LGI Homes, Inc., The Woodlands, Tex. (Nasdaq:LGIH) reported net income for the second quarter ended June 30 increased 55.9% to $32.2 million, or $1.39 per diluted share, compared to the prior-year quarter. Analysts polled by Dow Jones were expecting a gain of $1.26.

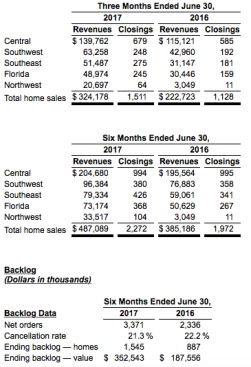

Home sales revenues increased 45.6% to $324.2 million in the quarter compared to a year earlier as home closings increased 34.0% to 1,511 homes. The average home sales price increased 8.7% to $214,545.

Gross margin as a percentage of homes sales revenues was 26.6% as compared to 26.5%. Ending backlog increased 74.2% to 1,545 units. Active Selling Communities at June 30, 2017 increased to 71 from 56.

The company reports 32,689 total owned and controlled lots at June 30, 2017.

“We are proud to announce an outstanding quarter at LGI Homes highlighting record-setting closings, revenues, average home sales price, community count, net income and EPS,” stated Eric Lipar, the company’s chairman and CEO. “Based on these solid results during the first half of the year, increased demand for home ownership, and robust orders we believe we are well positioned to finish the year strong and are updating our guidance. For the full year 2017, we now anticipate to close more than 5,000 homes. In addition, we are raising the range of our full year EPS guidance to $4.25 to $4.75 per basic share.”

The company forecast between 75 and 80 active selling communities at the end of 2017, closings of more than 5,000 homes in 2017, and basic EPS between $4.25 and $4.75 per share during 2017.