.

Net sales orders for the quarter increased 11% to 13,040 homes and 13% in value to $3.9 billion compared to 11,714 homes and $3.4 billion in the same quarter of fiscal 2016. The cancellation rate was 21%, unchanged from the prior year quarter.

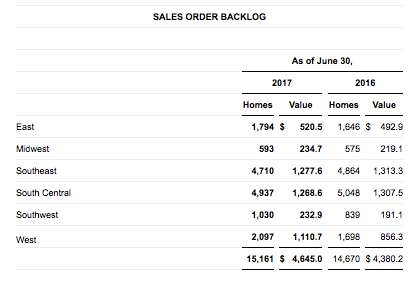

Backlog of homes under contract at June 30, 2017 increased 3% to 15,161 homes and 6% in value to $4.6 billion compared to 14,670 homes and $4.4 billion at June 30, 2016. The company’s homes in inventory at June 30, 2017 increased 9% to 27,600 homes compared to 25,300 homes at June 30, 2016.

During the third quarter of fiscal 2017, the Company repurchased 1.85 million shares of its common stock for $60.6 million and repaid at maturity $350 million principal amount of its senior notes. DHI ended the quarter with $460.8 million of home-building unrestricted cash and a home-building debt to total capital ratio of 24.8%.

Donald R. Horton, chairman, said, “Our balance sheet strength, liquidity and continued earnings growth and cash flow generation are increasing our flexibility, and we plan to maintain our disciplined, opportunistic position to improve the long-term value of our company. We remain focused on growing our revenues and pre-tax profits at a double-digit annual pace, while continuing to generate positive annual operating cash flows and improved returns. With 27,600 homes in inventory at the end of June and a robust supply of owned and controlled lots, we are well-positioned for the fourth quarter and fiscal 2018.”

On June 29, 2017, DHI entered into a definitive merger agreement with Forestar Group Inc. (Forestar) (NYSE:FOR), a publicly-traded residential real estate development company, to acquire 75% of the currently outstanding shares of Forestar for $17.75 per share in cash or approximately $560 million of total cash consideration. The strategic relationship between D.R. Horton and Forestar will significantly grow Forestar into a large, national residential land development company, selling lots to D.R. Horton and other home builders. Forestar will remain a public company with access to the capital markets to support its future growth. The transaction is expected to close during the Company’s first quarter of fiscal 2018.