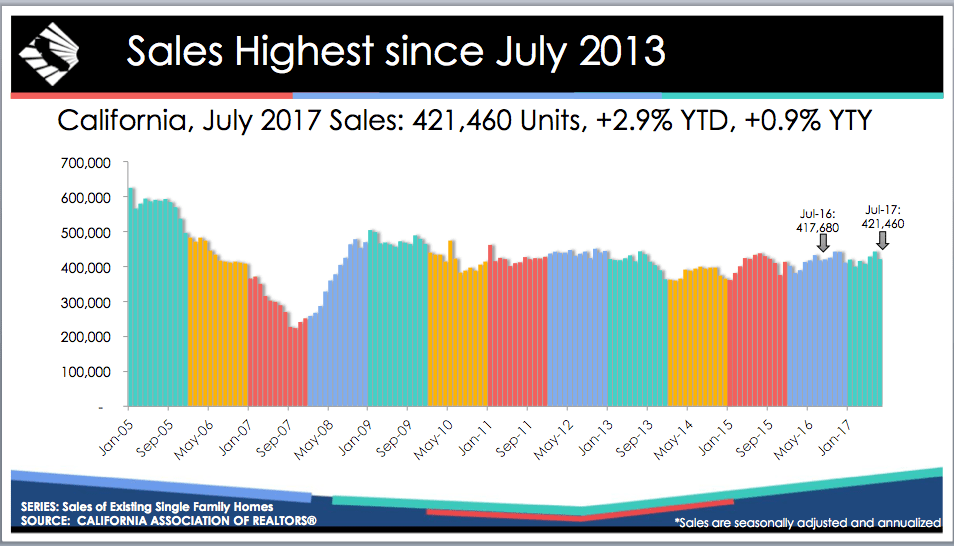

Closed escrow sales of existing, single-family detached homes in California remained above the 400,000 benchmark for the 16th consecutive month and totaled a seasonally adjusted annualized rate of 421,460 units in July, according to information collected by the California Assocation of Realtors from more than 90 local REALTOR® associations and MLSs statewide. The July figure was down 1.1% from the revised 443,120 level in June but up 0.9% compared with home sales in July 2016 of a revised 417,680. Year-to-date sales are running 2.9% ahead of last year’s pace, but are beginning to slow.

“As we enter the second half of the year, we are likely to see some slowdown in sales that extends beyond the typical seasonality change,” said C.A.R. President Geoff McIntosh. “While the rate of closed sales indicates that California’s housing market has continued to move forward, tight supply continued to push up prices and lower affordability, which can ultimately undermine the housing market by putting homeownership out of reach for too many households.”

Although declining to its lowest point since April 2017, the statewide median price remained above the $500,000 mark for the fifth straight month and remained close to the most-recent peak. The median price declined 1.1% from a revised $555,410 in June to $549,460 in July, but was up 7.4% compared with the revised $511,420 recorded in July 2016.

“Despite a dip from the recent record high in June, the statewide median price continued to rise at a high single-digit rate in July, and was growing at the second fastest pace in 2017,” said C.A.R. Senior Vice President and Chief Economist Leslie-Appleton-Young. “Tight inventory remained the fuel to upward momentum in home prices, particularly in the Bay Area and other high-priced markets. With supply expected to be tight for the rest of the year, home prices should grow moderately in the next few months.”

Other key points from C.A.R.’s July 2017 resale housing report include:

- The Central Valley posted both the fastest and most broad-based increase. Overall, the Central Valley experienced a 1.7% increase in July, with Kings (+52.2%), Madera (+39.7%), and Glenn (+23.5%) posting double-digit gains. Fresno, Sacramento, Merced, Placer, and Stanislaus also experienced an uptick in closed sales in July.

- July’s 7.4% increase in home prices was the second fastest this year, and faster than any month last year except January suggesting that affordability is not only deteriorating, but deteriorating at a faster rate.

- Inventory is poised to continue to constrain the housing market as C.A.R.’s Unsold Inventory Index remained tight, despite an increase from 2.7 months in June to 3.2 months in July. The increase should not be interpreted as anything other than a seasonal slowdown after the peak summer months. The index measures the number of months needed to sell the supply of homes on the market at the current sales rate. The index stood at 3.6 months in July 2016.

- The median number of days it took to sell a single-family home was essentially flat at 22.8 days compared with 22.4 days in June but was down from 28 days in July 2016.

- C.A.R.’s sales-to-list price ratio was 100% of listing prices statewide in July, 100% in June, and 99.2% in July 2016. Regionally, San Francisco had the highest sales-to-list price ratio at 118.6% and Mariposa had the lowest at 93.3%.

- The average price per square foot for an existing, single-family home statewide was $270 in July, $269 in June, and $251 in July 2016.

- San Mateo had the highest price per square foot in July at $898/sq. ft., followed by San Francisco ($893/sq. ft.), and Santa Clara ($672/sq. ft.). Counties with the lowest price per square foot in July included Kern ($135/sq.ft.), Lassen ($136/sq. ft.), Siskiyou ($142/sq. ft.), and Del Norte ($142/sq. ft.).

- Mortgage rates continued to go lower in July as the 30-year, fixed-mortgage interest rate averaged 3.90% in July, down from 4.01% in June but up from 3.57% in July 2016, according to Freddie Mac. The five-year, adjustable-rate mortgage interest rates edged up in July to an average of 3.14% from 3.12% in June and was up from 2.78% in July 2016.