Century Communities, Inc. (NYSE:CCS), Greenwood Village, Col. after market close Thursday reported for the second quarter ending June 30 net income of $14.8 million, or $0.66 per share, compared to $13.1 million, or $0.62 per share, for the prior year quarter. The results were in line with analyst expectations of a net of $0.65 per share.

The company attributed the improvement in net income to an increase in home sales revenues and home-building gross margin, along with lower SG&A as a percent of home sales revenues.

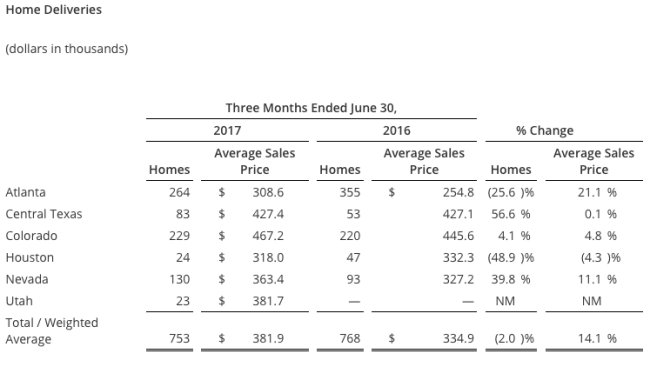

Home sales revenues for the second quarter 2017 increased 11.8% to $287.6 million, compared to $257.2 million for the prior year quarter. The growth in home sales revenues was primarily due to a higher average sales price of home deliveries of $381,900, compared to $334,900 in the prior year quarter. Deliveries in the second quarter of 2017 were 753 homes compared to 768 homes for the prior year quarter.

Adjusted home-building gross margin percentage, excluding interest and purchase price accounting, was stable at 21.1% in the second quarter 2017 compared to the prior year quarter. Home-building gross margin percentage in the second quarter 2017 was 18.7%, as compared to 19.2% in the prior year quarter as a result of increased financing costs. SG&A as a percent of home sales revenues improved to 11.9%, from 12.2% in the prior year quarter.

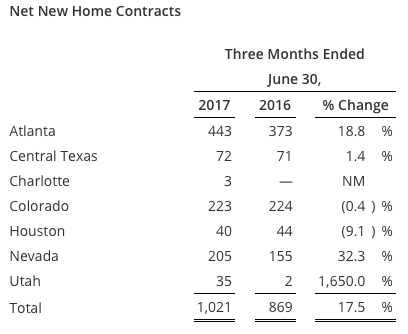

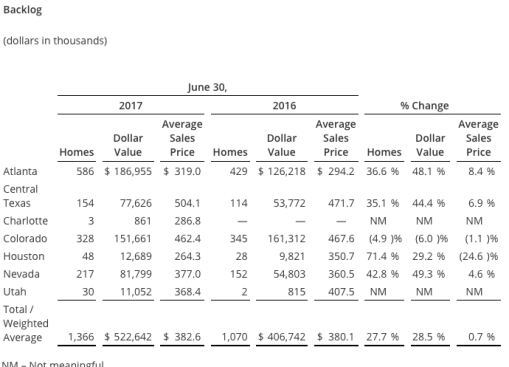

Net new home contracts in the second quarter 2017 increased to 1,021 homes, an increase of 17.5%, compared to 869 homes in the prior year quarter, largely attributable to stronger demand trends in most divisions, led by the Atlanta and Nevada markets, driving an overall increase in absorption rates. At the end of the second quarter 2017, the company had 1,366 homes in backlog, representing $522.6 million of backlog dollar value, compared to 1,070 homes, representing $406.7 million of backlog dollar value in the prior year quarter.

On April 11, 2017, the company announced that it had entered into a definitive agreement pursuant to which UCP, Inc. (NYSE: UCP) will be merged into the Company in a transaction with an aggregate value of approximately $360 million, including the payment of approximately $153 million of existing UCP indebtedness. The transaction has been unanimously approved by the board of directors of both Century and UCP and was also approved by UCP shareholders on August 1, 2017.

The addition of UCP will expand Century’s reach into the states of California and Washington while reinforcing Century’s presence in the Southeast. The combined company will operate in 10 states, 17 markets and 111 communities, with revenues of approximately $1.5 billion and inventories of $1.3 billion (calculated on a pro forma basis as of and for the twelve months ended June 30, 2017, respectively). Together, Century and UCP will benefit from increased scale through a geographically diverse portfolio with essentially no overlap, which provides for a seamless integration on an enhanced platform. The merger is expected to be accretive to Century’s 2018 earnings per share as a result of cost synergies and economies of scale.

Upon completion of the merger, each share of UCP Class A common stock outstanding immediately prior to the closing will be converted into the right to receive $5.32 in cash and 0.2309 of a newly issued share of Century common stock. Approximately 4.24 million shares of Century common stock are expected to be issued in connection with the transaction, resulting in a broadening of Century’s investor base and an increase in share liquidity. Century stockholders would own, on a pro forma basis, approximately 84% of the combined company. The transaction is expected to close on Friday, August 4, 2017, subject to the satisfaction of customary closing conditions.

In May 2017, the company successfully completed a private offering of $400 million in aggregate principal amount of 5.875% Senior Notes due 2025. The company used a portion of the $395 million of net proceeds from the offering for the repayment of outstanding indebtedness under its revolving credit facility, with the remainder of the net proceeds intended for general corporate purposes, including the funding of the planned merger transaction with UCP. During the second quarter of 2017, the company issued approximately 382,719 shares under its ATM Program for $9.6 million, or $25.16 per share.

As of June 30, 2017, the Company had total assets of $1.4 billion and inventories of $927.0 million. Liabilities totaled $883.7 million, which included $776.8 million of long-term debt. As of June 30, 2017, the Company had $400.0 million of availability under its credit facility.

Dale Francescon, co- of the Company, stated, “With the acquisition of UCP in the final stages of completion, we are eager to further build Century into an even larger and more profitable home builder. As we look forward, we have a three pronged focus to enhance our returns on equity, which includes rapidly integrating UCP with Century, deploying capital on sound investments at attractive paybacks, and controlling costs to deliver stronger margins across our expanded footprint. With these objectives in place, we look forward to advancing our long term growth strategy of our combined business.”

Rob Francescon, Co-CEO, stated, “Our 18% growth in new contracts to a record 1,021 sales, coupled with our 28% increase in backlog to 1,366 homes, reinforces our positive view on the home-building environment. During the second quarter, we recorded our first sales in our newest market, Charlotte, and our Utah and financial services divisions both achieved profitability. We are encouraged by the trajectory of our multi-market strategy and are poised for additional success.”